How to Financially Prepare for Veteran Long-Term Care

Apr 16, 2024 | 3 min. read

The soaring cost of long-term care for veterans means that, for some, a lifetime of savings could be wiped out in just a few years. To avoid that outcome, your family needs to have a plan.

What is long-term care?

Long-term care is the assistance one needs with the “activities of daily living” - bathing, dressing, transferring (getting in or out of a bed or chair), walking and using the bathroom – as the result of aging, cognitive or physical impairment, or extended illness. And when it comes to financial planning, it’s among the most misunderstood and, consequently, least frequently addressed areas of need.

According to the 2024 First Command Financial Behaviors Index survey, 15 percent of military members say suffering an illness or becoming debilitated is their top retirement financial concern, while nine percent say not being able to afford healthcare costs is their primary retirement financial worry. That’s why planning ahead for the possibility of needing long-term care is essential for veterans.

Long-Term Care Considerations for Veterans

What are my options for long-term care as a veteran?

As a veteran, you may be entitled to a range of benefits that can help ease the burden of some of these costs. Speak to your financial advisor and find out what veteran and veteran spouse long-term care benefits you may be eligible to receive. Other options include:

- VA Aid and Attendance Benefit

- Rely on your family.

- Pay for it out of pocket.

- Count on Medicaid, which requires spending down most of your accumulated assets.

- Secure private long-term care insurance.

Assumptions vs. Reality in Long-Term Care

Let’s take a look at the gap between most people’s assumptions and reality:

Do I need long-term care insurance?

Assumption: I probably won’t need long-term care.

Reality: Approximately 70 percent of all Americans over the age of 65 will require some form of long-term care. And yet, only 10 percent of service members say military healthcare benefits for veterans over the age of 65 is their most important concern according to the First Command Financial Behaviors Index survey.

Caregiver long-term care insurance

Assumption: If I do need help, my family will be able to provide it.

Reality: In many cases, family members don’t live in the same location and it’s not feasible for them to relocate. But even when there is no geographic challenge, family members generally do not have the time or necessary skills to provide professional care.

Does the VA cover long-term care?

Assumption: As a veteran, I’m eligible to be covered for all my long-term care needs.

Reality: Although the VA and other sources do provide certain coverage, you may not meet all requirements and you may still be responsible for a copay. It is always a good idea to speak with a financial advisor to gain a better understanding of the long-term care solutions available to you.

What does long-term care insurance cover?

Assumption: Most expenses will be covered by my private health insurance, the VA, or Medicare.

Reality: The ongoing costs associated with long-term care are not covered by private health insurance or Medicare. Although Medicaid covers many of the expenses associated with long-term care, it does so only when all of your other available assets have been exhausted.

Is long-term care expensive?

Assumption: Any expenses I have to pay for will be relatively modest.

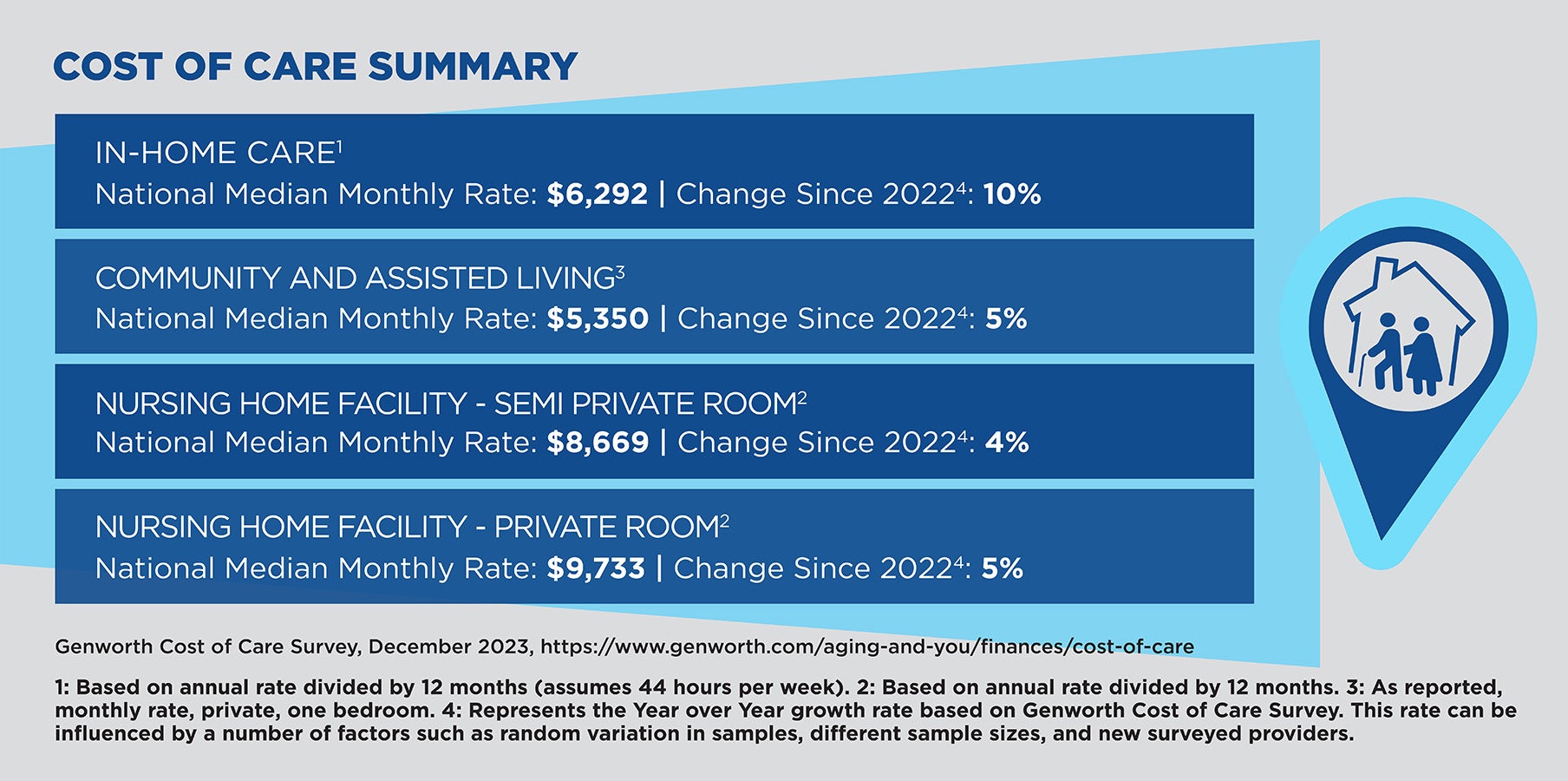

Reality: Only a few years of paying for professional long-term care can deplete hundreds of thousands of dollars of life savings. In the below Cost of Care Summary chart, you can review the cost of in-home care, community and assisted living, and nursing home facilities. The price varies between each option. You should evaluate the cost of care in several different types of facilities to make better informed decisions.

Long-Term Care Planning: Time Is Not On Your Side

When it comes to long-term care planning for veterans, time is not on your side. The cost of long-term care insurance is based on your age at the time of application – the younger you are, the more affordable the coverage. Add to that the fact that approval is subject to verifying that you are in good health and it’s easy to understand why it’s generally best to determine whether long-term care insurance makes sense for your family sooner rather than later. How soon? The American Association for Long-Term Care Insurance pointed to an ideal time around the mid-50s to apply.

Take the first steps toward building your plan

There is no one right answer when it comes to building a plan for long-term care because it depends on so many personal variables. Your assets. Your personal health and family health history. The cost of care in the state or community where you live. Your family’s ability – or inability – to play a role. That’s why effectively tackling this challenge should begin with two important steps:

- Have a candid conversation with your family – whether that means your children or your parents – about the roles everyone is willing and capable of playing, the cost of long-term care and the option that is most likely to fit everyone’s needs.

- Meet with a financial advisor with knowledge and experience about long-term care planning, and work with them to build a plan that is right for your family.

Once you’ve taken those steps, you will be armed with the information you need to help make the right decisions about how to secure your future, protect your assets and safeguard your family’s financial future.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.