Military Retirement COLA 2025: What You Need to Know

Nov 21, 2024 | 6 min. read

What is the military retirement COLA for 2025?

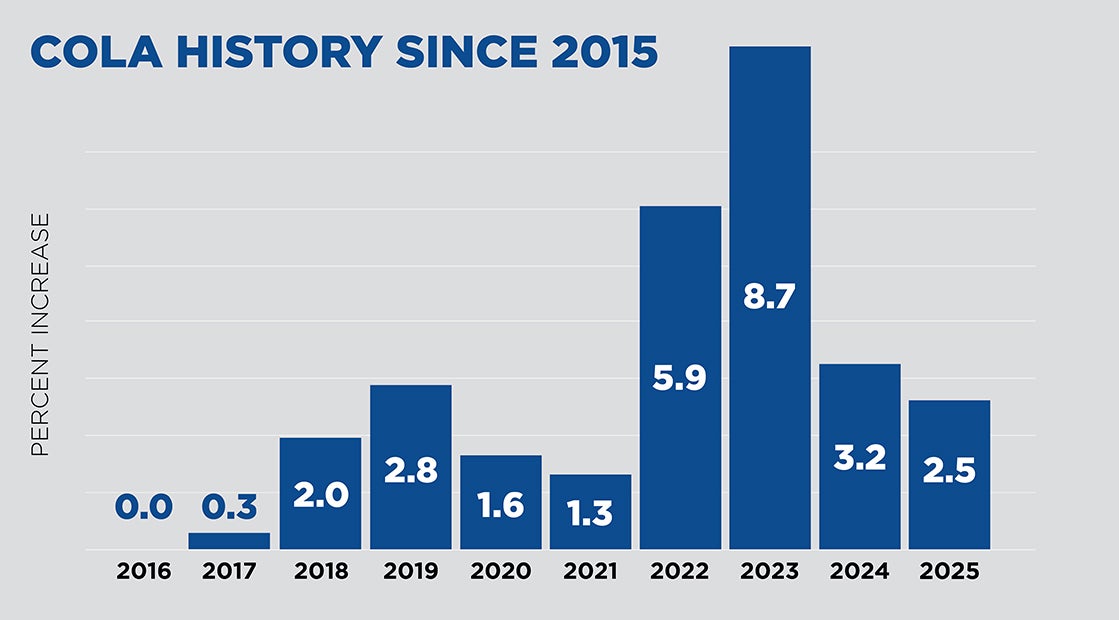

The Consumer Price Index (CPI) set a 2.5 percent cost-of-living adjustment for military retirees in 2025. It’s slightly less than the 3.2 percent increase in 2024 and notably less than 2023’s 8.7 percent adjustment, which was the third highest in the past 50 years. 2025’s COLA does, however, closely align with the 20-year average of 2.6 percent.

The lower percentage reflects declining inflation, which is good news for Americans, but the pursuit of financial security remains challenging and requires ongoing diligence.

What is the military retiree COLA?

A cost-of-living adjustment, or COLA, is a percentage increase in compensation that accounts for rising consumer prices, or inflation. For military retirees, a COLA typically increases your pension income. It originated in the 1970s, a period of high inflation, to protect government workers against rising costs.

Who qualifies for the military retiree COLA?

Active-duty retirees, reserve retirees, and disability retirees receive the COLA. Individuals who are Survivor Benefit Plan recipients or the surviving spouses of disabled veterans who receive Dependency and Indemnity Compensation benefits also receive it.

How is the military retiree COLA determined?

The Department of Labor determines the annual COLA by calculating the CPI, a measurement of the cost of a broad sampling of consumer goods and expenses. The CPI of the current year is compared to the previous year’s CPI. If there is an increase, a COLA equals the percentage increase. If there is a decrease or no increase in the CPI, there is no COLA, and retirement pay will remain the same -- not decrease.

Service members in their first year of retirement receive a partial COLA if they retired between Jan. 1 and Sept. 30 to prevent the receipt of both retirement pay based on a new pay raise and a full COLA. This partial COLA is calculated differently depending upon an individual’s retirement plan. COLAs for retirees who joined the military after Aug. 1, 1986 and who are in the Redux retirement plan are one percentage point lower. For more information, visit: Retirement Cost of Living Adjustments (defense.gov).

When does the 2025 COLA take effect?

A COLA for military retirees takes effect on Dec. 1 of each year. So, for December of 2024, military retirees will see the 2025 COLA in their pay beginning on Dec. 31.

Is the COLA for military retirees the same as the annual pay raise for active-duty service members?

The COLA for retirees differs from the annual pay increase for active-duty service members. While the retiree COLA is based on the CPI, active-duty pay raises are based on the Employment Cost Index, which measures the increase in private-sector wages. For more information on the 2025 military pay raise, click here.

Is the military retiree COLA taxable?

Military retirement income is subject to federal taxation, so an increase in military retirement pay from a COLA is taxed. State income tax laws vary, so depending upon your state of residency, military retirement pay and a COLA may or may not be taxed.

Don’t confuse the COLA that affects a military pension (and other government benefits like Social Security and VA disability payments) with the overseas cost-of-living allowance. The overseas COLA is a temporary non-taxable allowance that offsets higher prices service members must pay for certain goods and services while stationed outside of the continental United States. It is not related to the annual COLA that measures changes in the CPI.

Are other military, VA or government benefits affected by the COLA?

Survivor Benefit Plan annuities, VA disability compensation and pensions, and Social Security benefits are adjusted to keep pace with inflation using the same COLA that applies to military retirement pay.

Your military pension and full retirement

For many military retirees, a military pension is just one important piece of their overall retirement picture. Many accumulate assets in the TSP or an IRA and most follow the years spent on active duty with a second career, in some cases earning a second pension or accumulating additional assets in their employer’s retirement plan. To learn more about how you can effectively leverage these assets to prepare for your full retirement, check out our article on income planning for retirement or reach out to a First Command Financial Advisor near you.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Any recommendations provided to you in this report are strictly for financial planning purposes only. Should you require legal or tax advice, you should consult with your attorney or tax advisor.

TSP funds have very low administrative and investment expenses and, low expenses can have a positive effect on the rate of return of your investment.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.