Gold's Luster Continues to Dull

By: First Command's Investment Management Team

Oct 27, 2022 | 5 min. read

Don't be seduced by gold's luster.

Markets have been volatile this year, and as usual, there is a wide range of opinions about how investors should respond. While every correction or bear market is unique, there is always one familiar recommendation that you are guaranteed to encounter. The pitch usually goes something like this:

- “Right now, you need to buy gold to ensure the government doesn’t inflate away your savings.”

- “Right now, you need to buy gold to ensure that you’re protected when the current/next president ruins the economy.”

- “Right now, the only way to take care of your retirement is to buy gold in your 401(k).”

It’s a tale as old as time. Of course, what you rarely hear after such one-size-fits-all recommendations is a reference to the gold bug’s conflict of interest via ownership or sponsorship of a typically-high-commission gold brokerage firm.

This time, they’ll say, is different. After all, we have seen both stock and bond markets ravaged by geopolitical conflicts, and 40-year high inflation, all of which should drive historic interest in precious metals. It’s a heuristic that has been so frequently quoted by infomercials and podcast advertisements that it has almost become conventional wisdom. Clearly, therefore, we should have already seen such investors reap huge benefits following this simple advice.

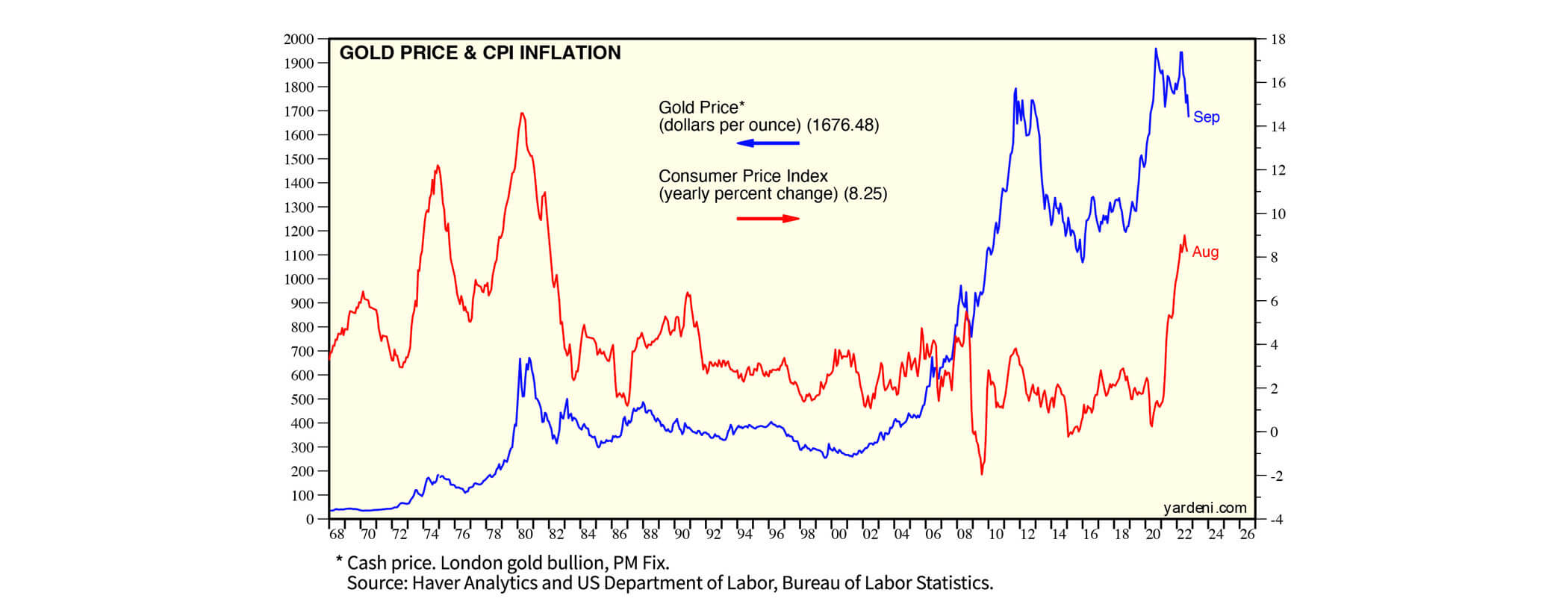

Unfortunately, actual data invalidates most of this oversimplified argument. Historically, the link between inflation (measured by the Consumer Price Index, or CPI) and gold prices has not been strong. In fact, over the past half century, the correlation between the price of gold and inflation has been a paltry 0.16 (i) – if gold were in fact a good inflation hedge, we would expect this to be much closer to 1. Today is a textbook example of this point. With inflation hitting multi-decade highs, gold has been trading relatively sideways for the past few years, again exhibiting little direct correlation.

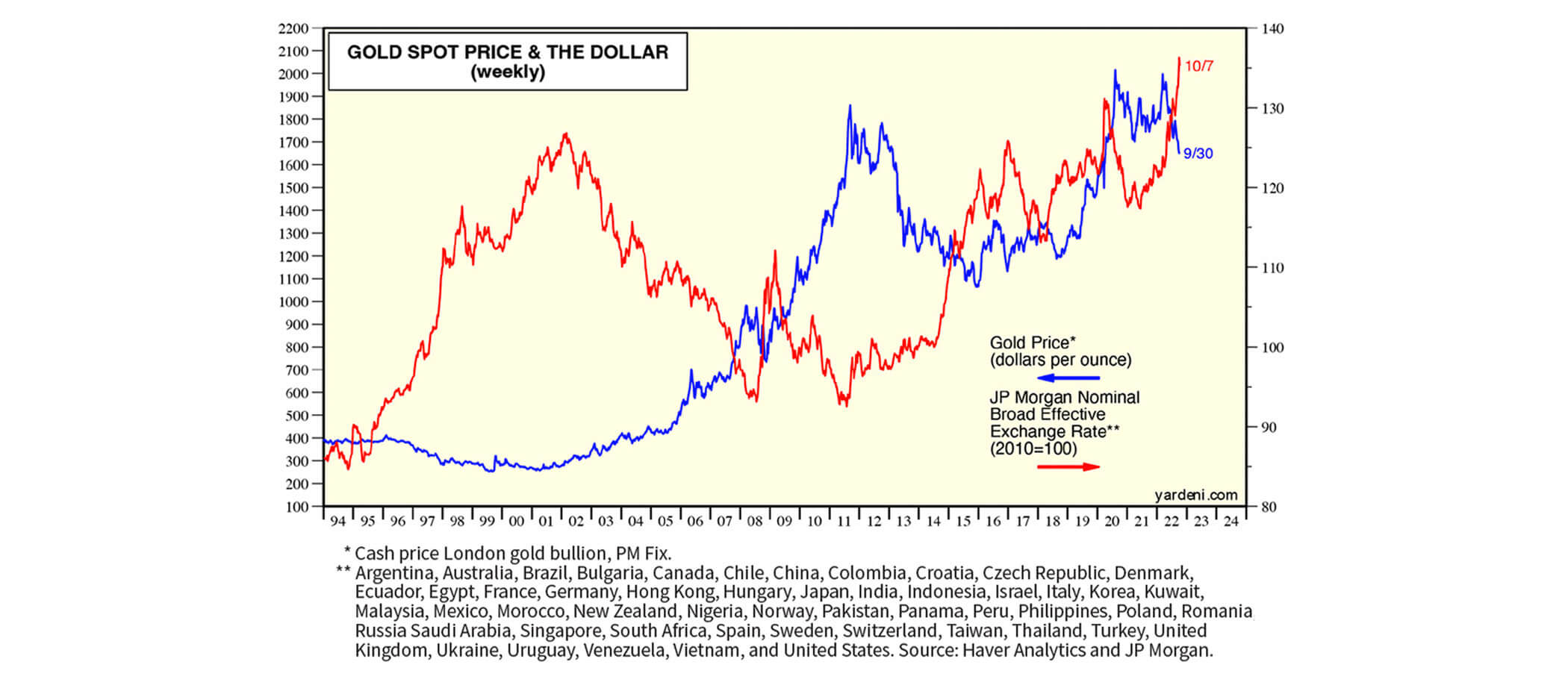

What about the US Dollar (USD), which is another frequently cited reason for buying gold? In theory it should minimize the impact of a weakening currency over time, as any commodity that is priced in dollars should increase in value as dollars decline relative to other currencies. The data actually does lend some support to this supposition, as historically when the USD weakens, we have seen a corresponding increase in gold prices.

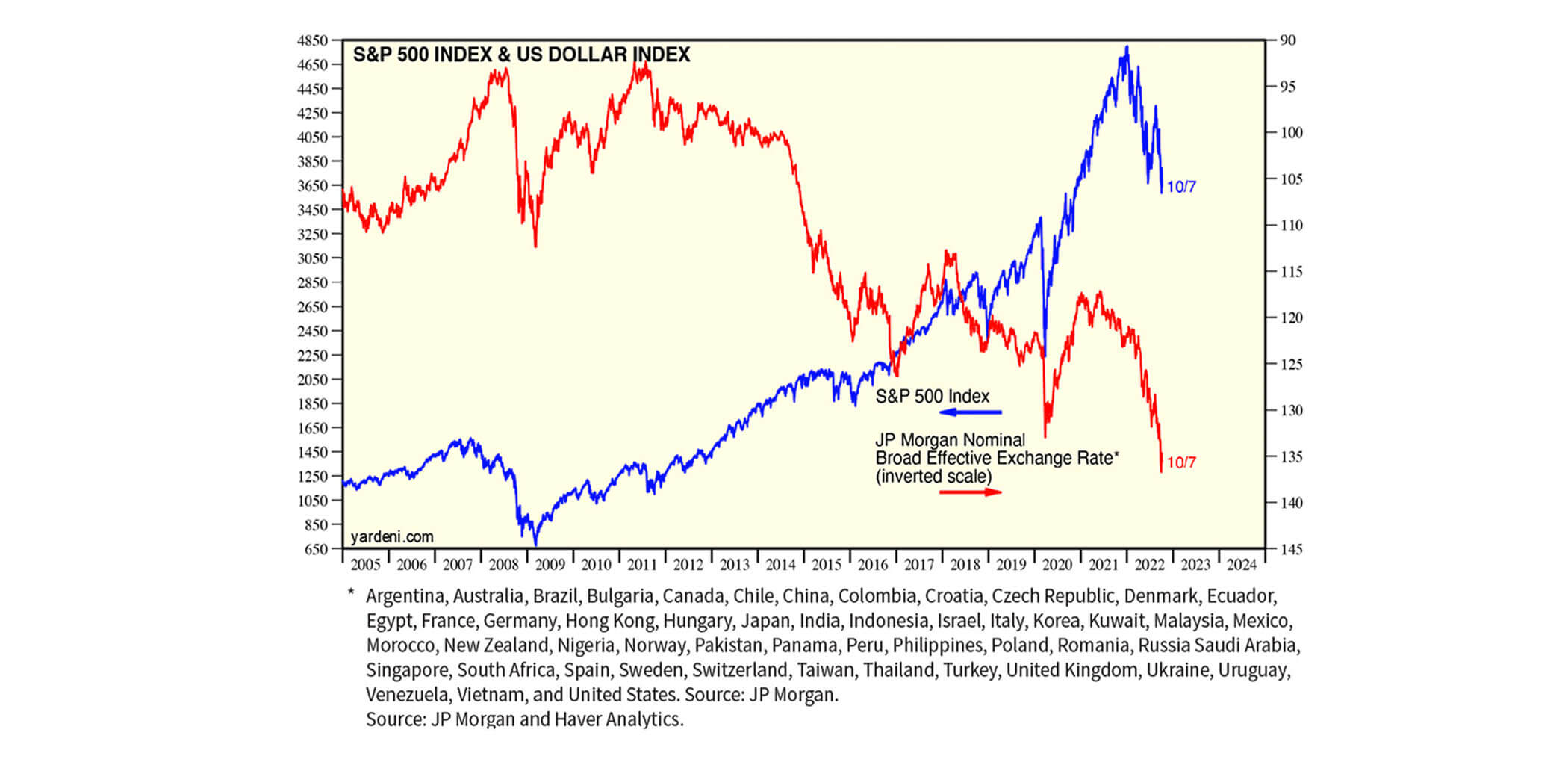

Does that mean you should immediately hedge your currency risk with bullion? Not at all. First, the USD has been showing spectacular strength this year, so the debasement argument is already flawed. And even if it did depreciate, there’s actually another common asset class that has exhibited a similarly efficient correlation to the USD: the S&P 500. This means that simply owning stocks has proven to be just as effective of a hedge against foreign exchange risk as holding the precious metal, but with some obvious upsides.

To drive home the point:

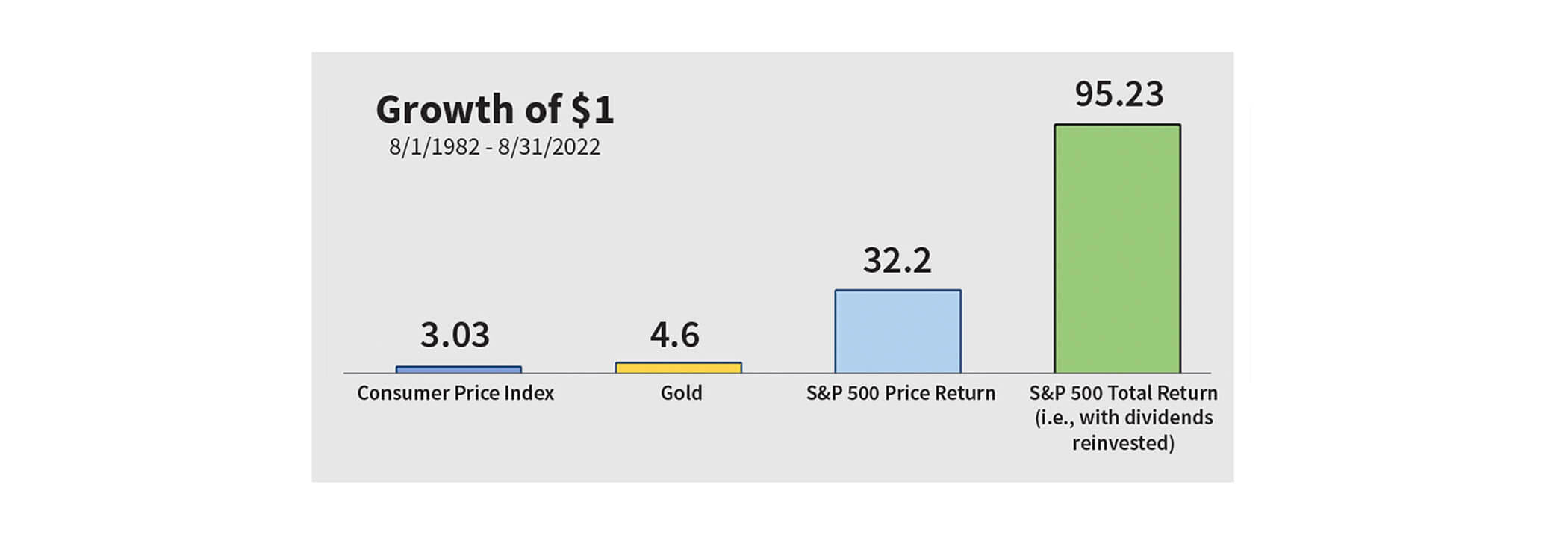

- Over the past 40 years as of 8/31/2022 (ii):

- Inflation as measured by the CPI has averaged 2.9% annually, meaning prices have roughly tripled on a cumulative basis during this timeframe (resulting in an approximately 67% decrease in purchasing power).

- Gold returns have averaged 4.7% annually, cumulatively increasing by about 4.6 times.

- S&P 500 returns, however, have averaged 9.7% annually, or an increase of about 32.2 times the amount originally invested! And this is before considering dividend reinvestment, which brings us to the final point:

- On top of lackluster returns and hedging ability, gold provides no income while held. In fact, it often brings storage fees and insurance costs for holding it in physical form. This further handicaps the metal against dividend and interest paying asset classes. When you consider the income that stocks produce over time, the graph below depicts the complete picture.

Clearly, there will be times when gold, and precious metals more broadly, will outperform stocks and bonds. But this can be said for every asset class. While it would be nice to be able to accurately predict which will be the best performing asset class every year, this is obviously impossible. And while a position in gold may be capable of providing some small level of hedge against market and geopolitical risk, it should be considered only as a minor part of a broadly diversified portfolio, not as a replacement.

Financial markets will likely continue to experience periods of volatility. There will be more threats to global stability. Policy makers and governments are going to stumble. But for as long as those things have been happening, history shows that it has never been a smart decision to hoard gold. That means, no matter what you’re hearing from fear-mongers about it being time to liquidate stocks and dump everything into gold because of the next “economy collapsing” event, there is significant historical evidence that you will achieve better results over time by diversifying your assets across traditional asset classes.

The information in this report was prepared by John Weitzer, Chief Investment Officer, Matt Wiley, Director Investment Management, and Matt Conner, Investment Advisory Consultant of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual advisor. All statistics quoted are as of the date of this publication, unless otherwise noted. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

©2022 First Command Financial Services, Inc. is the parent company of First Command Brokerage Services, Inc. (Member SIPC, FINRA), First Command Advisory Services, Inc. Securities products and brokerage services are provided by First Command Brokerage Services, Inc., a broker-dealer. Financial planning and investment advisory services are offered by First Command Advisory Services, Inc., an investment adviser. A financial plan, by itself, cannot assure that retirement or other financial goals will be met. Actual results, performance, or achievements may differ materially from any future results, performance, or achievements expressed or implied herein. Over a longer time horizon, equity markets historically exhibit higher highs and higher lows, and thus bull markets have created more wealth than corrections and bear markets have destroyed – if you stay fully invested in accordance with a financial plan.

Footnotes:

(i) CNBC

(ii) Bloomberg, Morningstar

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.