What is a Target Date Fund?

By: William Sager, CFA

Investment Analyst

Feb 7, 2020 | 5 min. read

Target date funds offer a convenient, low-maintenance way to invest for retirement. But are they right for you?

A target date fund – also known as a lifecycle fund – is a type of mutual fund that adjusts its allocation based on your age, investing mostly in stocks when you’re younger and moving into less risky bonds when you’re older.

Target date funds have become increasingly popular in recent years. They are typically marketed to investors as a convenient, “set it and forget it” way to invest for retirement and more and more frequently are one of the options available in employer retirement plans like 401(k)s and the Thrift Savings Plan (TSP).

How Target Date Funds Work

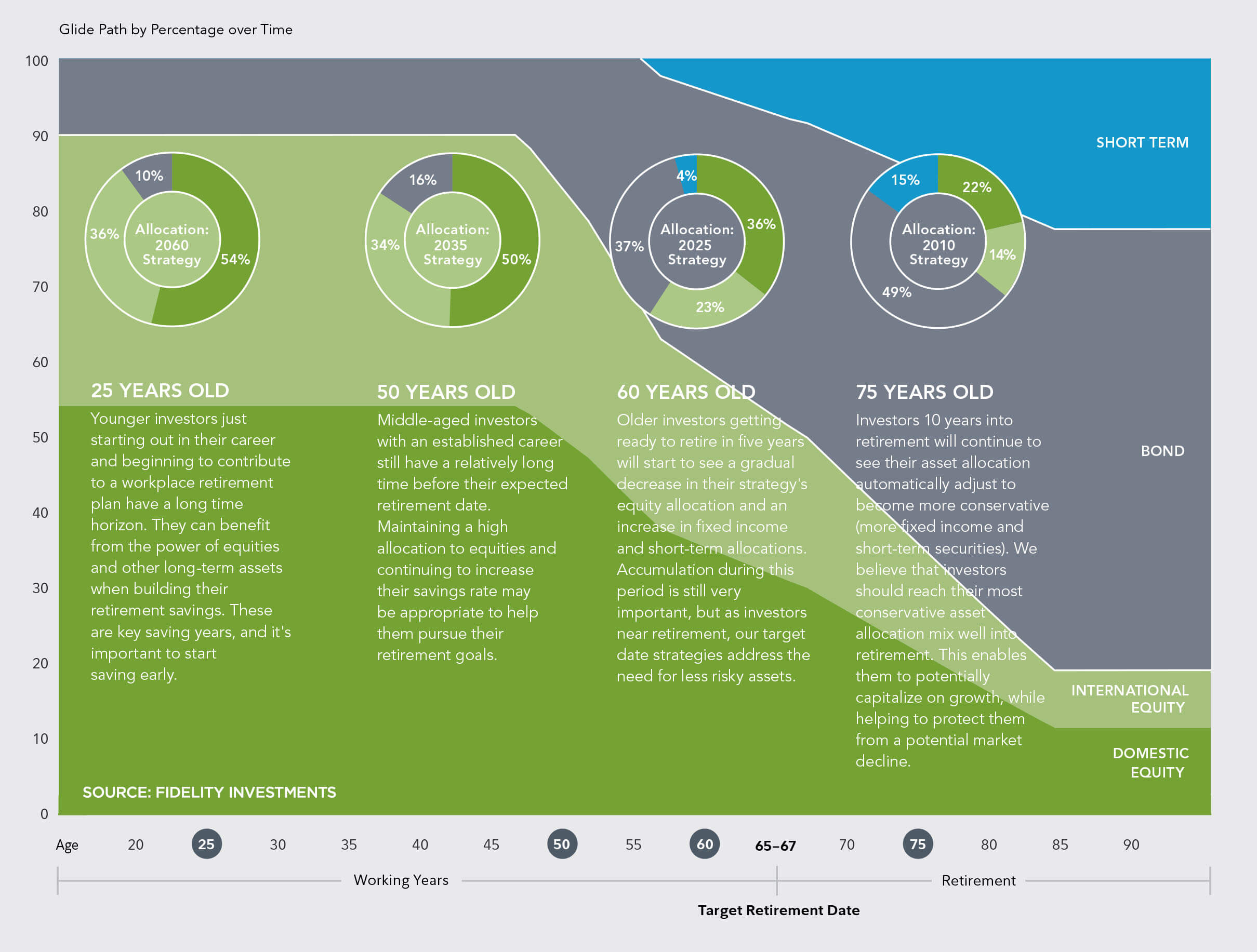

Target date funds are designed to help investors set and maintain an asset allocation appropriate for their time horizon and risk comfort level. Once an investor selects a target date fund, the fund manager is responsible for adjusting the allocation of the fund as the target date approaches. This gradual shift in allocation over time is referred to as a glide path and is illustrated in the chart below.

“To” Versus “Through” with Lifecycle Funds

An important question to ask when choosing among target date funds is whether a particular fund is a “to” fund, in which the glide path freezes your asset allocation when the target year is reached or a “through” fund that continues the glide path for 10 years or more past the target date before freezing the asset allocation? The philosophy of “through” funds is that life doesn’t stop at retirement. One still may have 20 years or more of living expenses, and the glide path toward safer investments should reflect that.

What’s in a Name?

The names of target date funds often refer to the specific year being targeted. For example, you might see funds with names like "Retirement Fund 2030" or "Target 2030" that are designed for individuals who intend to retire in or near the year 2030. However, you don’t have to choose a fund with a name/target date that corresponds to your planned retirement date. Instead, make your choice based on how aggressive or conservative you want to be with your investments at various ages. For example, a “Target 2050” fund will generally be more aggressive than a “Target 2030” fund within the same fund family, so if you’re comfortable allocating a higher percentage of your portfolio to stocks, you may elect to invest in the “Target 2050” fund even if you plan to retire well before then.

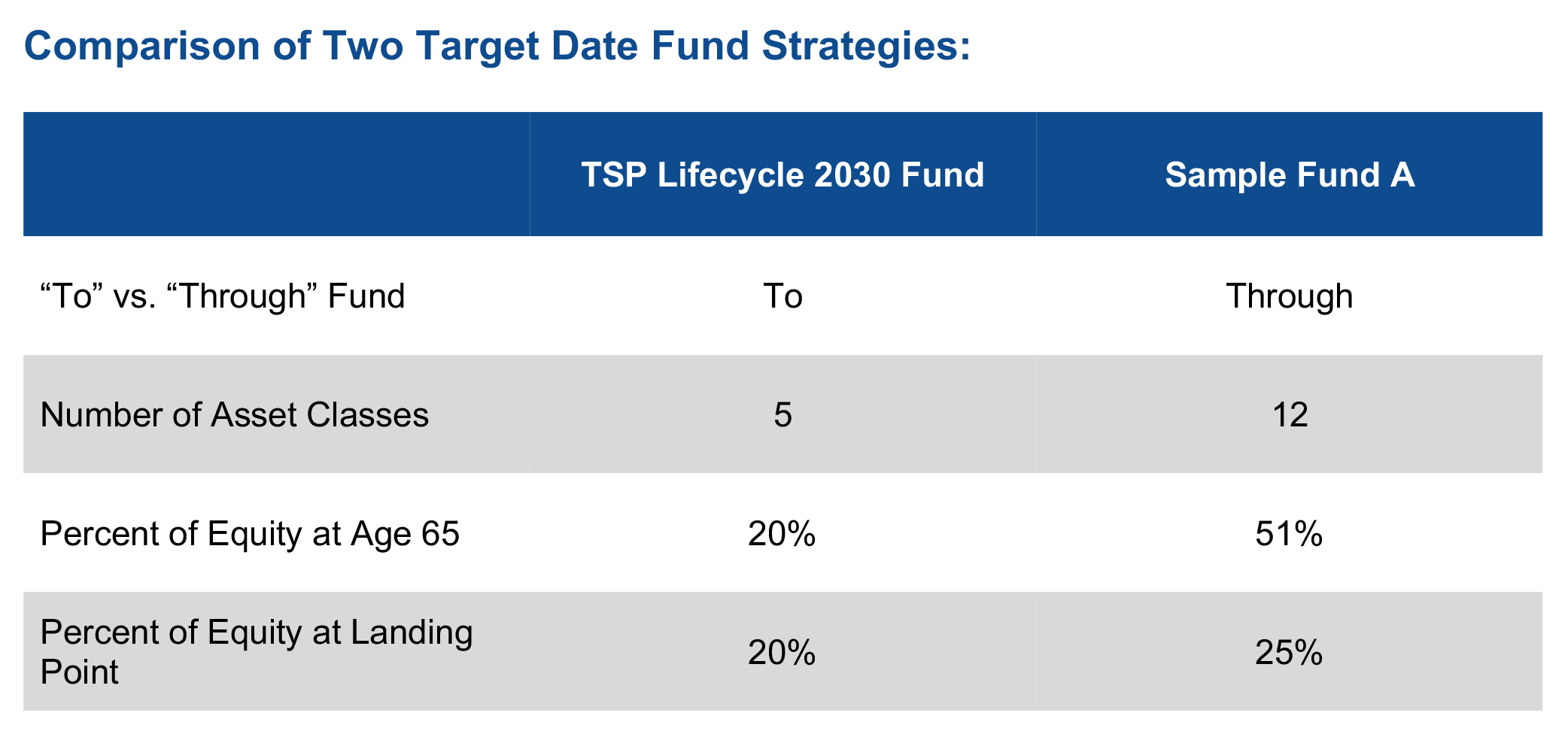

It is important to note that target date funds vary not only in the underlying investments but also in the asset mix over time – i.e. glide path – even for funds that share the same targeted date. The table below offers a comparison between the TSP Lifecycle Fund 2030 and the Sample Fund A.

A Word about Taxes and Lifecycle Funds

Because target date funds often trade more frequently than other mutual funds in order to adhere to their prescribed allocation, they are relatively inefficient when it comes to taxes. In other words, they distribute more capital gains than more passive funds. That makes them best suited for IRAs or other tax-qualified plans.

Asset Allocation isn’t Everything

Retiring on your terms isn’t just a function of putting your money in the right mutual fund. It’s also about investing the right amount of money. Regardless of the target date you choose, an under-funded nest egg will simply not support a financially secure retirement.

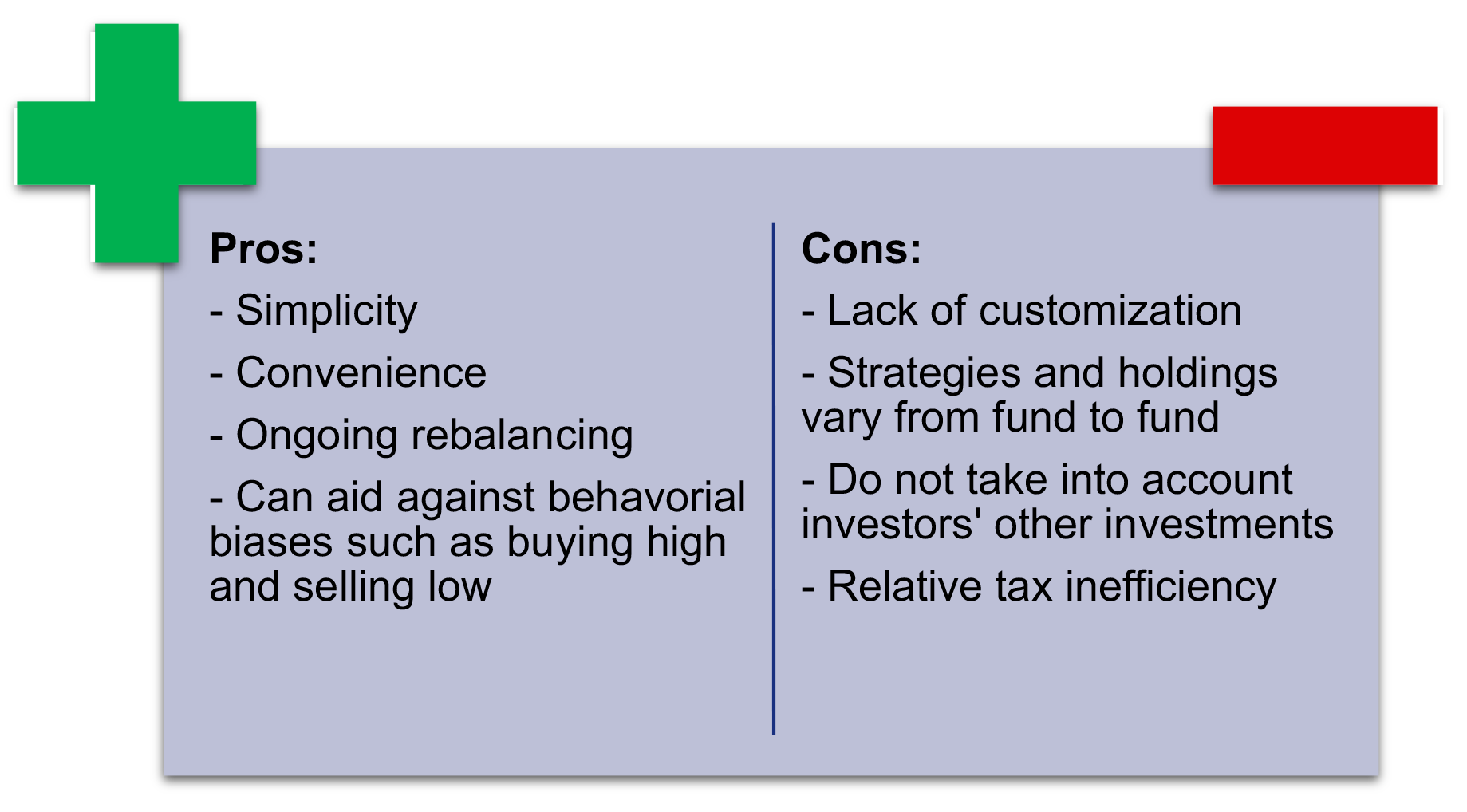

Pros and Cons of Target Date Funds

Summing it up

Before investing in a target date fund:

- Consider your investment style – do you want to play an active role in managing your investments, or do you prefer the more hands-off approach of a target date fund?

- Read the fund’s prospectus to gain an understanding of where the fund will invest your money and how the investments will change over time.

- Make sure the fund’s investment mix at the target date and thereafter is a good fit for your risk tolerance and future plans.

- Assess the fund’s tax efficiency. The frequent rebalancing required to maintain an appropriate asset allocation can trigger regular capital gains.

- Examine the fund’s fees. Target date funds typically “pass through” the fees of the underlying mutual funds in addition to charging fees themselves.

TSP accounts have very low administrative and investment expenses and, low expenses can have a positive effect on the rate of return of your investment.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.