Assessing the Damage

By: John S. Weitzer, CFA

Chief Investment Officer

Sep 1, 2020 | 6 min. read

CIO John Weitzer examines the widespread human and economic toll of the virus and potential signs of healing.

When I was 10 years old, a tornado ripped through my neighborhood in West Allis, Wisconsin. I remember climbing up from the basement with my family after the storm had passed and going outside to investigate. The sky above was orange-pink, and to the east, where the storm had headed, it was dark purple. It was eerily quiet. Other families exited their homes and made their way to the street. All of us were assessing the aftermath of the storm. We observed what trees had gone down and whose roof was peeled off their house. We heard through the grapevine that our church several blocks to the east was hit by the tornado. We had just experienced a natural disaster, but our minds were already turning to cleaning up the debris and repairing the damage.

These memories came flooding back to me as I was thinking about the current state of the pandemic. It has been nearly six months since COVID-19 hit the U.S. We have seen an initial wave and a resurgence, and we are not out of the woods. But in terms of accessing the economic damage, I have the same feeling today that I had over four decades ago – the feeling of coming outside after a violent storm and looking around at the initial damage it had wrought.

The virus and resulting nationwide shelter-in-place policies put in place to mitigate its spread have caused great damage both in term of human lives as well as economically. How much damage?

- COVID Deaths – As of the date of this commentary, more than 180,000 people have died from this virus.[1] We will see more deaths through the remainder of the year.[2] This is a great tragedy that cannot be undone.

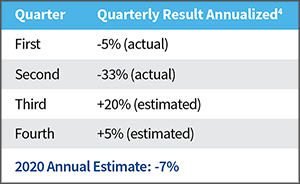

- Gross Domestic Product (GDP) – We entered 2020 estimating that the GDP annual growth rate (which measures the economic output of the U.S.) would be around two percent.[3] Here are actual and projected numbers for 2020:

Based on the current course, we do not expect a return to the same levels of economic output that we had at the end of 2019 until 2023.[5] Between the patchwork, state-by-state approach being taken to identify a balance between safety and economic growth and the murky outlook on how many lost jobs will return, there are simply too many unknowns for us to be optimistic at this stage about a rapid recovery. Of course, the successful development of a truly effective vaccine could accelerate this path, but that remains elusive for the time being; even when one or more vaccines are approved, distribution and widespread adoptions are hurdles that must still be cleared. And so, for now, the best analogy for our economy is probably a battleship that has just taken a torpedo to the hull and is slowly making its way to port for repairs.

- U.S. Corporate Earnings – We expected U.S. companies (as represented by companies in the S&P 500 stock index) to grow their earnings between three and eight percent in 2020.[6] Instead, due to the virus and policies enacted to mitigate it, corporate earnings are projected to contract by 26 percent.[7] This is a significant drop, and, for most of the same reasons given for our caution about the speed of GDP recovery, we do not project U.S. companies to recover to the same earnings level until the latter half of 2022.

- Bankruptcies – The pandemic and its disruption to global supply chains, consumer spending, and manufacturing activity resulted in bankruptcy filings at the fastest rate since 2013.[8] Through June, there have been over 3,400 bankruptcies in the U.S.[9] This is on par with the first half of 2008, during the Great Financial Crisis (2007-2009). Some of the companies filing for bankruptcy are very familiar names – Hertz, JC Penney, J Crew, Chesapeake Energy, Cirque du Soleil, GNC, Neiman Marcus, Brooks Brothers, Sur la Table, Lord & Taylor, and Virgin Atlantic.[10]

- Unemployment – As you might guess, when the economy tanks, corporate earnings materially decrease and companies go bankrupt, people lose their jobs. Heading into 2020, the unemployment rate was a very low 3.5 percent.[11] Due to COVID, the rate spiked up to 15 percent and has since drifted down to 10 percent. We are projecting the rate to settle at around eight percent by the end of 2020. As of the end of July, 16 million out-of-work Americans were receiving unemployment checks.[12] We do not expect to see pre-pandemic levels of employment for several years.

- Collateral Damage – Some examples of collateral damage are higher suicide rates, an increase in domestic violence, increased drug and alcohol abuse, derailed educational paths, shorter life spans and a decrease in public health services.[13] During the last U.S. recession (2008-2009), the “bleak job market helped spike suicide rates in the United States and Europe, claiming the lives of 10,000 more people than prior to the downturn.”[14] In Europe and the United States, suicide rates rise about one percent for every one percentage point increase in unemployment, according to research published by lead author Aaron Reeves from Oxford University.[15] Los Alamos, New Mexico has seen a threefold increase in suicides.[16] Suicides in Cook County, Illinois are up 13 percent over last year.[17] In Fresno, California, suicides are up 70 percent over last year.[18]

- COVID Baby Bust? – During the two-month shelter-in-place period of this pandemic, a friend had suggested that we would see a lot of new babies 10 months in the future as people were “stuck home” with their romantic partners. He jokingly referred to this potential phenomenon as the COVID Baby Boom. However, research shows that the most likely result is a COVID Baby Bust. The decline of births could be “on the order of 300,000 to 500,000 fewer births next year.”[19] This estimate is based on the lessons learned from economic studies of fertility behavior, along with data obtained during the Great Financial Crisis (2007-2009) and the 1918 Spanish Flu.[20] The reasons for this outcome are not yet clear, but there are some indications that it may be associated with the high levels of anxiety – both financial and personal – that many people have been experiencing since the onset of the pandemic.

- Federal Debt – In response to the pandemic, the federal government has taken on trillions in additional debt. At the end of 2019, there was about $22 trillion in federal debt.[21] Our economic output as a nation was about the same. Now, our economic output has dropped seven percent, but our federal debt has increased to $26.6 trillion.[22] This is not good. J.P. Morgan Asset Management forecasts that U.S. debt will be over 125 percent of our Nation’s economic output in 2030.[23] Studies have shown that when a country’s debt exceeds 120 percent of its GDP, economic growth will slow and even stall. Our long-term debt, in other words, just became a more immediate problem. If we do not solve for this in our generation, our children and grandchildren will have less opportunity and potentially a lower standard of living than we enjoy today.

The pandemic is similar in some ways to a natural disaster, but its impact is more widespread and potentially longer lasting. It’s becoming clear now that we will not recover from this in months, but years. Having said that, there are signs that the process of healing has begun. Though it may not feel like it to many, we have, technically speaking, already emerged from the pandemic-related recession, which ended up being the shortest recession in U.S. history. In addition, U.S. stock markets have recovered their losses and are posting small positive returns through the end of July. Stocks tend to be effective prognosticators of the future because stock investors invest not for today but for tomorrow. They seem to be pointing past the dark purple sky towards clearer skies – which would be a welcome sight for all of us.

First Command is here for you.

Considering the economic damage wrought by the coronavirus, financial markets have proven to be surprisingly resilient. It’s been yet another lesson in why the best course of action for long-term investors is almost always to stick to their plan and avoid making impulsive changes to their investment portfolio. If you have questions or concerns specific to your situation that have not been addressed, please reach out to your Advisor. Thank you for the confidence you have placed in First Command. We are committed to being at our best for you at this important time.

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

All estimates provided are for informational purposes only and should not be relied on to make investment or other decisions. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. An investor cannot invest directly in an index.

©2020 First Command Financial Services, Inc. is the parent company of First Command Brokerage Services, Inc. (Member SIPC, FINRA), First Command Advisory Services, Inc., First Command Insurance Services, Inc. and First Command Bank. Securities products and brokerage services are provided by First Command Brokerage Services, Inc., a broker-dealer. Financial planning and investment advisory services are provided by First Command Advisory Services, Inc., an investment adviser. Insurance products and services are provided by First Command Insurance Services, Inc. Banking products and services are provided by First Command Bank (Member FDIC). Securities are not FDIC insured, have no bank guarantee and may lose value. A financial plan, by itself, cannot assure that retirement or other financial goals will be met.

Footnotes

[1] https://www.worldometers.info/coronavirus/country/us/

[2] https://covid19.healthdata.org/united-states-of-america.

[3] https://www.firstcommand.com/coaching-center/insights/market-outlook-2020/.

[4] YRI Economic Forecasts by Yardeni Research, Inc., page 1 (May 26, 2020). Please note that these are quarterly numbers that are annualized. For instance, if the quarter annualized number is -40%, it really means that the economic output for the quarter fell 10%, but the number is annualized to show what would happen if that same run rate lasted for a year or four quarters.

[5] Same at page 2.

[6] https://www.firstcommand.com/coaching-center/insights/market-outlook-2020/.

[7] Same.

[9] Same.

[10] Same. See also, https://fortune.com/2020/08/04/companies-filing-bankruptcy-2020-due-to-covid-list-filed-chapter-11-coronavirus-pandemic/.

[11] https://www.firstcommand.com/coaching-center/insights/market-outlook-2020/.

[12] https://www.ftportfolios.com/retail/blogs/Economics/index.aspx

[13] “COVID’s Other Casualties – Researchers warn the COVID-19 lockdown will take its own toll on health” by M.B. Pell and Benjamin Lesser, Reuters Investigates (April 3, 2020)(https://www.reuters.com/investigates/special-report/health-coronavirus-usa-cost/).

[14] Same.

[15] Same.

[17] Same.

[18] Same.

[19] https://www.brookings.edu/research/half-a-million-fewer-children-the-coming-covid-baby-bust/. See also, https://www.ai-cio.com/news/long-range-investing-relation-decline-births-fertility-rate/?apos=7_art&utm_source=newsletter&utm_medium=email&utm_campaign=CIOAlert.

[20] Same.

[21] Yardeni Research (August 2020).

[22] https://usdebtclock.org/#.

[23] J.P. Morgan Guide to the Markets (3Q 2020), page 25 (6/30/2020).

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.