How to Take Advantage of Market Volatility

Jan 29, 2021 | 4 min. read

Dollar cost averaging is an investment strategy that aims to capitalize on the market’s ups and downs.

If you inherited a large sum of money unexpectedly, what would you do with it? Purchase your dream home? Send your children to college debt-free? Embark on a luxurious retirement?

We all have dreams that we’d make reality, if only money weren’t an issue. Most of us, however, won’t be lucky enough to receive an unexpected sum of money able to fulfill of our wishes. Instead, we must pursue our goals a different way – by consistently investing a portion of our income. Unlike an inheritance, investing comes with some risk. But there’s a simple way to harness the volatility of the market and turn it to our advantage.

Dollar Cost Averaging

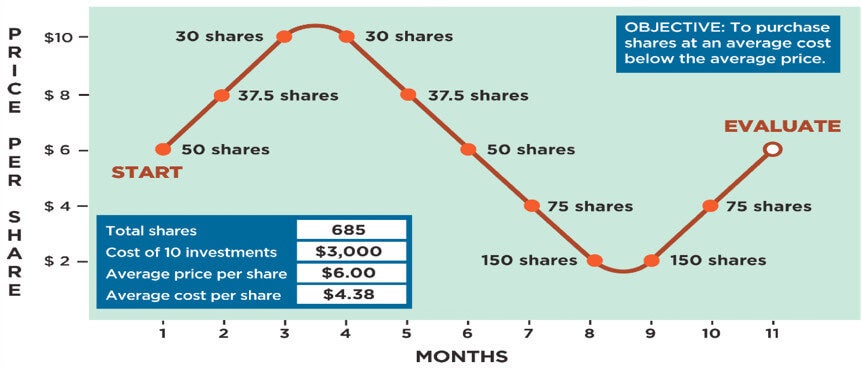

Dollar cost averaging is the practice of investing an equal amount of money at regular intervals, regardless of market performance. The objective of this investment strategy is to reduce the average cost per share by purchasing more shares when prices are low and fewer when prices are high. To better understand the considerable advantages of doing so, take a look at this graph depicting a hypothetical investment scenario:

Notice how many more shares our hypothetical investor – we’ll call her Mary – buys when prices dip to $2 per share than when the price rises to $10 per share? The result, as you can see in the accompanying table, is that Mary’s average cost per share – $4.38 – is markedly lower than the average price per share – $6.00 – over the period in which she was investing.

What does that mean in terms of dollars and cents? Let’s do the math. At the end of 11 months, Mary has accumulated 685 shares that are worth $6.00 each. That’s $4,100, a handsome profit on her $3,000 investment, despite the fact that the price per share at the end of 11 months was exactly where it began.

Full Disclosure

It’s important to offer a couple of caveats here. First, this hypothetical scenario dramatically exaggerates the short-term volatility of a typical investment in order to illustrate the concept of dollar cost averaging. It does not represent the past or future performance of any particular investment. Second, dollar cost averaging is not magic. No matter how many low-priced shares you buy, you’ll only earn a profit if the price of those shares eventually rises. And because it involves continuous investment in securities regardless of fluctuating price levels, investors should consider their financial ability to continue purchases through periods of low-price levels.

Taking the Emotion Out of Investing

But the fact remains that dollar cost averaging is an excellent way to invest for long-term goals. While not assuring a profit or protecting from a loss, it can help remove the emotions that cause so many investors to buy high and sell low from the equation. And by dollar cost averaging via a monthly allotment or bank draft, you can capitalize on yet another time-tested investing method: paying yourself first.

In an ideal scenario, we’d be able to precisely predict future market movement, which would allow us to buy investments when they’re low and sell them at a higher price. But timing the market is an imperfect science that comes with considerable risk. If you’re willing to take a long-term, patient approach and stick with it despite market fluctuations, dollar cost averaging is a well-known strategy to help you pursue building wealth over time. Talk with your Financial Advisor today about putting dollar cost averaging to work for you.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.