Does The Inverted Yield Curve Signal An Oncoming Recession?

By: John S. Weitzer, CFA

Senior Vice President and Chief Investment Officer

Aug 20, 2019 | 8 min. read

The inversion of the yield curve has sparked concern among investors, but let’s examine all economic indicators before drawing a conclusion.

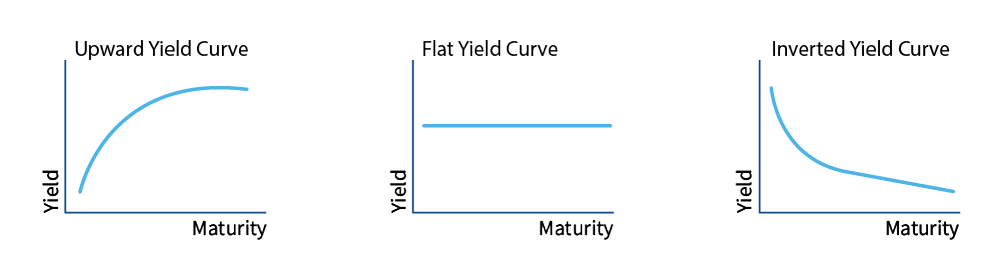

What is a yield curve? A yield curve is a line that plots the interest rates of bills, notes and bonds having equal credit quality but differing maturity dates (such as 2-year, 5-year, 10-year, and 30-year debt). The shape of the yield curve is viewed as having predictive power regarding changes in economic output and growth.

An upward sweeping yield curve, in which short-term interest rates are lower than long-term rates, is generally indicative of an expanding economy. A flat yield curve means that short-term interest rates are equal to long-term rates. An inverted yield curve occurs when short-term interest rates are higher than long-term rates. Inverted yield curves have been reliable predictors of recessions in the past because they often signal a credit crunch where banks tighten lending, and as a result, economic output declines. An anticipated recession can cause an equity bear market (a drop in the stock market of more than 20%).

On August 14, the yield on the 2-year U.S. Treasury note rose above the 10-year U.S. Treasury note yield. This is technically referred to as a 2/10 Inverted Yield Curve. The U.S. equity markets reacted negatively to this inversion due to the widely held belief that a recession is all but guaranteed.

What is the normal sequence of events that leads to an inverted yield curve? In the past, the Federal Reserve (the Fed) has raised the federal funds rate — or the short-term interest rate — during economic booms to combat inflation. This increase in short-term interest rates would cause banks to curtail lending. Investors, expecting the decline in borrowing power to cause a recession, would buy long-term U.S. Treasury securities, forcing long-term interest rates down. An inverted yield curve is the result.

In summary:

- An overheating economy creates rising inflation.

- The Fed raises short-term interest rates to combat the inflation.

- Rising short-term interest rates cause banks to cut back on lending.

- The diminished borrowing power causes the recession.

It is important to note, however, that while recessions are almost always preceded by an inversion of the yield curve, not all inverted yield curves lead to a recession. [1] And the signs that normally lead to an inverted yield curve and signal a recession are currently more restrained than would typically be expected. Let’s look closely at the causation chain, link by link.

- Overheating economy – The U.S. economy is growing between two and three percent in 2019. That level of economic growth is average at best. A string of three percent economic growth years, year over year, would not “overheat” the U.S. economy.

- Rising Inflation – Inflation is currently well contained at around two percent. It is not rising. In fact, this is one of the irregularities of this 10-year economic expansion.

- Fed Raises Rates – In July, the Fed lowered an already low federal funds rate by 0.25 percent to a range of 2 to 2.25 percent. The Fed isn’t raising rates. They are cutting rates!

- Credit Crunch –Banks are currently lending at a typical level, so individuals and companies can still borrow money.

So, if all the links in the causation chain are muted at best, does the conclusion of recession naturally follow? Clearly it’s a possibility, but at present I would not consider this to be a likely scenario.

Veteran investment strategist and market prognosticator Ed Yardeni made the case that if there is no “boom,” there really can’t be a “bust.”[2] Currently, the economy is performing well and there are no material signs of an inflationary boom or speculative excesses that require Fed intervention. Dr. Yardeni stated that we must “keep an eye on bank credit metrics—specifically, net interest margin, charge-offs and dividends, and business loans. Right now, those metrics aren’t signaling a credit crunch.”[3]

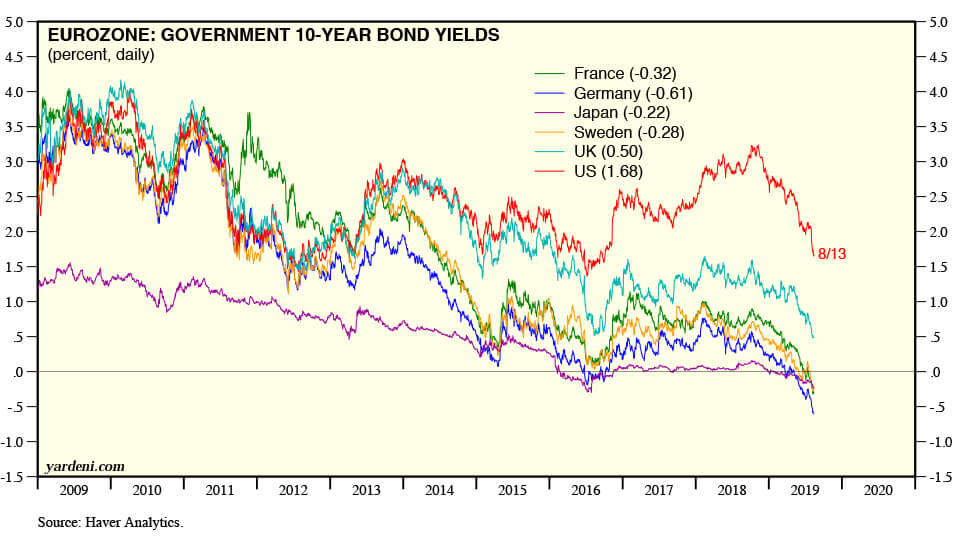

If an overheating economy, rising inflation, Fed intervention, and a credit crunch do not exist, what could be causing the inverted yield curve? Yardeni Research puts forth the following opinion. We now live in a globalized bond market and the behaviors of other central banks around the world affect us more significantly than in the past. The inversion of the yield curve seems to be attributable mostly to the negative interest rate policies of the European Central Bank (ECB), the Bank of Japan (BOJ), and others.[4] Examine the chart below.

[5]

So, what do negative interest rates in other countries have to do with declining yields on long-term bonds in the U.S.? The theory is that if U.S. bonds offer the most attractive rates, investors anticipating a global economic slowdown will flock to U.S. Treasury notes (why buy a German or Japanese bond that guarantees you will lose money when you can buy a U.S. bond with a positive yield?). As demand exceeds supply, the price of U.S. bonds will rise and yields — which have an inverse relationship to price — will decline.

Former chair of the Federal Reserve, Janet Yellen seems to agree that this inverted yield curve may be a weaker recessionary signal than in past years. She makes the following points:

- Markets should place less weight on this yield curve inversion.

- “Historically, [the yield curve inversion] has been a pretty good signal of recession and I think that’s when markets pay attention to it, but I would really urge that on this occasion it may be a less good signal[.]” [6]

Here are some key points to keep in mind:

- The U.S. economy is still growing at a rate of more than two percent (3.1 percent in the first quarter of 2019, 2.2 percent in the second quarter of 2019).

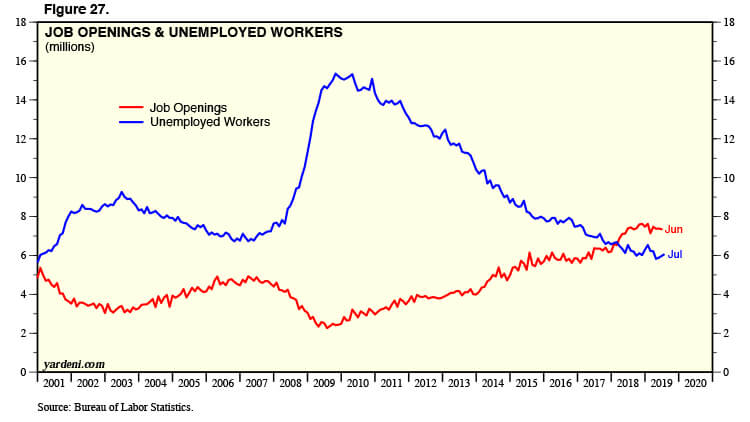

- Unemployment is running low at 3.7 percent and there are more jobs than job seekers right now (see below).

[7]

3. Those with jobs have paychecks and spend money. Around 70 percent of U.S. economic output is based on consumption of goods and services. The U.S. consumer is in good shape, which bodes well for the U.S. economy. The July retail sales report surpassed all expectations, rising at a robust 0.7 percent.[8]

4. Economic activity is not being impeded by banks not lending money.

I believe that the global equity markets are reacting badly based on the almost universal belief that an inverted yield curve guarantees a recession. The quality of this recessionary signal may have diminished, and it’s important to dig further into the actual causation chain and analyze each link. It’s also critical to examine current and estimated U.S. economic activity, the state of the U.S. consumer and what banks are doing.

Let’s go back to our original question – does the current inverted yield curve signal an oncoming recession? The answer is that it has been a reliable predictor of recessions in the past, so we must take it seriously. It is important to note, however, that inverted yield curves tell us very little about the timing of future downturns. In fact, in past instances of a 2/10 Inverted Yield Curve like we recently witnessed, a recession has not materialized for almost two years. And, for now at least, economic data seems to be more consistent with an economic slowdown than a full-blown recession.

All of these conflicting signals make predicting a specific outcome in the economy and the stock market a fool’s game. We will continue to carefully monitor key indicators like economic growth, inflation, interest rates and liquidity and keep you apprised of any noteworthy developments, but for now we see no reason to deviate from your long-term financial plan.

[1] "Yield Curve Inverts: Head for the Hills?”, by Edward Yardeni (August 16, 2019). Over the last ten inverted yield curve events, only seven recessions followed. This means that in the last ten inverted yield curve events, there were three instances were a recession did not follow.

[2] Yardeni Research Morning Briefing (July 11, 2019).

[3] Yardeni Research Morning Briefing (August 15, 2019).

[4] The Yield Curve: What Is It Really Predicting, Topical Study #83, Yardeni Research (April 7, 2019).

[5] Yardeni Research (2019).

[6] Please see the following on CNBC: https://www.cnbc.com/2019/08/14/janet-yellen-say-yield-curve-inversion-may-be-false-recession-signal-this-time.html.

[7] Yardeni Research (2019).

[8] Solid Report for July Retail Sales, Wells Fargo Securities – Economics Group (August 15, 2019).

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.