2025 Military BAH Rates: Housing Allowance Changes

Dec 19, 2024 | 6 min. read

Understanding the Updates, Rates and Impact on Service Members

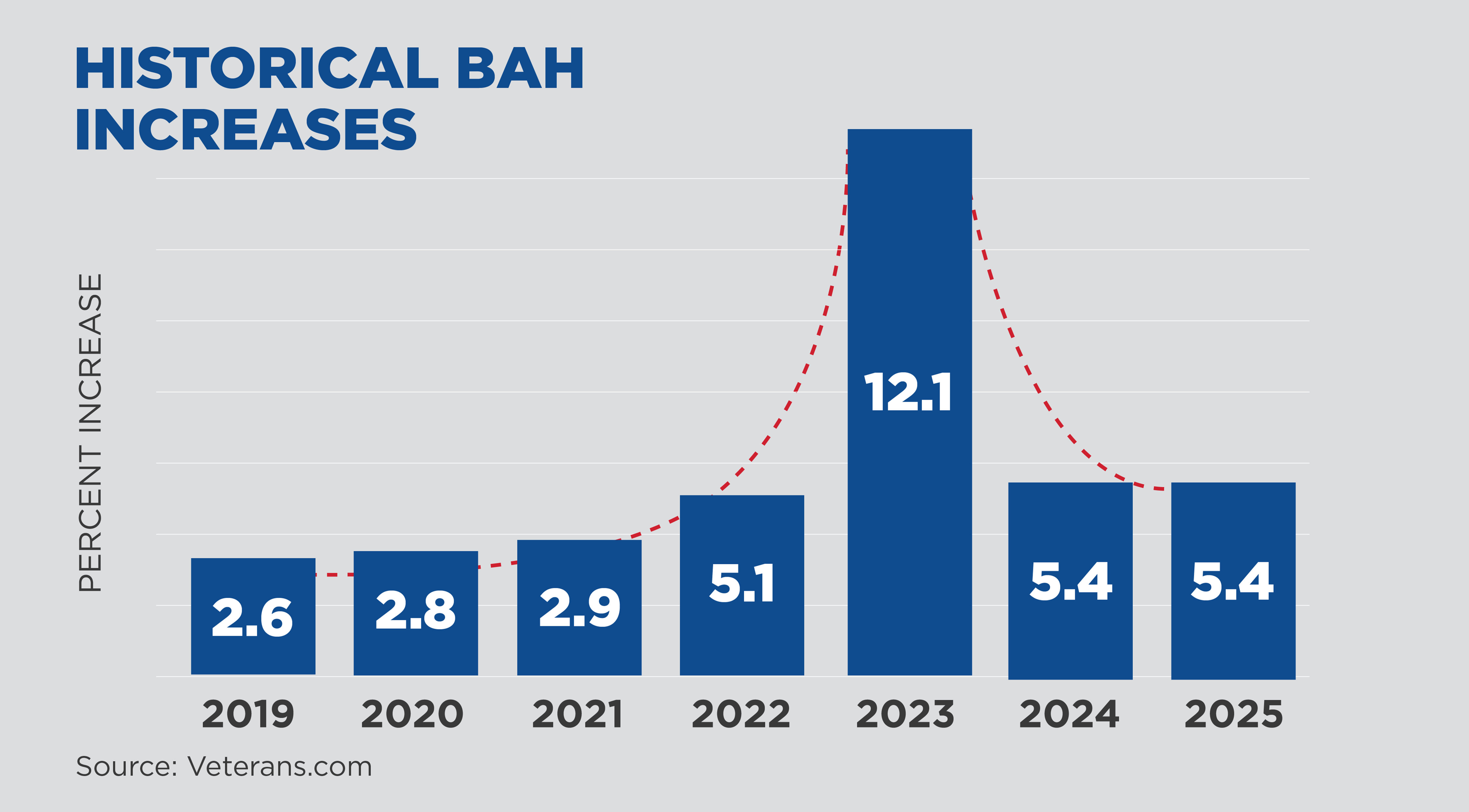

The Department of Defense (DoD) approved a 5.4 percent increase to the military Basic Allowance for Housing (BAH) for 2025. Rate changes take effect on Jan. 1. The 5.4 percent increase is the national average for BAH rates across the country, so the allowance for your specific location may differ.

As the graph below shows, the 2025 BAH increase is less than the 2023 increase, when housing costs escalated sharply. But the new rate matches current housing cost increases across the country and exceeds the 3.8% average annual BAH increase over the previous 10 years.

What is BAH?

BAH is an allowance to offset the cost of housing for service members who do not receive government-provided housing. By law, it’s meant to cover 95 percent of your housing costs, minus renters’ insurance. Rates are recalculated every year. If the rates go down where you are living, you will be grandfathered into the older, higher rate. If the rates go up where you are living, you'll receive the new, higher amount.

How is BAH calculated?

The amount of your BAH depends upon your location, pay grade, and whether you have dependents. BAH rates are calculated each year using median market rents and average utility expenditures (electricity, water/sewer, and heating fuel) for civilians with income levels comparable to military members in each local market area. Therefore, BAH rates in high-cost areas will be greater than those in low-cost areas. Visit the Defense Travel Management Office website for more information on how BAH is calculated and other allowance details.

Basic Housing Allowance (BAH) FAQ

Q: Do I have to pay taxes on my BAH?

A: According to the Internal Revenue Service (IRS), BAH is tax exempt and can be excluded from gross income as a qualified military benefit. It is exempt from federal, state and Social Security taxes. Excludable income like BAH will not be included in the wages, tips and compensation amount shown in box 1 on your IRS Form W-2.

Q: Can service members use their BAH for mortgage payments?

A: Yes. Members are free to use their BAH as they choose. However, BAH should not be expected to cover home ownership expenses or track fluctuations in the home purchase market. BAH is targeted to local rental markets.

Q: Does family size make a difference in the BAH rate a service member receives?

A: No. While BAH distinguishes between with-dependent and without-dependent status, the with-dependent compensation is based on comparable civilians using average family size. BAH rates do not increase with increases in the number of dependents.

Q: Can both members of a dual military couple receive BAH?

A: In general, both members of a dual military couple without dependents receive single BAH. If the couple has children, one spouse can claim them and receive BAH with dependents. The other spouse would continue to receive single BAH.

Q: Do military retirees still receive BAH?

A: No, BAH is only available to active-duty service members.

Q: Does BAH include Basic Allowance for Subsistence (BAS)?

A: No, although BAS is often paired with BAH when examining military benefits or total income, it is an individual and separate benefit.

Q: Do you get BAH on PCS leave?

A: BAH procedures vary when PCSing, depending on factors like whether the PCS originates from in or out of the continental United States, whether the member lived in military housing at the departure duty station, the duration of leave between duty stations, dependent status, and family member relocation needs. Connect with your command’s finance office to determine how BAH is handled in your individual circumstances.

Q: Can my spouse or children use my Post-9/11 GI Bill and get BAH?

A: Only active-duty service members are eligible to receive BAH. Money to help pay for housing when using GI Bill benefits is called a monthly housing allowance (MHA), and it’s based on the BAH rate for an E-5 with dependents for the zip code of the school. If Post-9/11 GI Bill benefits are transferred to a spouse, the recipient is not eligible for MHA while the service member is on active duty, but may qualify for it once the member separates. A dependent child that uses a transferred education benefit may qualify for MHA even when the service member remains on active duty.

Q: Does Veteran Readiness and Employment (VR&E) pay BAH?

A: Service members and veterans with service-connected disabilities that are enrolled in VR&E receive support, education and training to explore employment and independent living options. If a participant qualifies for the Post-9/11 GI Bill, the veteran may be eligible to receive BAH. For more information, visit Veteran Readiness and Employment (VR&E) Home (va.gov).

Q: How do I find the BAH rate for a specific location?

A: The Defense Travel Management Office provides an online BAH rate look-up form by zip code and pay grade. The page also allows you to look up housing costs in a given area or you can download a file with BAH rates for all locations and pay grades to help you make informed housing and relocation decisions.

Make the most of your robust military benefits

Between allowances like BAH and BAS, the opportunity to earn special pay, and the robust set of benefits included in the Blended Retirement System (BRS), military members have a unique opportunity to position themselves for future financial security. The 2025 military pay raise and the cost-of-living adjustment should be considered as you manage your finances as well. First Command Financial Advisors, most of whom served themselves and are well acquainted with military pay and benefits, have been helping service members and military families make smart financial decisions and integrate their benefits into comprehensive financial plans since 1958. If you’re ready to get your financial future squared away, schedule a complimentary consultation with a local First Command Advisor today.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Should you require legal or tax advice specific to your situation, you should consult with an attorney or qualified tax advisor. The information provided to you herein is provided for informational purposes only, is not intended to be tax or legal advice, and should not be used for the purpose of avoiding tax-related penalties under the Internal Revenue Code.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.