The Virus that Stopped the Longest Bull Market in U.S. History

By: John S. Weitzer, CFA

Chief Investment Officer

Mar 17, 2020 | 6 min. read

The fear and uncertainty caused by the coronavirus is being felt worldwide. First Command CIO John Weitzer offers perspective on the crisis and what we can expect.

March 12, 2020 marked the end of a more than 11-year bull market, the longest on record.[1] The start of a bear market marks the end of a bull market and, by definition, a bear market is an equity correction greater than 20 percent. As of the end of trading on March 12, the S&P 500 was down 28 percent.

Generally, equity bear markets result from an economic recession triggered by high interest rates, high inflation, an overheating economy, too much leverage (debt) in the system, asset bubbles that pop or banks restricting credit. None of that has happened here. What we have here is a global health crisis that has led directly to an almost unprecedented economic slowdown and produced panic selling in financial markets. All of which has been exacerbated by an oil war between Saudi Arabia and Russia (generally a power struggle for market share, and for Russia in particular, a way to hurt U.S. shale producers). Fear and uncertainty have resulted, and the capital markets intensely dislike both. As a result, we have a bear market that will most likely cause a global economic recession.

Right now, respected market prognosticator Ed Yardeni believes that the most probable outcome will be a global recession. In his most recent report, Yardeni said,

“Real GDP is likely to drop by 4% to 6%, at an annual rate, during Q2. There’s not much point in making a point estimate. That could be followed by a drop of 2% to 4% during Q3. That would be a severe recession. The question is whether it will be a short one. Needless to say, that depends on the virus. I’m of the opinion that the worst will be over by mid-year. If so, then a significant snapback in real GDP of 5% to 10% is possible during Q4.”[2]

The Coronavirus Pandemic

COVID-19 is a respiratory illness that can spread from person to person. The virus that causes COVID-19 is a novel coronavirus,[3] we are very familiar with ordinary coronaviruses, such as the common cold and flu. COVID-19 is a new and unique type of coronavirus that we do not have experience combatting.

On March 11, 2020, the World Health Organization (WHO) declared COVID-19 a pandemic. What is a pandemic? A pandemic is an epidemic occurring worldwide, or over a very wide area, crossing international boundaries and usually affecting many people that occurs almost simultaneously. On the evening of the same day, the President addressed the Nation from the Oval Office and discussed the disease and steps that the U.S. would take to slow down its spread, including a 30-day travel ban from Europe for foreign nationals, excluding the United Kingdom and Ireland. This ban applies to the 26 countries in the European Union where border-free travel is allowed. The NCAA March Madness tournament basketball games have been cancelled. The NBA and the NHL seasons have been suspended. There are school closings at all levels in all states as well.

As of March 12, there have been about 140,000 identified cases of COVID-19 around the world and about 5,000 deaths globally. Iran and Italy are particularly affected. There are about 1,800 identified cases in the U.S. and 40 deaths. This virus has spread worldwide and the number of active cases (identified cases minus recoveries minus deaths) has been increasing since this disease spread out from China. At this point, this virus cannot be fully contained, only slowed (like the seasonal flu). The cows are out of the barn and there currently is no vaccine to fight this virus.

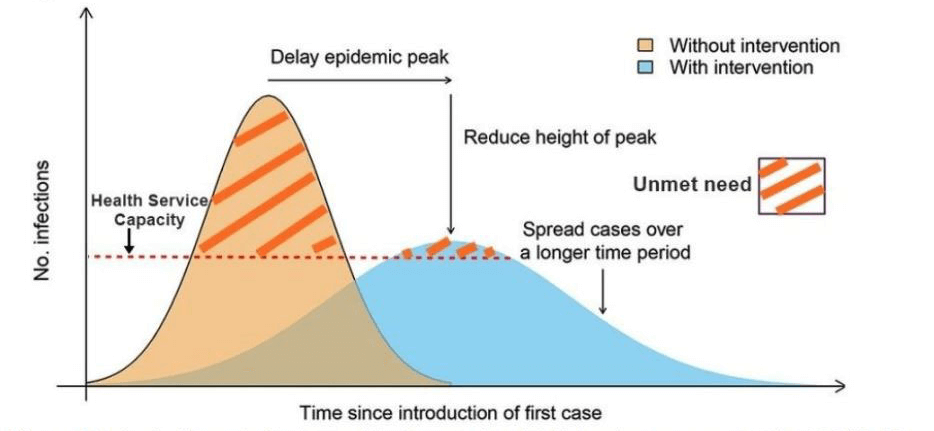

In the absence of a vaccine, each country is now using a strategy called “stretching.” This strategy includes using simple techniques to slow down the rate of infection – in essence, diversifying the disease’s impact over time. This is done through simple public health techniques like washing hands, practicing social distancing (especially with those that look ill), quarantines, school closings and avoiding large gatherings of people. This stretching strategy avoids a sharp peak in those infected. Why is that important? Because each country has a certain level of unused capacity in its medical system (used to treat severe cases) and if you can stretch out the disease over time and avoid a sharp peak, you can avoid overloading your medical system. If a country’s medical system gets swamped, you get triage and active decisions as to where to apply the limited medical resources. Italy is a prime example of a country with an overloaded medical system where reports indicate that they are not treating some elderly with pre-existing conditions. The chart below shows this strategy.

Here is what we know so far based on our limited (three months) experience with this new virus:

- It has a high infection or transfer rate;

- The young (under 10) are very resistant to the disease;

- The Case Fatality Rate (CFR) is low for those under 60 without complicating factors, but high to very high for those over 60 with complicating factors (4% to 14%);

- Complicating factors include heart disease, respiratory illness, diabetes, obesity, etc.;

- Eighty percent of those that contract the disease have mild to moderate illnesses;

- Fifteen percent of the cases require hospitalization;

- Five percent of the cases are severe and require intense medical treatment.

This disease seems to be very flu-like for most of the population, but particularly dangerous for the older segments of populations, especially those with complicating factors. With no vaccine, the “stretching” strategy is the only viable path to reduce the impact of the disease by preventing the overload of medical systems. There is also some evidence to suggest that the coming of summer will decrease the infection rate. Why is that? The rising humidity in the air during warmer weather attaches to the water globules holding the virus (from a sneeze or cough) and drags the virus to the ground where it cannot be inhaled by humans. This is generally why the flu subsides during the summer months and why it spreads rapidly in the cold months. If this ends up being true, we have 2-3 more months of spread risk, depending on location.

Keeping a Long-Term Perspective

We do not know when the virus will burn itself out or the full extent of the damage that it will cause. Nor do we know when Saudi Arabia and Russia will resolve their power struggle. History shows us that, with time, these matters will be resolved and that will allow the equity markets to heal. During the Great Financial Crisis (2008-2009), it seemed like the whole financial world had disintegrated and the world as we knew it was ending. The S&P 500 plummeted by more than 60 percent. But the world did not end. The issues were resolved, the capital markets regained their footing and the S&P 500 rose to all-time highs.

We will continue to closely monitor and keep you apprised of developments related to COVID-19 that could affect the economy or markets. If you have questions or concerns specific to your situation that have not been addressed, please do not hesitate to reach out to your Advisor. Thank you for the confidence you have placed in First Command.

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

All estimates provided are for informational purposes only and should not be relied on to make investment or other decisions. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world-renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. An investor cannot invest directly in an index.

©2020 First Command Financial Services, Inc. parent of First Command Financial Planning, Inc. (Member SIPC, FINRA), First Command Advisory Services, Inc., First Command Insurance Services, Inc. and First Command Bank. Securities and brokerage services are offered by First Command Financial Planning, Inc., a broker-dealer. Financial planning and investment advisory services are offered by First Command Advisory Services, Inc., an investment adviser. Insurance products and services are offered by First Command Insurance Services, Inc. Banking products and services are offered by First Command Bank. Securities products are not FDIC insured, have no bank guarantee and may lose value. A financial plan, by itself, cannot assure that retirement or other financial goals will be met. In Europe, investment and insurance products and services are offered through First Command Europe Limited. First Command Europe Limited is a wholly owned subsidiary of First Command Financial Services, Inc. and is authorized and regulated by the Financial Conduct Authority. Certain products and services offered in the United States may not be available through First Command Europe Limited.

Footnotes

[1] This bull market began on March 9, 2009.

[2] Source: Yardeni Morning Briefing (3/17/2020).

[3] Coronaviruses are named for the crown-like spikes on their surface. Human coronaviruses were first identified in the mid-1960s. Centers for Disease Control and Prevention (CDC) (https://www.cdc.gov/coronavirus/types.html).

[4] Same.

[5] Same.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.