Retirement Planning for Military Veterans: Getting Your Income in Order

Apr 26, 2024 | 17 min. read

If you retired from military service, your pension and other military benefits give you significant flexibility in developing a retirement income plan when you’re ready to stop working.

Retirement planning is about figuring out how to turn the benefits and assets you’ve earned or accumulated during your working years into a reliable lifelong stream of income. It’s that second stage, often referred to as retirement income planning, that we will focus on in article for military veterans.

Key Points

- An effective retirement income plan should be diversified, with both guaranteed income sources and a mix of investments that have historically kept pace with inflation.

- Having military retirement income is a significant advantage that may influence how you choose to allocate your investable assets.

- Your military retirement income may allow you to build a budget in which you utilize your guaranteed income to cover your fixed expenses and income from your investments to address your discretionary spending.

- If you are a veteran, you also have the option of lowering your living expenses by utilizing low-cost healthcare options through the VA or by living near a military base to utilize lower cost on-base resources.

- Making smart, informed decisions about when to claim your Social Security benefits can help maximize your guaranteed income.

- A financial advisor can work with you to build a comprehensive but flexible retirement income plan that supports your personal goals.

How Does Military Retirement Work?

Service members who accumulate 20 or more years of active service are eligible for military retirement benefits. There are currently four different versions of military retirement:

- Final Pay Plan

- High 36

- Career Status Bonus/Redux

- Blended Retirement System (BRS)

The plan you are covered by depends on the date you entered service, and in some cases, whether you chose to opt in to either Redux or BRS. But the variety of military retirement plans center around the same concepts. They all offer military retirees a percentage of their active duty base pay that is calculated by multiplying the number of years served by a multiplier.

The bottom line is that military retirees receive a monthly check for life up to half of their active-duty base pay. It’s the equivalent of having a substantial annuity and it provides significant flexibility when constructing a retirement income plan.

How much money will I need for retirement?

A good place to begin the retirement income planning process is by figuring out how much money you will need in retirement. For years, a popular rule of thumb was that you would need 70 to 80 percent of your pre-retirement income. That was based on the idea that you would no longer have to worry about work-related expenses like the cost of commuting, clothing, lunches out, etc. But in our post-pandemic, more casual work-from-home world, many of us spend less on those things than we did in the past. If you’re in that camp, it’s less likely that your expenses will substantially decline when you stop working.

The insidious power of inflation also erodes at your purchasing power through the course of a long retirement. This is notably apparent in the post-COVID world, where higher inflation rates have increased the cost of goods and services at a higher rate than previous years. Accounting for continued inflation is an important component of retirement income planning.

Even more significantly, the old rule of thumb fails to consider the fact that you will likely have much more free time in retirement. What you choose to do with all of that free time may, ultimately, be the single biggest determinant of how much money you will need in retirement. If you envision an active retirement filled with activities and travel, it’s entirely possible you’ll need to replace 100 percent or more of your pre-retirement income. But if you’re looking forward to slowing down in retirement, or plan to stay busy pursuing less expensive hobbies, that 70 to 80 percent rule of thumb might be entirely appropriate. That’s why it’s a good idea to begin thinking about what sort of retirement you want well before you get there.

How will I know if I’m financially prepared to retire?

Once you have an idea of how you want to live in retirement, a good first step in building a retirement income plan is to tally up all of your anticipated expenses and then compare them to the various sources of income you anticipate will be available to you. This will give you a good sense of how well prepared you are for retirement. You can convey these anticipated expenses and your goals to your First Command Financial Advisor to assist you in your retirement ventures. Here are some reminders about the different types of expenses and income that may apply to your situation.

Expenses

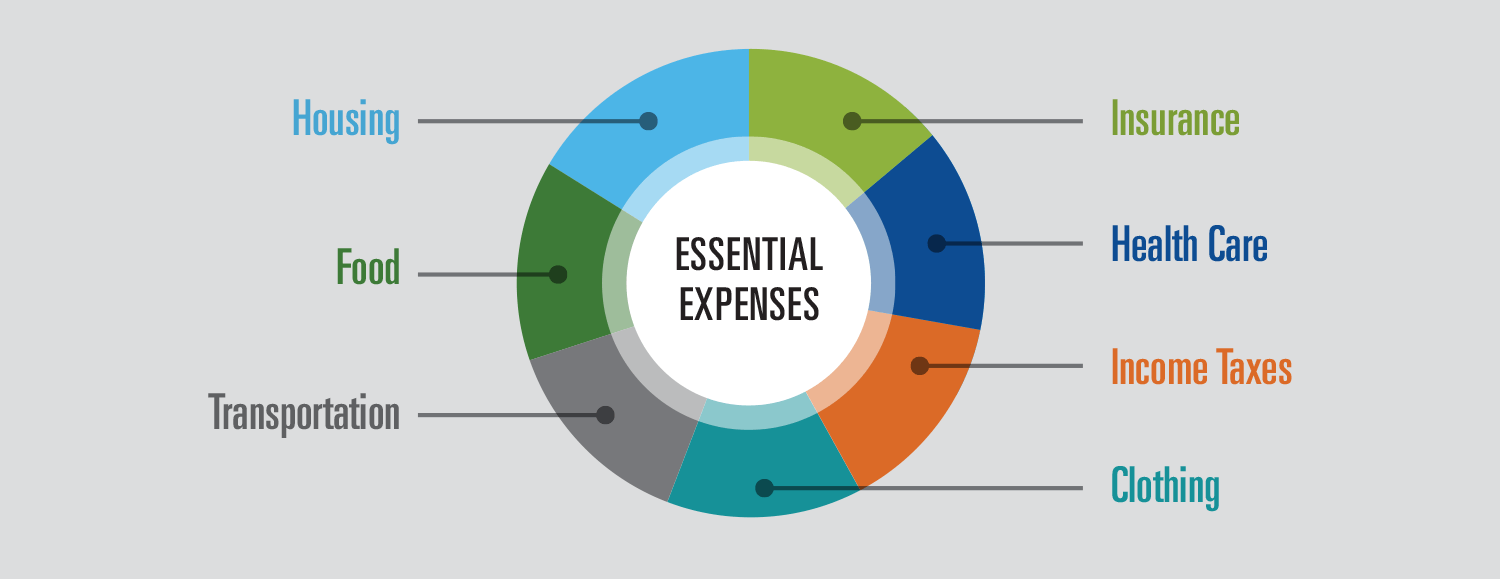

Expenses can typically be divided into two categories: essential needs like housing, food, clothing, utilities, transportation, medical expenses, maintenance, taxes and insurance; and discretionary or “fun” spending on things like experiences, entertainment, travel, and gifts.

Income

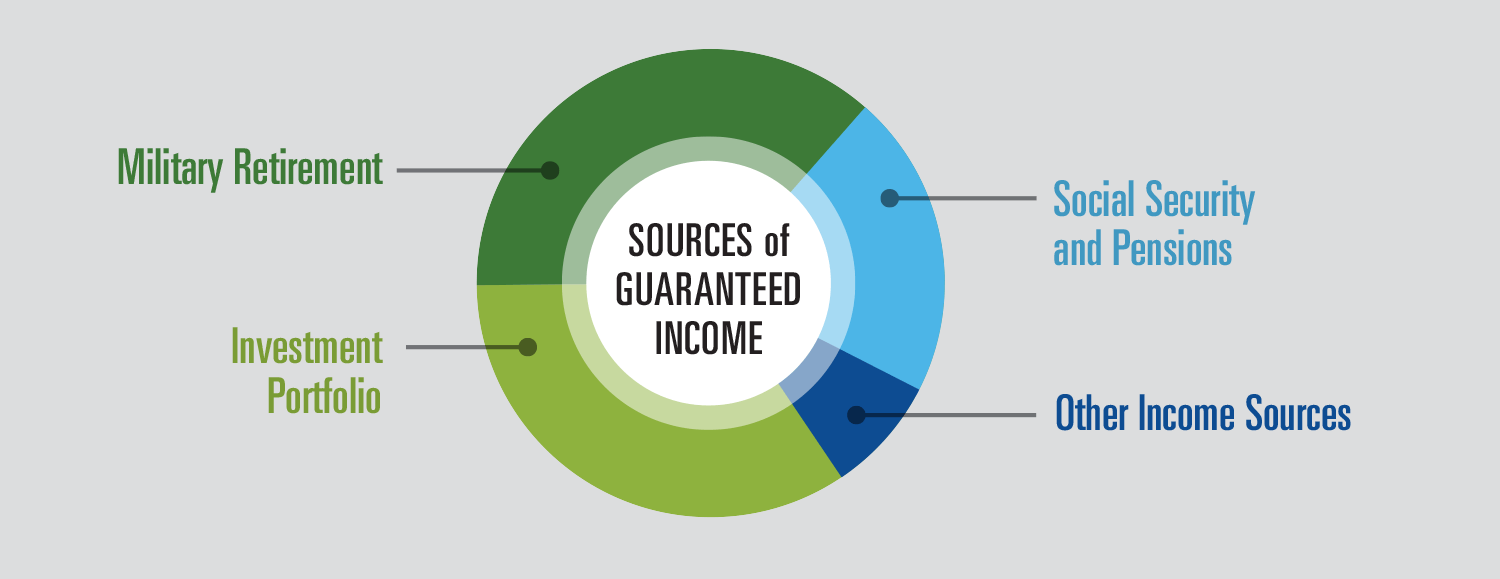

There are three possible types of income – guaranteed, one-time and variable. Guaranteed income comes from sources like Social Security, military retirement income, or annuities. One-time sources of income include inheritances, life insurance proceeds or profits from the sale of real estate or other assets. Variable income generally comes from sources like your investments (401(k), TSP, IRA, taxable stocks, bonds, or mutual funds), rental property, or even a part-time job.

If your anticipated expenses significantly exceed your anticipated income, it might be a sign that you need to make adjustments to your goals or push back your planned retirement date. Doing so can:

- Increase your monthly Social Security benefit

- Allow you more time to save while reducing the time you rely solely on retirement assets

- Give your investments an opportunity to grow

- Potentially save you thousands of dollars by extending the time in which you and any dependents are covered by your employer’s health insurance (this is particularly true if you are not yet eligible for Medicare).

If you don’t want to postpone retirement, another option to consider is working part-time in retirement – at least initially – to make up for the gap in your income.

How do my military retirement benefits fit into my retirement income plan?

Having a military pension offers significant advantages when constructing a retirement income plan. First is the fact that it provides a substantial amount of guaranteed, lifelong income. But there’s also a trickle-down effect: having more guaranteed income means you won’t have to withdraw as much money from your investments. That may affect how you choose to allocate those funds, potentially allowing you to focus less on short-term liquidity and more on long-term growth.

Your military retirement income may also give you more options when it comes to constructing a budget. One approach to consider is using guaranteed sources of income – like a military pension and Social Security – to pay for your fixed expenses, and using the income generated by your investment portfolio to pay for discretionary expenses. The idea is simple: to match fixed expenses to fixed sources of income and variable expenses to variable sources of income. There’s substantial peace of mind in knowing that all of your basic living expenses will be covered by guaranteed income, and an opportunity to adjust your discretionary spending from month to month and year to year based on changes in the variable income stream generated by your investments.

When should I begin taking Social Security?

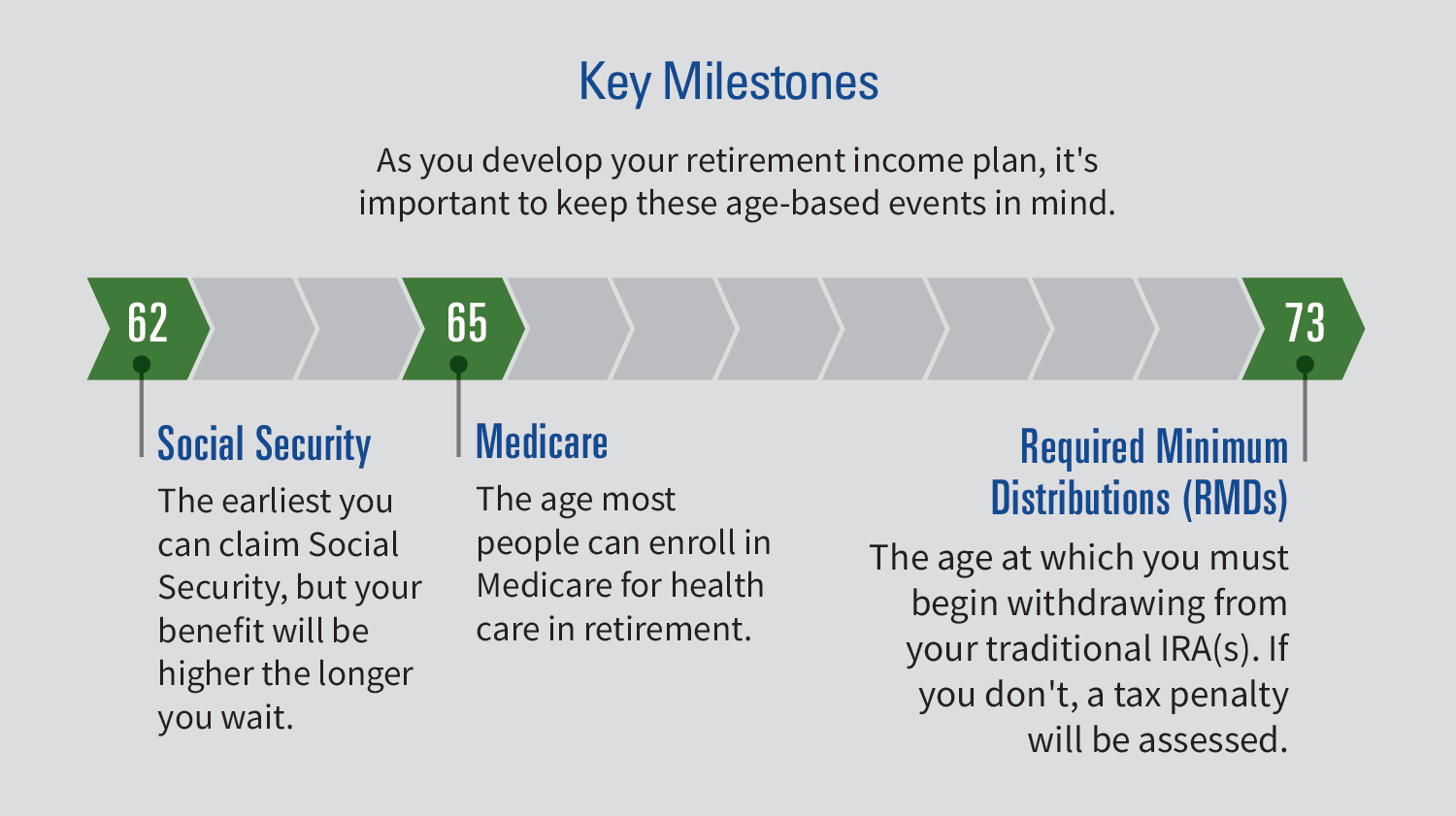

Social Security is a key component of most retirement income plans. The biggest question in most people’s minds when it comes to Social Security is whether they should take it early or late. The math is pretty straightforward. For those born in 1960 or later, claiming benefits at your full retirement age (FRA) of 67 rather than when they are first available to you at age 62 will increase every monthly check you receive for the rest of your life by 30 percent. And for every year you delay past your FRA until you’re 70, you will receive an additional 8 percent.

That would seem to make a powerful case for waiting to claim your Social Security benefit, but that’s not necessarily true for everybody. For those with health issues, it may make more sense to claim their benefits early. And those who need Social Security to retire may place a higher value on being able to quit working while they are still relatively young than receiving a larger monthly check by waiting eight years to stop working.

Military retirees are uniquely well positioned to capitalize on the rules governing Social Security. Because their pension is likely to be their largest source of guaranteed income, it may be more realistic for them to wait to claim Social Security. This is particularly true if they have also accumulated significant funds for retirement in a TSP account or an IRA.

Will I owe taxes on my military retirement income?

When you’re budgeting for retirement, it’s important to consider how much you’ll have to pay each year in taxes – because the number that really matters is your after-tax income. Most military retirement benefits, like your pension, are fully taxable at the federal level but may be waived or reduced at the state level, depending on your place of residence. VA disability benefits are notably excluded from income tax considerations. And based on their income, most military retirees will owe taxes on their Social Security benefits.

You may also owe income or capital gains taxes on the money you withdraw from your investment accounts. And in the case of traditional IRAs or 401(k) plans, you will be required to begin making taxable withdrawals beginning at age 73 (age 75 for those born after 1960). Figuring out how to make tax-savvy withdrawals can be challenging, especially when drawing from multiple accounts with unique tax implications. That’s why it’s a good idea to consult with a knowledgeable financial advisor and accountant and develop a plan for how to access your funds in a tax-efficient manner.

Begin preparing now

Even if you’re still a few years away from retirement, there are preparatory steps you can begin taking now:

- Envision the retirement lifestyle you want and estimate how much monthly and annual income you will need.

- Tally up your sources of guaranteed income and the current value of your investments. You can review your estimated Social Security benefits here.

- Begin building your cash reserves. You’ll need more liquidity once you stop working. Strive to accumulate at least enough to cover one year’s worth of your estimated retirement expenses.

Once you’ve done those things, meet with a financial advisor to share this information and begin mapping out a more detailed plan of action. Talk about:

- When you want to retire and what is realistic

- Your primary retirement objectives

- When you should begin taking Social Security

- How your portfolio should be allocated in retirement and what tax-efficient steps you can begin taking now to get there

- If it makes sense to pay off your mortgage and, if so, how you should do it

One more thing. Don’t wait until you are ready to retire to begin this process. The earlier you start, the more likely it is that you will be able to make any adjustments that may be necessary to better prepare you for the retirement you envision.

Frequently Asked Questions

Q: Should I pay off my mortgage in retirement?

- Given each person’s mortgage and retirement income circumstances are unique, there’s no one answer to whether you should pay off your mortgage in retirement. Retirees may benefit from paying off a mortgage that has a higher interest rate than can be returned from a high-yield savings account, CD, or diversified investments.

- Lower rate mortgages can be utilized to have a greater return on investments than you would pay in interest over time on your mortgage balance—provided your cash flow is sufficient to support continuing your monthly payments.

- It is not recommended to drain significant portions of your cash savings or investment portfolio balances with the sole purpose of paying down a mortgage balance.

Q: Should I purchase an annuity?

- An annuity is a contract between you and an insurance company that requires the insurer to make payments to you for an agreed-upon period in exchange for one or more payments to the insurer.

- If you have earned a military pension, which is effectively a lifetime annuity, you probably don’t need the additional guaranteed income that an annuity would provide. But for those individuals with a low tolerance for risk and not concerned with legacy planning, an annuity may be worthy of consideration.

Q: How much can I safely withdraw from my retirement accounts?

- A common retirement withdrawal strategy calls for a person to withdraw 4 percent in the first year of retirement, and then to adjust that amount to account for inflation in each subsequent year. For example, if you have $1 million saved or invested for retirement, you could withdraw up to $40,000 the first year, and if inflation is 2% the following year, you could take out $40,800.

- The 4 percent rule was devised in 1994 by now-retired financial advisor Bill Bengen, who was seeking to identify a “safe” withdrawal rate that would prevent people from outliving their money. It assumes that when you retire, your portfolio is evenly split between stocks and bonds.

- A recent study by Chicago-based investment research firm Morningstar suggests that the 4 percent withdrawal rate may be too aggressive. Its research recommends a 3.3 percent starting withdrawal rate. One of the key findings of the Morningstar study was that the more flexible retirees are with their spending, the greater the chance they can raise the withdrawal rate over time.

TSP funds have very low administrative and investment expenses and, low expenses can have a positive effect on the rate of return of your investment.

The information in this article is provided for informational purposes only and is based on known and unknown risks, assumptions, uncertainties and other factors. The information is not appropriate for the purposes of making a decision to carry out a transaction or trade nor does it provide any form of investment advice, or make any recommendations regarding particular financial instruments, investments, or products. Actual results, performance, or achievements may differ materially from any future results, performance, or achievements expressed or implied herein. Investing in securities has an inherent risk and your investments may lose value. Always seek the advice of a competent financial advisor who will evaluate and make recommendations based on your specific financial situation.

Diversification, asset allocation and portfolio rebalancing do not guarantee a profit or protect against a loss in a declining market. They are methods used to help manage risk. Investment returns and principal value will fluctuate and your investment, when redeemed, may be worth more or less than its original cost. Sales charges and taxes may apply.

Guarantee depends on the claims-paying ability of the issuing insurance company and does not apply to the investment return or principal value of the separate account. Before buying an annuity, you should find out about the particular annuity you are considering. Request a prospectus from your Financial Advisor and read it carefully. The prospectus contains important information about the annuity contract, including fees and charges, investment options, death benefits and annuity payment options.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Any recommendations provided to you in this article are strictly for financial planning purposes only. Should you require legal or tax advice, you should consult with your attorney or tax advisor.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.