Recent Enhancements Make the TSP Better Than Ever

Sep 30, 2019 | 5 min. read

Expanded withdrawal options make the TSP an attractive option for generating retirement income

For years, the Thrift Savings Plan (TSP) has offered military members and federal employees an attractive set of low-cost investment options for accumulating retirement funds during their working years. Now, the expanded withdrawal options contained in the TSP Modernization Act have enhanced its appeal as a tool for generating flexible income in retirement.

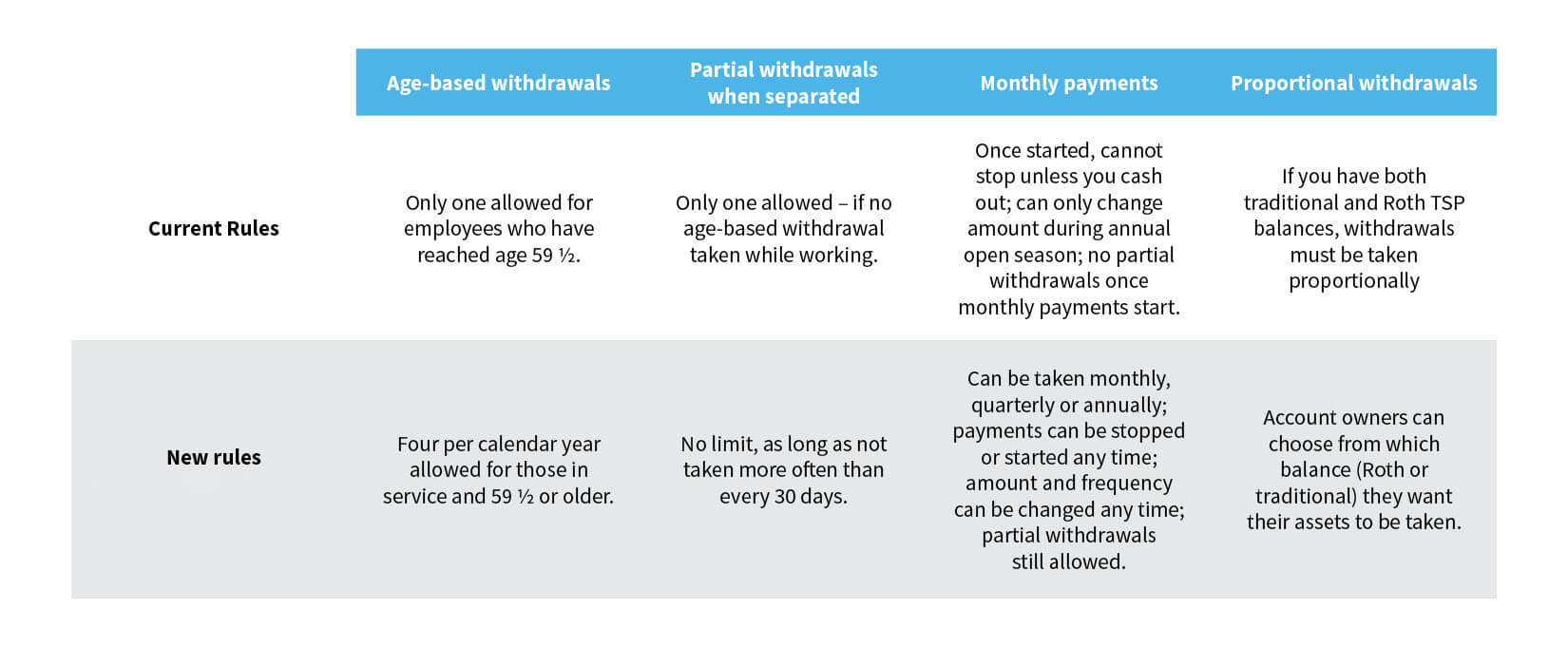

Here is a comparison of the current and new rules relating to TSP withdrawals.

For those in the military, this is the second significant enhancement to the TSP in the last two years. With the implementation of the Blended Retirement System on Jan. 1, 2018, service members began receiving an automatic contribution to their TSP account equal to 1 percent of their base pay and matching contributions on the first 5 percent of their own pay invested in the TSP.

First Command enthusiastically promotes the value of the TSP to our clients as part of our lifetime approach to financial planning. It plays a key role in our efforts to help clients:

- Start saving early by paying themselves first

- Build assets throughout their working years

- Transition from asset accumulation to asset distribution at retirement

In fact, we believe the TSP should be the go-to option for service members investing for their future retirement and our Financial Advisors coach their clients accordingly. That seems to hold true for the financial planning profession, as well, given that 77 percent of career military families who work with a financial advisor participate in the TSP, versus only 45 percent of those without an advisor.[1]

Despite the recent enhancements to the TSP and its many attractive features, though, experience has taught us that making contributions alone is not enough to ensure a secure retirement for most people. It’s important to contribute the right amount and to allocate your contributions in a way that is aligned with your particular goals and risk comfort level.

At a minimum, we encourage clients to contribute the 5 percent of their pay necessary to receive a full matching contribution – and discourage them from investing too conservatively for a retirement that is often decades away. According to the TSP and our own Financial Behaviors Index survey of military families, roughly one-third of all contributions go to the conservative G Fund – despite the fact that several options which provide more exposure to stocks have produced significantly higher long-term returns. This interactive table allows you to compare the historic returns of the various TSP investment options.

The Thrift Savings Plan just keeps getting better and better. And that’s great news for the military members and federal employees who have exclusive access to this outstanding retirement-planning resource.

Prior to requesting a rollover from your Thrift Savings Plan (TSP) account to an Individual Retirement Account (IRA), you should consider whether the rollover is suitable for you. There may be important differences in features, costs, services, withdrawal options and other important aspects between your TSP account and IRA.

TSP accounts have very low administrative and investment expenses. Expenses can have a significant impact on your investment returns over time.

[1] First Command Financial Behaviors Index

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.