Making the GI Bill Work for You in 2024

May 30, 2024 | 5 min. read

Minimize college debt by maximizing military benefits and savings tools.

Regardless of your plan for educating yourself, the rising costs of higher education can be daunting. According to collegedata.com, the average annual cost of public college tuition and fees for the 2023-2024 school year was $28,840 for in-state residents and $46,730 for out-of-state students. And the average $60,420 price tag for private school can be even more intimidating.

Despite surging costs, the demand for a college education continues to increase as well. This perfect storm has contributed to total student loan debt of $1.75 trillion in the U.S., with the average graduate owing $28,950 in student loans, according to Forbes.

To avoid joining these grim statistics, it’s important to have a financial plan that accounts for all of the resources at your disposal—including the Post-9/11 GI Bill. This program is a standout benefit that, with proper planning, can be the key to earning a college degree with limited or no debt.

This article will go over GI Bill education benefits for service members and dependents that can help mitigate education costs but you can also get started by talking to your Financial Advisor. It will also include a GI Bill calculator to best determine the benefits available to you or your child as a recipient of GI Bill benefits. Your Advisor can help you make the most of your hard-earned benefits and recommend supplementary resources as part of a holistic, customized plan.

2024 GI Bill Benefits & Rates

There are many benefits of the Post-9/11 GI Bill. For starters, it covers the full cost of public school tuition for four years. For those with their hearts set on a private college or university, it can put a dent in the tuition bill, but there are funding limits.

First Command is here to help you determine possible uses for your GI Bill benefits. For starters, determining an estimation of your benefits based on the educational institution of your choosing and your location can give you the information you need to make a detailed plan. Using this GI Bill calculator can give you estimation of the benefits you’ll receive.

The Post-9/11 GI Bill can be used for undergraduate, graduate, vocational, licensing and certification classes, as long as the program is approved by the Department of Veterans Affairs. These programs can earn veterans a bachelor’s degree, master’s degree, vocational license, or other educational milestone to assist in their transition to civilian life.

Housing and Additional GI Bill Benefits

Active-duty service members receive the Basic Allowance for Housing (BAH) benefit to assist with the cost of housing while utilizing GI Bill benefits. These benefits are often increased each year to combat rising housing costs, and each eligible service member receives a benefit proportional to the cost of living in their specific location.

GI Bill recipients who are no longer active duty receive the Monthly Housing Allowance (MHA) while utilizing GI Bill benefits to cover a portion of housing costs while in school. These rates are determined by the school location and the number of credits taken. Online classes are covered by GI Bill benefits, but you must take at least one in-person class to be eligible for the MHA on top of schooling costs. In addition, the MHA is not available if you’re on active duty (active-duty service members utilize the BAH).

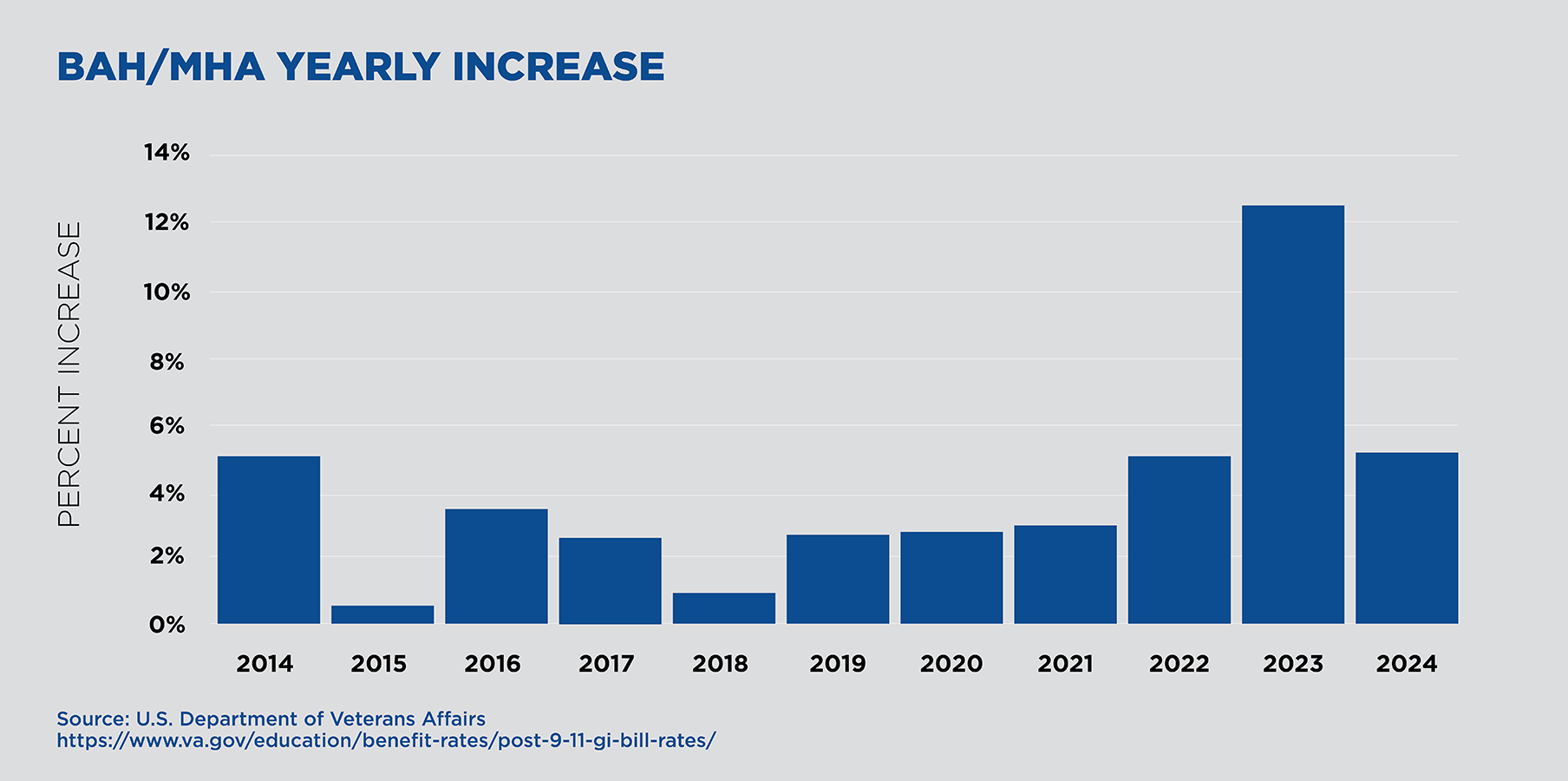

Similar to the BAH, MHA benefits usually increase year-over-year in proportion to rising costs. Each year, however, may have a different increase than previous years.

Service members can see housing benefit increases year-over-year in the below chart:

Finally, the bill provides a stipend to assist with the cost of books and supplies. These benefits can be variable but typically max at $500 per semester of school (or $1,000 per year).

2024 GI Bill Payment Schedule

Applying for the GI Bill can seem daunting, but is ultimately a straightforward process. You application begins online, over the phone, or in person at a regional VA office. The application consists of submitting required documents and relaying your desired school information. It is recommended to apply for benefits early, as once you are approved you can utilize the benefits at any time. It is worth noting the VA suggests at least 30 days of processing time before payments are made. The VA application website FAQ section is a valuable resource for determining the best course of application for you.

This process can seem complex, but the VA application portal condenses these steps for you to follow. You can begin your online application here and utilize various channels for assistance, such as by calling (888) 442-4551 to speak to a VA representative.

Another commonly confused aspect of GI Bill planning regards the timing of payments once an eligible recipient is approved to receive benefits. Once approved, fees associated with schooling, such as tuition costs, are paid directly to the educational institution of your choice. Schools will either receive payments toward the full cost of tuition (in the case of state schools) or a portion of tuition costs each semester for private schools. Payments to schools can vary in timeline, so working with an admissions counselor to clarify any timelines may be a wise choice.

BAH and MHA benefits are paid directly to the recipient and are normally distributed at the beginning of each month—it is important to note, however, that there is no definitive date on which you are certain to receive your benefits. Other benefits, such as a stipend for books and supplies, are often paid on an as-needed basis and have no certain timelines.

The Post 9/11 GI Bill vs the Montgomery GI Bill

There is also another GI Bill—the Montgomery GI Bill—that offers veterans tuition assistance benefits but with a different payment structure. Instead of paying tuition directly to the school like the Post-9/11 GI Bill, the Montgomery GI Bill sends a check directly to the student. Eligibility differs for each bill but generally, the Post-9/11 GI Bill offers veteran students more assistance when pursuing a standard, four-year degree. However, there are some exceptions so learn more about the differences and be sure you are applying for the bill most beneficial to you. One difference, for example, is the Montgomery GI Bill expires sooner than Post 9/11 GI Bill benefits.

Cool Things You Can Use the GI Bill For

In addition to a traditional four-year education, the GI Bill has a host of other applications that may interest those who are eligible. In exchange for additional service time, for example, eligible recipients can transfer their benefit for use by a spouse or child. There are certain limitations to this benefit, but those with families may find this an enticing option.

Veterans with the travel bug, can utilize their GI benefits to study and live in another country if the accredited program is eligible for GI Bill benefits. Recipients looking to travel with their benefits can find more information on international programs on the VA website.

Another enticing option for GI bill recipients is using their benefits to pay for the cost of flight training once an eligible recipient has already achieved a private flight license. While the GI Bill can NOT be used for the ‘recreational’ license required before becoming a professional, benefits can be applied to achieving professional licensing for a variety of aircraft.

Other differentiated uses of GI Bill benefits include on-the-job training stipends for industries such as plumbing, hotel management, and firefighting. Also eligible for benefits are certification programs for Emergency Medical Technicians (EMT), HVAC repair, and barber/beautician school programs. The VA website provides a comprehensive view of eligible programs to best utilize your benefits for your life path.

Who’s Eligible for the GI Bill?

In general, the Department of Veterans Affairs (VA) broadly defines eligible service members as those who “have at least 90 days of aggregate active-duty service after September 10, 2001, and are still on active duty,” or those who “are honorably discharged or discharged with a service-connected disability after 30 days.” Veterans, spouses, dependents, and purple heart recipients are eligible. Another thing to note is if your service ended before January 1, 2013, your Post-9/11 GI Bill benefits will expire 15 years after your last separation date from active service. However, if your service ended on or after January 1, 2013, your benefits won’t expire thanks to a law called the Forever GI Bill - Harry W. Colmery Veterans Educational Assistance Act. You can read about full eligibility requirements here.

Service members with at least six years of service can transfer education benefits from the GI Bill to a spouse or child as long as they are willing to commit to an additional four years of service. Recently, the Department of Defense added an additional restriction to the transfer policy—beginning on July 12, 2019, only service members with less than 16 years of service will be able to take advantage of the transfer option. So far, the only exception is for Purple Heart recipients, who are not required to meet the years of service qualification or commit to an additional period of service. To find out full eligibility requirements for survivors and dependents, read more here.

Apply Now

The GI Bill is a crucial piece of the puzzle towards funding higher education and it’s a benefit you have earned through your service. You can apply right through the government’s website at https://www.va.gov/education/how-to-apply/.

GI Bill FAQ

Q: How much does the GI Bill cover in 2024?

A: For educational expenses (for those who receive 100% of the GI Bill benefit), the GI Bill will cover the cost of a public, four-year institution or up to $27,105.05 for a private school. Other programs are also eligible for payment from GI Bill services. A full list of benefit payouts can be found here. GI Bill rates for 2024 are set through July 31.

MHA and BAH benefits are determined by the location of your educational institution.

Q: Can my spouse use my GI Bill and get BAH?

A: Generally speaking, yes, those that meet certain service requirements are eligible to transfer their GI Bill benefits to a spouse or child. This transfer does require certain service requirements and may require a service member to serve for additional time. More details can be found about transferring your GI Bill benefits here.

Q: How long is the GI Bill good for?

A: For veterans whose service ended prior to January 1, 2013, post 9/11 GI Bill benefits expire 15 years after your last day of service. For those whose last day of service was on or after January 1, 2013, GI Bill benefits never expire thanks to the Forever GI Bill. While in force until 2030, Montgomery GI Bill benefits are usable for ten years from date of separation from service.

Q: What is the difference between the GI Bill and tuition assistance?

A: Tuition assistance programs are available for those currently on active duty who are seeking higher education or vocational certifications. Those eligible programs, therefore, do not deplete GI Bill benefits—they are capped per year, however, and may not cover the full cost of certain programs. Though you can utilize GI Bill benefits while on active duty, most veterans choose to utilize their benefits once separating from the service. Tuition assistance is a popular program for attaining higher education while still serving, prior to utilizing Gi Bill benefits. More information on tuition assistance programs can be found here.

Q: Is the GI Bill taxable?

A: According to the Internal Revenue Service (IRS), GI Bill payments are NOT considered taxable income at the federal level.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Should you require legal or tax advice specific to your situation, you should consult with an attorney or qualified tax advisor. The information provided to you herein is provided for informational purposes only, is not intended to be tax or legal advice, and should not be used for the purpose of avoiding tax-related penalties under the Internal Revenue Code.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.