What is the Blended Retirement System (BRS)?

Feb 27, 2025 | 8 min. read

We’ve boiled down the BRS to the 8 things you need to know in 2025, including current army continuation pay rates.

The Blended Retirement System (BRS) is the current retirement system for the U.S. military. Implemented in January 2018, it combines the traditional pension available to those who serve 20 years or more with matching TSP contributions, the opportunity to earn a mid-career bonus and options for taking a portion of your retirement pay as a lump sum.

More than 80 percent of service members do not serve the 20 years required to earn a lifetime pension1. One of the objectives of the Department of Defense in implementing the BRS was to give those members an opportunity to leave the military with retirement savings equivalent to those a worker in the private sector might accrue in a 401(k) plan.

In 2025, there are several changes coming to the BRS. These changes include an update to TSP contributions, and the announcement of future changes to continuation pay eligibility for service members in the Army.

What does this mean for you? How can you best capitalize on the benefits offered within the BRS? We’ve outlined eight key things you need to know.

1. Lifelong Pension for 20+ Years of Service

For members who serve 20 years or more, the BRS provides a guaranteed lifelong pension2. This pension, often referred to as military retirement income, is calculated using this formula:

High-3 x Years of Service x 2%

So, for example, if the average of your three highest years of earnings (High-3) was $53,088 and you served for 20 years, your monthly pension would be calculated as follows:

$4,424 ($53,088/12) x 20 x 2% = $1,770

Like Social Security, military retirement income is protected from inflation by an annual Cost of Living Adjustment (COLA), based on changes in the Consumer Price Index (CPI) as measured by the Department of Labor.

2. Personal Monthly Contributions

The Thrift Savings Plan (TSP) is a defined contribution retirement savings plan, much like a 401(k) offered at many private companies. After 60 days of service, you are eligible to begin making contributions directly from your paycheck. Unless otherwise specified, your contributions will default to five percent of your monthly pay. These contributions can be adjusted at any time. The money you contribute to the plan is not subject to a vesting schedule, so if you separate from the service, it belongs to you.

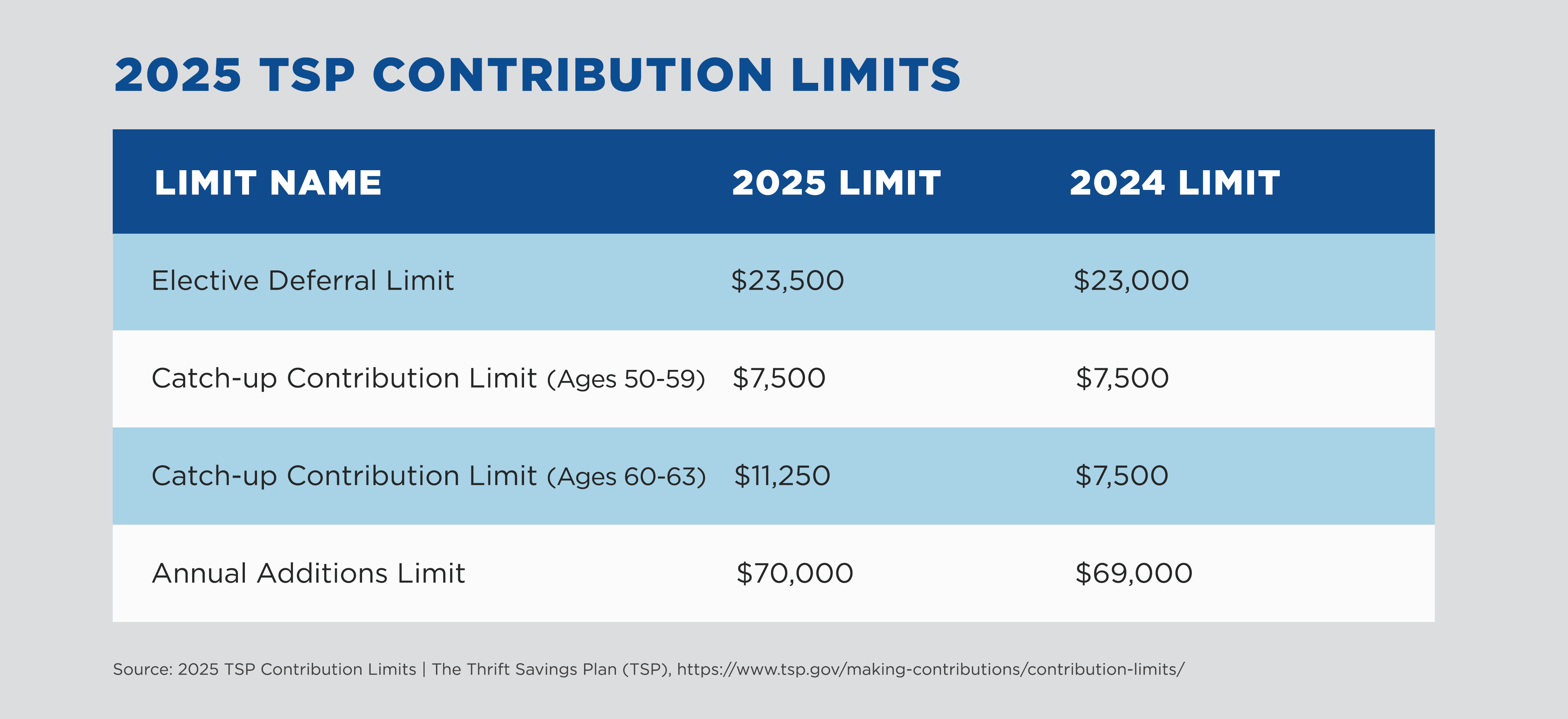

In 2024, for service members aged 50 and older, you were eligible to contribute an additional $7,500 yearly to your TSP in ‘catch-up’ pay to bridge any contribution gaps you may have had during your service. In 2025, this limit has been increased to the greater value of either $10,000 or 150% of the limit in effect for 2024. This increase has been also made eligible for service members aged 60 – 63.

Below you’ll find the annual TSP contribution limits for 2025. The Elective Deferral limit refers to the maximum amount one person can contribute toward their TSP in each calendar year from elective deferrals.

The annual additions limit applies to all TSP-eligible service members and is the most one person can accrue in their TSP in total. Each year’s Annual Additions Limit is inclusive of Elective Deferrals, matching programs, and includes the ability for service members stationed in combat zones to contribute greater amounts to their TSP. Those within combat zones may also have their income tax requirements waived, meaning they can more easily benefit from larger contributions. Your First Command Financial Advisor can help you navigate this specific benefit to help you create future financial security.

3. Automatic Government Contributions

Regardless of your personal contributions to your TSP, the government will contribute an amount equal to one percent of your salary on a pre-tax basis every pay period, beginning 60 days after your start date. These funds are not deducted from your pay—they are contributed from the federal government at no cost to you. This one percent is an automatic contribution, and you do not have to do anything to receive it. Automatic contributions vest after two years, at which point they are yours to take with you if you leave the service.

4. Matching Contributions

The BRS offers matching contributions in the TSP. This means that after two years of service, the government will match your pre-tax contributions dollar for dollar up to the first three percent and 50 cents on the dollar up to the next two percent. In other words, if you contribute five percent of your own pay to your TSP account, you will be investing an amount equal to 10 percent of your pay (5 percent individual contributions + 4 percent matching contributions + 1 percent automatic contributions). Better yet, all matching contributions are immediately vested.

The bottom line is that if you’re not contributing at 5 percent to the TSP, you’re not taking full advantage of the government’s matching contributions. And there’s one more thing to keep in mind – even though contributions above 5 percent are not matched, that doesn’t mean it’s not a good idea to benefit from the tax advantages of the TSP by contributing more if you are able.

5. Investment Options

Service members decide where the money in their TSP is invested by choosing from a menu of mutual funds. These funds vary in their historical performance, asset allocation and risk. It’s important to select funds that are aligned with your circumstances, objectives and tolerance for risk. A First Command Financial Advisor can help you determine which funds are the best fit for you.

6. Traditional or Roth Accounts

TSP contributions can be put into a traditional retirement account, Roth account, or a combination of both. Contributions to a traditional retirement account come out of your paycheck before you pay taxes on them, thus reducing your taxable income for the year. Taxes on the earnings are deferred until you begin withdrawing the money in retirement, at which point they are taxed as ordinary income.

In contrast, contributions to a Roth account are made after taxes, so there is no immediate tax benefit. However, both contributions and earnings can be withdrawn tax-free in retirement, assuming that all IRS requirements are met. This is a particularly compelling feature for those who begin investing early in life and benefit from the power of compounding.

So, which is the best option for you – traditional or Roth? A knowledgeable financial advisor can help you decide.

7. Continuation Pay

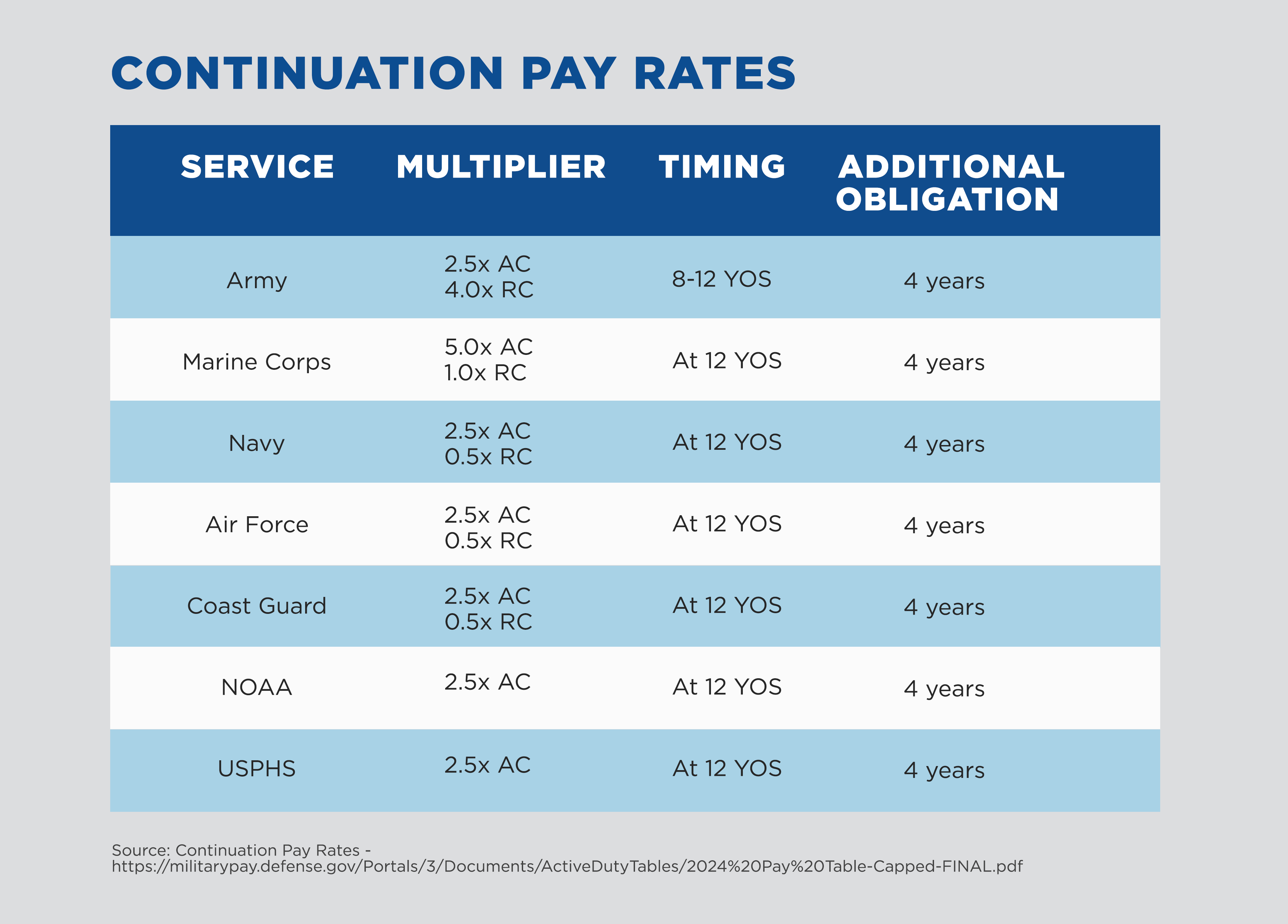

Continuation pay is a direct cash payout, paid as a mid-career benefit in exchange for a commitment of continuing service. This benefit is equal to a multiplier times monthly base pay for those on active duty and a smaller multiplier times monthly base pay for those in the Guard or Reserve. See below for a detailed breakdown of the current continuation pay rates for all branches.

In 2025, the Army announced changes to its continuation pay policy. While this year, the eligibility window, multiplier, and service obligation remain the same as 2024, in future years, the eligibility window will change. In calendar year 2026, the Army continuation pay eligibility window will expand to those who have completed no less than seven and not more than 12 years of service3. In calendar year 2027, the window will shrink to those who have completed no less than seven and not more than 10 years of service3. For now, the additional service obligation and continuation pay multiplier remains the same.

8. Retirement Pay Options

For those in the BRS, there are three options for receiving retirement pay: (1) full monthly payments, (2) a 25 percent lump-sum payment and monthly payments based on 75 percent of retired pay, and (3) a 50 percent lump-sum payment and monthly payments based on 50 percent of retired pay. For both lump sum options, the reduced retirement pay remains in effect until you reach full retirement age, which is currently 67. At that time, retirement pay will be restored to the full amount.

There is a degree of risk to taking the lump-sum payments, however, in that the lump sum payout is less than the payments that would be received over that time, effectively reducing the total retirement income of a service member who chooses this option.

Connect with a First Command Financial Advisor

As you can see, the structure of the BRS makes it necessary for service members to be active in preparing for their financial future. There are multiple decision points that will require increased financial engagement, disciplined savings behaviors, and smart investment choices.

Luckily, the complexity of the Blended Retirement System is not a puzzle you have to solve on your own. A First Command Financial Advisor can help you integrate all of your military benefits into a comprehensive financial plan tailored to your unique circumstances and goals. And then serve as your personal financial coach, helping you make smart, informed decisions at every step of your financial journey.

1Frequently Asked Questions Regarding the New Blended Retirement System Sections. (2018, March 28).

2Active duty military receive their pension after military retirement. Members of the National Guard and Reserve are eligible to receive this benefit at age 60.

3Please note the future changes to eligibility criteria are listed in calendar years, not fiscal years.

TSP funds have very low administrative and investment expenses and, low expenses can have a positive effect on the rate of return of your investment. Prior to requesting a rollover from your Thrift Savings Plan (TSP) account to an Individual Retirement Account (IRA), you should consider whether the rollover is suitable for you. There may be important differences in features, costs, services, withdrawal options and other important aspects between your TSP account and IRA.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Any recommendations provided to you in this article are strictly for financial planning purposes only. Should you require legal or tax advice, you should consult with your attorney or tax advisor.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.