2025 SGLI & VGLI Coverage: Are Your Family's Needs Met?

Jun 20, 2025 | 7 min. read

SGLI and VGLI life insurance rates are changing on July 1, 2025. Consider whether the rates and levels of protection are right for your family.

Life insurance isn’t always the easiest topic to bring up. For many people, it can feel uncomfortable to talk about—almost like tempting fate—and buying it can seem unrewarding, since the benefits aren’t always immediately visible. But talking about and addressing the need for life insurance may give you the peace of mind that comes from knowing that your family can be prepared in the event of your unexpected death.

What is SGLI and how much does it cost?

Military members are eligible for affordable term life insurance known as Servicemembers’ Group Life Insurance (SGLI). Through June 2025, military members are automatically enrolled in SGLI at the full coverage amount of $500,000 for just $31 per month, or $372 per year. Beginning July 1, 2025, the cost for $500,000 of coverage will decrease to $26 per month, or $312 per year. You can find a complete list of the upcoming discounted premium rates, by coverage amount, on the Department of Veterans Affairs (VA) website.

While auto-enrollment is set at $500,000, you have the ability to make changes to your SGLI coverage at any time and can select coverage in increments of $50,000. For service members with families, full coverage is usually advisable. And even though $500,000 in coverage may be more than single service members with no dependents need, SGLI’s affordability makes paying for it and designating parents, siblings, or other family members as beneficiaries an option worthy of consideration.

Those covered by SGLI also automatically receive traumatic injury protection in the form of Servicemembers’ Group Life Insurance Traumatic Injury Protection (TSGLI). If the criteria for a traumatic injury are met, eligible service members may receive from $25,000 to $100,000 in short-term financial support to help during the recovery from a severe injury that is sustained while serving in the military. The $1 monthly cost of TSGLI is included in the SGLI premium.

What is VGLI and how much does it cost?

Separating or retiring service members can’t take SGLI with them when they leave active duty, but they have the option to replace their SGLI with Veterans’ Group Life Insurance (VGLI). They can apply for VGLI within 1 year and 120 days from discharge for up to the amount of coverage they had with SGLI. If a service member has less than the maximum SGLI coverage upon leaving active duty, they can increase their coverage by $25,000 one year after getting VGLI and then every five years afterward, up to a total of $500,000 until reaching the age of 60.

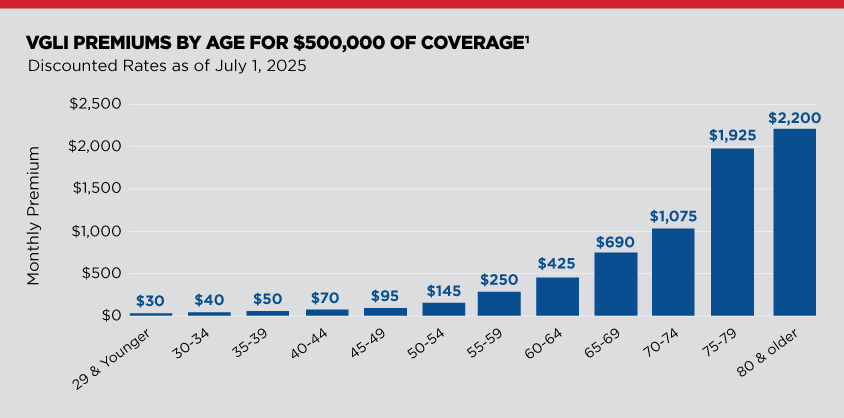

Monthly premiums for VGLI are substantially higher than SGLI and are based on your age and the amount of coverage you choose. They increase at five-year intervals, so VGLI is not an ideal long-term or permanent solution if other life insurance options are available to you. Through June 2025, at age 65, the same $500,000 of coverage that costs $31 per month for those on active duty costs $735 per month for veterans. On July 1, 2025, VGLI rates will decrease, and $500,000 of coverage for a 65-year-old will cost $690 per month. A complete list of discounted VGLI rates is available, by coverage amount and age, on the VA’s website. Even with the upcoming rate discounts, VGLI remains a more costly life insurance option as one gets older. That’s a good reason to consider alternative coverage options like a permanent life insurance policy that allows you to lock in your monthly premium prior to exiting active duty.

A First Command Financial Advisor can help you assess the needs of your family to determine the right amount and type of life insurance you will need to replace SGLI when you leave the military.

SGLI may not go as far as you think

For some families, the purpose of life insurance is to replace part or all of the income of the deceased. If it’s only necessary to replace that lost income temporarily, $500,000 might go a long way. But if the objective is to indefinitely or permanently replace the lost income, it may be necessary to keep the lump sum intact and live off the interest it generates. In that scenario, $500,000 won’t go nearly as far. A frequently cited rule of thumb suggests spending no more than 3% to 4% of the principal annually to preserve it and keep pace with inflation. In that case, $500,000 would produce only $15,000 to $20,000 in annual income.

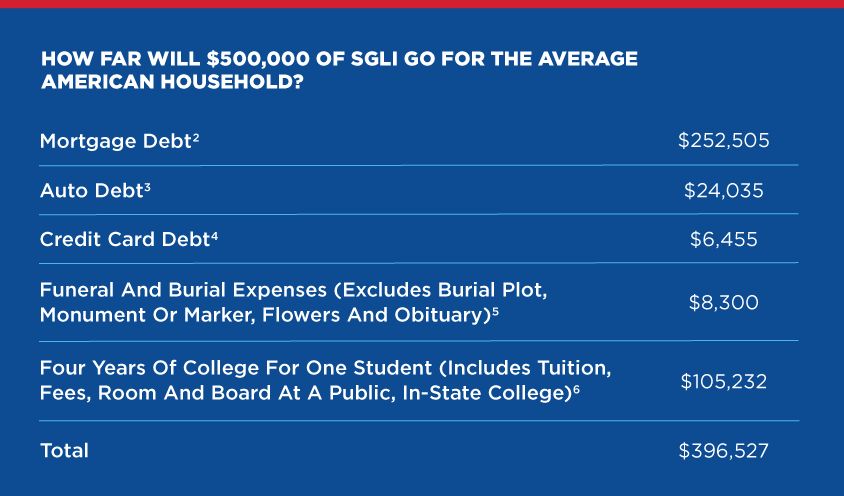

In some cases, it may make more sense to use life insurance proceeds to pay off debt and reduce the cost of living for the surviving family members, or to set aside a portion for anticipated future expenses, like college tuition for children. But this can add up. As the table below illustrates, paying off an average mortgage, car loan, and credit card balance while covering funeral expenses and setting aside enough money to pay college tuition for just one child can exhaust most of a service member’s SGLI benefit, leaving only a relatively small amount to help generate supplemental income.

How do you supplement or replace SGLI and VGLI to prepare for your family’s needs?

You may need help determining the best way to fill any gap that might exist between your military life insurance and the needs of your survivors. An experienced financial advisor can walk you through a detailed survivor needs analysis that takes the unique circumstances of your family into account. And even if you don’t have dependents yet, planning ahead can be a smart financial move for the family you hope to have one day. The simple truth is that life insurance is most affordable when you are young and in good health.

At First Command, three out of four of our Financial Advisors are veterans or military spouses. They are well versed in military pay and benefits, and the unique challenges and opportunities associated with life in the military. Your Advisor can help determine if your life insurance coverage is aligned with the needs of your family to help ensure that you've taken action to protect the people you care about most.

Frequently Asked Questions

Can you have SGLI and VGLI at the same time?

Only active-duty service members are eligible to enroll in SGLI. Upon separation or retirement, you have up to one year and 120 days from discharge to apply for VGLI.

Do veterans still have SGLI?

You do not keep SGLI when you leave active duty. You do have 120 days of free SGLI coverage from the date you leave the military, but you will need to consider other options for the long term, like applying for VGLI or securing personal life insurance.

Should I replace SGLI with VGLI?

The answer depends upon your individual circumstances. Look at the cost of VGLI for the age at which you are leaving the military and be aware that premiums increase every five years, getting substantially higher around 55 years of age. And keep in mind that the sooner you purchase a personal policy, the lower your premium will be. Your insurability is a factor to consider too. If you have a pre-existing medical condition, VGLI may be appealing – at least initially – because no proof of insurability is required. Your Financial Advisor can help you determine whether VGLI or a personal life insurance policy is right for you.

Are SGLI or VGLI premiums or coverage options changing in 2025?

Premiums for SGLI and VGLI are decreasing as of July 1, 2025. SGLI rates will go from 6 cents per $1,000 of coverage to 5 cents per $1,000 of coverage. VGLI rates will be discounted between 2% to 17%, depending on a veteran’s age, with an average discount of 11%. Coverage options for both SGLI and VGLI remain unchanged at up to $500,000.

The last SGLI premium change occurred in 2019 when the rate decreased from 7 cents to 6 cents per $1,000 of coverage.7 VGLI rates last changed in April of 2021 when they decreased an average of 7% across all age groups.8 The last change in coverage for SGLI and VGLI occurred in March of 2023 when it increased from up to $400,000 to up to $500,000.9

Why are SGLI and VGLI rates decreasing?

Premiums for SGLI and VGLI are decreasing because of the sound financial position of the two programs.

1VGLI Premium Discount - Life Insurance

2Average US Mortgage Debt Increases to $252,505 in 2024

3 Economic Pressures Continue to Drive Growth in the Credit Card and Personal Loan Sectors | TransUnion

4Average Credit Card Debt Study 2025 – Forbes Advisor

52023 NFDA General Price List Study Shows Inflation Increasing Faster than the Cost of a Funeral > National Funeral Directors Association (NFDA)

62024 Average Cost of Colleges

7Servicemembers Group Life Insurance SGLI Premiums - 2024 Rates (themilitarywallet.com)

8viewPDF.cfm (va.gov)

9SGLI Increase to $500,000 FAQs - Life Insurance (va.gov)

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.