Context for this Novel Coronavirus

By: John S. Weitzer, CFA

Chief Investment Officer

Feb 29, 2020 | 6 min. read

Investors are concerned about the potential global impact of the coronavirus. We have seen a material correction in U.S. and overseas stock markets in response to news that the virus has spread beyond China’s borders. An unexpected surge in the number of cases in South Korea, Italy, and Iran has raised the possibility that the virus could be evolving into a pandemic (worldwide infection versus containment in China).

This virus has been officially labelled COVID-19. I am not a virologist by any stretch, but I have been trained in economics, investments and history. I will attempt to provide some context to COVID-19 based on my experience and education and provide you with some perspectives about how this virus could affect the economy and the capital markets.

Before I begin, I think that it is important to note that any virus that has the potential to take human life is a tragedy that transcends the temporary collateral damage that may be caused to economies or financial markets. We recognize it as such, and we wish to express our sympathies for those affected by the virus in any way.

Coronavirus origins and symptoms

Coronavirus disease 2019 (or COVID-19) is a respiratory illness that can spread from person to person. The virus that causes COVID-19 is a novel coronavirus,[1] we are very familiar with ordinary coronaviruses, such as the common cold and flu. COVID-19 is a new and unique type of coronavirus that we do not have experience combatting.

The World Health Organization (WHO) reports that:

- About 80 percent of those infected recover from COVID-19 without needing special treatment.

- Around one out of every six people who gets COVID-19 becomes seriously ill and develops difficulty breathing.

- Older people, and those with underlying medical problems like high blood pressure, heart problems or diabetes, are more likely to develop serious illness.

The current case fatality rate (or CFR) is estimated to be around two percent.[2] This CFR is much lower than for SARS (CFR of 10 percent) or MERS (40 percent), which I discuss in more detail below.

As of February 27, these are the statistics related to COVID-19[3]:

- 82,548 infections (95 percent in mainland China)

- 2,810 deaths (98 percent in mainland China)

- 60 deaths outside of mainland China

Historical perspective

As with all things, it is best to look at this global event in context. Please consider our experience with epidemics:

- The Severe Acute Respiratory Syndrome (SARS) outbreak of 2003–2004 started in China. SARS was also a coronavirus. It spread worldwide within a few months, but it was quickly contained. No known transmission has occurred since 2004. During the outbreak, about 8,000 individuals were infected and around 800 died (10 percent CFR).[4]

- The Middle East Respiratory Syndrome (MERS) is a contagious, sometimes fatal respiratory illness. MERS was also a coronavirus. The disease was first identified in Saudi Arabia in 2012. There were 2,500 confirmed cases of MERS across 27 countries, with roughly 1,000 fatalities (40 percent CFR).[5]

- The Ebola Virus Disease (EVD) is a viral hemorrhagic fever of humans and other primates caused by Ebola viruses. The 2014–16 outbreak in West Africa was the largest and most complex Ebola outbreak since the virus was first discovered in 1976. This outbreak resulted in around 29,000 cases and 11,000 deaths (38 percent CFR).[6]

- The SARS, MERS, and EVD outbreaks were eventually contained and did not cause significant lasting damage to the global economy or the financial markets.

- The Centers for Disease Control and Prevention (CDC) estimates that influenza (the flu, another coronavirus) has resulted in “9 million–45 million illnesses, 140,000–810,000 hospitalizations, and 12,000–61,000 deaths annually from 2010 through 2017 in the U.S. alone. Preliminarily, the CDC estimates that 80,000 Americans died of the flu and its complications last winter – the disease’s highest death toll in at least four decades.”[7]

- Far more people die from influenza (the flu) every year than the outbreaks discussed above. We apparently do not fear the annual flu as much as we feared SARS, MERS, EVD, or now fear the COVID-19. Approximately 45 percent of the U.S. adult population receives the annual flu vaccination.[8] Think about this for a moment. The annual flu claims 12,000 – 61,000 lives a year in the U.S. alone, several multiples of where the current COVID-19 casualty rate stands currently, and yet only 45 percent of the adult U.S. population receive the annual flu vaccine.

- According to Brian Wesbury, Chief Economist at First Trust, many people are focusing on the total number of infected individuals and lives lost, but what they should be focusing on is the total number of active cases.[9] According to Worldometer, which aggregates statistics from health agencies across the world, total active cases peaked on Feb. 17 at 58,747 and have since been declining. The total active cases as of Feb. 26 stood at 46,222, a drop of 21 percent.[10]

Economic impact

From an economic standpoint, we expect the following:

- The U.S. economy will grow around two percent for the first quarter of 2020. The economic impact caused by COVID-19 will mostly be felt in the second quarter, which could knock growth down by 0.25 percent or so. Based on what we know at this time, we do not anticipate that this outbreak will push the U.S. economy into a recession.

- Capital goods exports to China and imports from China will be depressed due to the fact that Chinese factories closed for a period of time, and even though reopened, are operating at about 50 percent capacity.

- The negative impact of disrupted supply chains on the U.S. economy could be mitigated for several reasons. First, increased U.S. imports from Vietnam (which has been spared in the outbreak so far) have offset some of the diminished U.S. trade with China.[11] Second, the possibility of U.S. companies having brought forward shipments in an effort to get ahead of previously scheduled tariffs has increased U.S. inventories, which provide some cushion to supply chain disruptions.[12] Third, many U.S. companies started to lift some of their supply chains out of China to diversify risk during the China/U.S. Trade/Tariff spat that began in early 2018.[13]

- If this epidemic were to last longer, the supply of consumer goods that relies on Chinese parts would dwindle and prices would most likely increase (price inflation caused by too many dollars chasing too few goods).

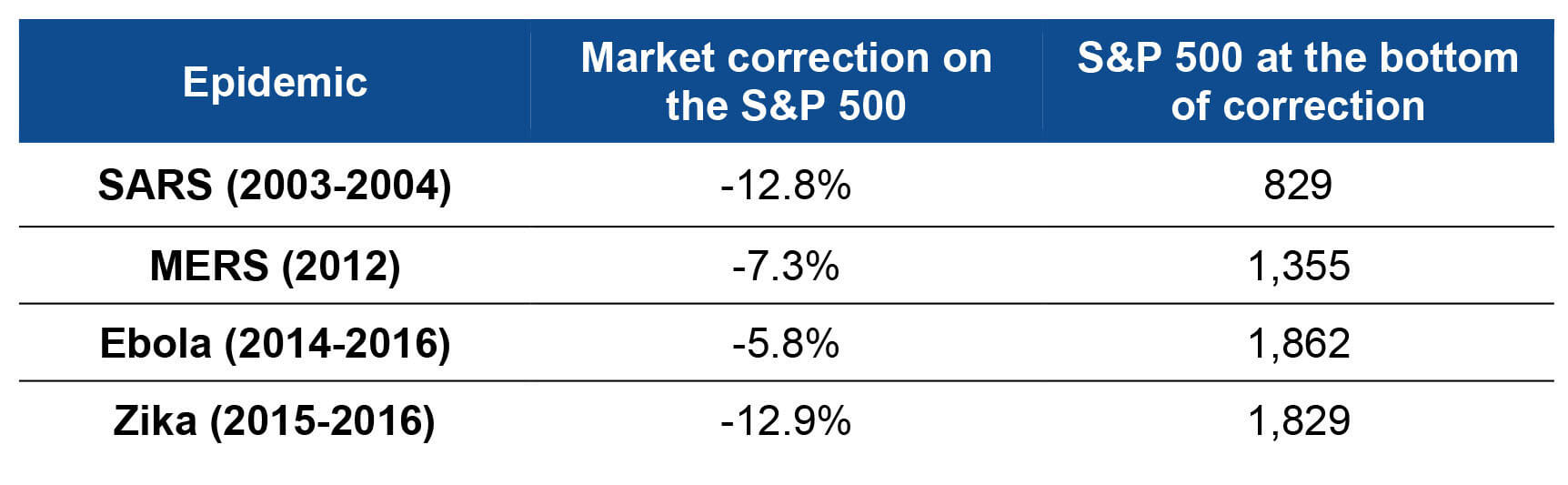

Market impact of past epidemics

We do not know and cannot guess when this virus will burn itself out. We only know that, at some point, it will end. Consider the following historical information on market corrections caused by various epidemics.[14]

As you review the table, keep in mind that the S&P 500 was at 2,979 on Feb. 27.

Looking back, the economic output of the U.S. at the beginning of 2003 (the year SARS made its entrance) was $11 trillion.[15] Today, it is double that at $22 trillion.[16] Epidemics such as those in the table above seem to negatively impact economic growth and disturb the capital markets over shorter time horizons (1 to 2-year periods). Over longer time periods, history would indicate that economies and financial markets are not significantly impacted. As legendary investor Warren Buffett said in an interview on CNBC earlier this week, “The real question is: ‘Has the 10-year or 20-year outlook for American businesses changed in the last 24 or 48 hours?’”

We will continue to closely monitor and keep you apprised of developments related to COVID-19 that could affect the economy or markets. If you have questions or concerns specific to your situation that have not been addressed, please do not hesitate to reach out to your Advisor. Thank you for the confidence you have placed in First Command.

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

All estimates provided are for informational purposes only and should not be relied on to make investment or other decisions. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. An investor cannot invest directly in an index.

©2020 First Command Financial Services, Inc. parent of First Command Financial Planning, Inc. (Member SIPC, FINRA), First Command Advisory Services, Inc., First Command Insurance Services, Inc. and First Command Bank. Securities and brokerage services are offered by First Command Financial Planning, Inc., a broker-dealer. Financial planning and investment advisory services are offered by First Command Advisory Services, Inc., an investment adviser. Insurance products and services are offered by First Command Insurance Services, Inc. Banking products and services are offered by First Command Bank. Securities products are not FDIC insured, have no bank guarantee and may lose value. A financial plan, by itself, cannot assure that retirement or other financial goals will be met. In Europe, investment and insurance products and services are offered through First Command Europe Limited. First Command Europe Limited is a wholly owned subsidiary of First Command Financial Services, Inc. and is authorized and regulated by the Financial Conduct Authority. Certain products and services offered in the United States may not be available through First Command Europe Limited.

Footnotes

[1] Coronaviruses are named for the crown-like spikes on their surface. Human coronaviruses were first identified in the mid-1960s. Centers for Disease Control and Prevention (CDC) (https://www.cdc.gov/coronavirus/types.html).

[2] Yang S, Cao P, Du P, Wu Z, Zhuang Z, Yang L, Yu X, Zhou Q, Feng X, Wang X, Li W, Liu E, Chen J, Chen Y, He D; on behalf of COVID-19 evidence and recommendations working group. Early estimation of the case fatality rate of COVID-19 in mainland China: a datadriven analysis. Ann Transl Med 2020;8(4):128. doi: 10.21037/ atm.2020.02.66.

[3] Center for Systems Science and Engineering (CSSE) at John Hopkins University (https://systems.jhu.edu/research/public-health/ncov/).

[4] https://www.nhs.uk/conditions/sars/.

[5] https://www.sciencenews.org/article/how-new-wuhan-coronavirus-stacks-up-against-sars-mers.

[6] https://www.cdc.gov/vhf/ebola/history/2014-2016-outbreak/index.html.

[7] Yardeni Research Morning Briefing (1/27/2020). The referred to flu season was the winter of 2018-2019.

[8] https://www.cdc.gov/flu/fluvaxview/coverage-1819estimates.htm.

[9] “Time to Fear the Coronavirus?” by Brian Wesbury, Chief Economist of First Trust (February 27, 2020). The number of active cases is equal to the number of infected cases minus deaths and minus those that have recovered.

[10] Same.

[11] COVID-19: Potential Trade Buffers & Trade Policy, Wells Fargo Securities – Economics Group (February 26, 2020).

[12] Same.

[13] “Time to Fear the Coronavirus?” by Brian Wesbury, Chief Economist of First Trust (February 27, 2020).

[15] https://fred.stlouisfed.org/series/GDP.

[16] Same.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.