2023 Market Outlook

By: John Weitzer, CFA, SVP and Chief Investment Officer

and First Command's Investment Management Team

Jan 12, 2023 | 18 min. read

A Year in Review.

The Market Outlook is our annual tradition of reflecting on the year just ended and sharing our expectations for economic growth and the performance of financial markets for the year ahead.

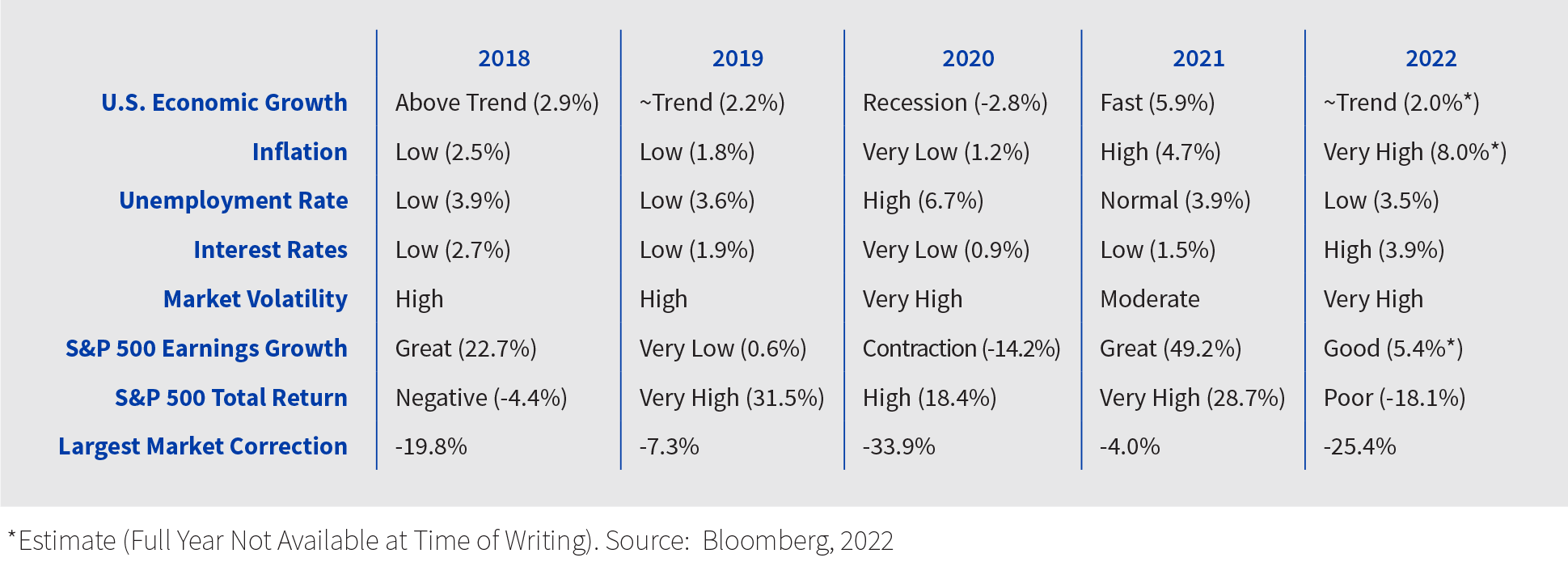

As the following snapshot of recent history shows, we have encountered a wide array of environments over the last few years:

Indeed, through a broader lens, in just 5 years we have experienced:

- An old normal, characterized by low unemployment, inflation, interest rates, and growth;

- A global pandemic and economic shutdown; and,

- The thawing of a frozen world, punctuated by a temporary surge in growth, along with a durable rise in inflation and interest rates.

Today, we are attempting to again establish some sense of normalcy in this post-pandemic world, although finding that equilibrium will take time. The cure for the pandemic prescribed by policymakers included an explosion in money supply vis-à-vis massive deficit spending by fiscal authorities, and balance sheet expansion by central banks that almost certainly helped avert a global economic calamity. The cure was not without side effects, however; the most obvious of which has been a surge in prices.

Much of this inflation is still symptomatic of the pandemic itself. While dislocated supply chains have continued to normalize, other economic sectors have been slower to adjust. Wages, for example, remain elevated given a still tight employment landscape, and shelter costs are only now beginning to slow after several years of historic appreciation in housing prices. This has pressed previously accommodative monetary authorities to tighten the money supply by raising interest rates at a nearly unprecedented pace. And that, in turn, has pressured financial assets, including both stocks and bonds, which we will discuss in later sections.

Comments on Our 2022 Estimates

Writing this section of our annual outlook is extremely humbling. Approaching the markets with respect and a spirit of humility has always been prudent, and therefore is ingrained in the timeless principles that govern the way in which we invest the assets entrusted to us by our clients.

While we anticipated a higher level of inflation in 2022, we underappreciated how entrenched it would become, particularly without insight into Russia’s invasion of Ukraine in February 2022 (which refractured still healing supply chains and disrupted global commodity markets). This, of course, had implications for almost every one of our forecasts, as central banks reacted by rapidly raising interest rates. For the Federal Reserve, this marked a material pivot from projecting no more than three 0.25% interest rate hikes for 2022 at the outset of the year to implementing the equivalent of seventeen 0.25% interest rate increases. So, without further ado:

- As already acknowledged, we materially underestimated inflation for the year. We had projected a rate of 3-4%, which was almost double the trend prior to the pandemic. However, inflation based on the headline Consumer Price Index clocked in at 8% for the full year.

- Similarly, while we anticipated the beginning of a rate hiking cycle by the Federal Reserve, we underestimated its magnitude by a wide margin, projecting a 2022 Federal Funds year-end rate of 0.5-1.0% versus the actual mark of 4.3%.

- Both of these misses planted the seeds for another miss on the 10 Year Treasury rate, which we assumed would rise to 1.75-2.25%. Instead, it ended 2022 at 3.9%.

- As financial conditions tightened, economic growth slowed from 2021’s rapid pace, which we correctly anticipated. However, we projected it would slow from almost 6% in 2021 to closer to 2.5-3.5%. It actually slowed to 2%.

Despite missing significantly on rate-related forecasts, we did accurately predict the continuation of a tight labor market, calling for an unemployment rate of 3.5-4.5% at year end. Unemployment ended the year at 3.5%. We were also on the spot with our corporate earnings growth forecast. We anticipated aggregate profit growth in the realm of 5-10% for 2022, and actual profit growth is tracking to the mid-single digits.

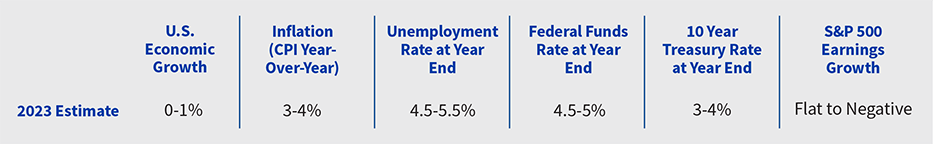

Looking Ahead to 2023

We expect 2023 to be a transition year bookended by the Fed’s aggressive monetary policy in 2022 and by a much more normal economic environment in 2024. We believe that bridging this gap will entail slower growth, elevated interest rates, and higher unemployment.

Economic Growth

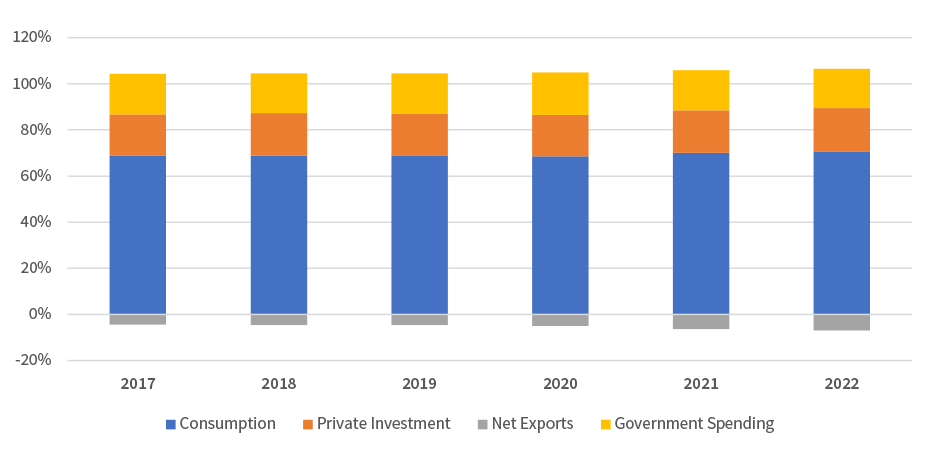

The US economy is comprised of four major segments: consumer spending, private sector investment, government spending, and net exports. At 70% of the total, consumer spending is by far the largest. Buoyed by robust job growth and bank balances padded by pandemic-related stimulus measures, the consumer continued to spend in 2022 despite steeply rising interest rates and inflation. There are signs, though, that financial pressure is building. Large, consumer-facing companies as varied as Walmart, Chipotle, and Molson-Coors have all noted that they are seeing customers trading down to cheaper substitute products. At the same time, savings as a percentage of disposable income has fallen sharply. Additionally, the Federal Reserve is trying to fight inflation by loosening a tight labor market, which likely means an uptick in unemployment in 2023 and downward pressure on spending. More positively, household balance sheets are still fairly strong in the aggregate, and this could help cushion the economy against some of the negative impact from expected job losses.

Figure 1: Major Segments of the US Economy(1)

Private investment growth slowed from 12% in Q1 2022 to just 2% in Q3 and this part of the economy is likely to weaken further in 2023. With more people working from home, investment in office buildings has been declining since the onset of the pandemic in 2020 and, more recently, home construction has dried up in response to the dramatic increase in mortgage rates. Businesses are still spending on equipment and software, but leading indicators like the Institute of Supply Management’s New Orders Index suggest these segments could soften as well.

Government action was crucial to keeping the economy afloat during the pandemic, but writing trillion dollar checks to households, businesses, and state and local governments drove the federal debt to levels not seen since WWII. The return to more normal spending in 2022 was a modest headwind for the economy. Looking ahead, the debt overhang and a split government in Washington suggest that this part of the economy is unlikely to have an outsized impact, negatively or positively, in 2023.

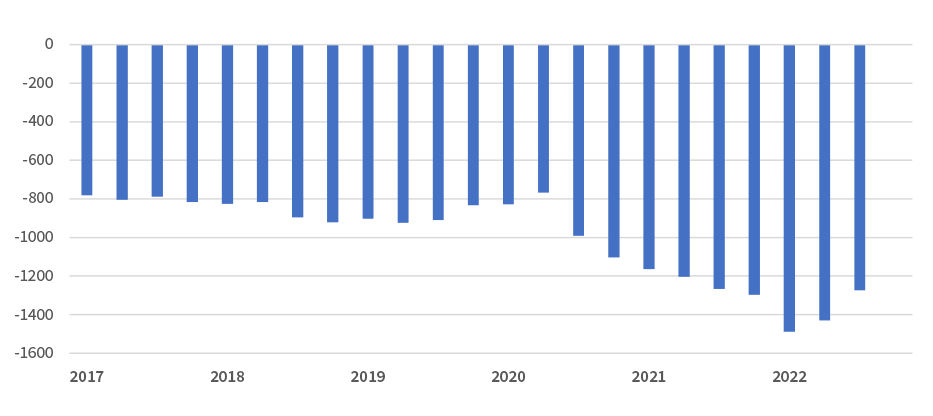

Net exports are a small part of the economy, but are also volatile and can meaningfully impact overall growth in any given year. This segment consistently detracts from GDP, meaning we regularly import more than we export, but fluctuations in the gap between the two can add to or subtract from growth. The difference between exports and imports widened during the pandemic as the US fared better economically than most countries, but that gap has recently begun to shrink. A continued move back toward pre-pandemic levels would provide some support to GDP and help to partially offset weakness elsewhere in the economy.

Figure 2: US Net Exports ($Bn at annual rates)(2)

Putting the pieces together, it seems likely that economic growth will slow in 2023 due to pressure on the consumer and weakness in private investment. The possibility of a recession cannot be discounted but we expect any contraction to be modest due to the lack of any major imbalances in the economy (such as the technology and housing bubbles in 2001 and 2008, respectively) and the fact that private sector balance sheets are generally healthy.

Inflation and Rates

Inflation was the economic story of the year in 2022, as climbing prices provoked aggressive action from the Federal Reserve that rippled through global financial markets, driving stock and bond prices lower. Traditional 60/40 portfolios had one of their worst years on record because, for the first time in a couple of generations, a bear market in stocks was accompanied by rising interest rates as inflation accelerated. What caused all this turmoil? In the end, it comes down to too much money chasing too few goods.

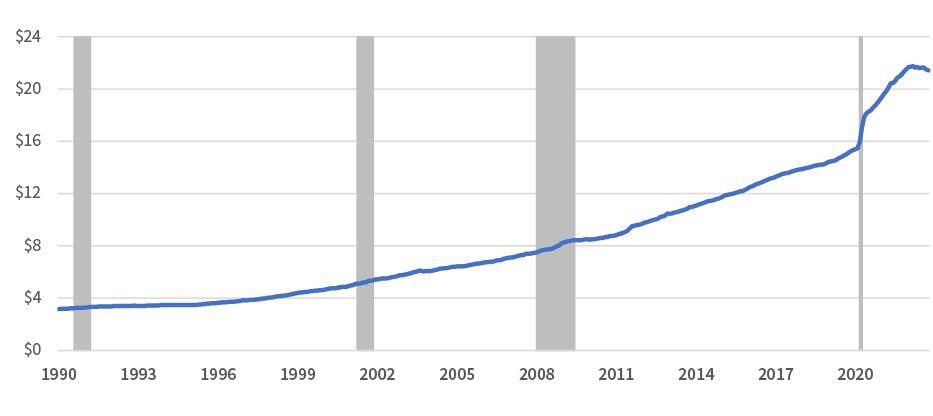

When the pandemic struck, the government flooded the economy with money to keep it afloat. Consumers received direct payments and expanded unemployment benefits, businesses were given loans, many of which were eventually forgiven, and states got billions of dollars in grants. In all, the money supply spiked by over 40%, or more than $6 trillion, in just two years.

Figure 3: United States M2 Money Supply ($ Tn)(3)

While the government was taking unprecedented steps to support demand by providing households and businesses with the means to keep spending, things were changing rapidly on the supply side as well. Production fell as factories either closed or cut back in response to Covid. Goods that were produced had a hard time getting to their destination because much of the global transportation infrastructure was clogged with bottlenecks.

At first there was not much of a response in prices because, early in the pandemic, people refrained from spending due to the high degree of uncertainty surrounding COVID despite easy access to cash. By early 2021, though, vaccines were available, the economy was beginning to open, and any fear on the part of businesses and consumers was subsiding. Pent-up demand accelerated into still-limited supply and the result was a rapid increase in prices that proved to be more than just transitory, as the Federal Reserve had hoped.

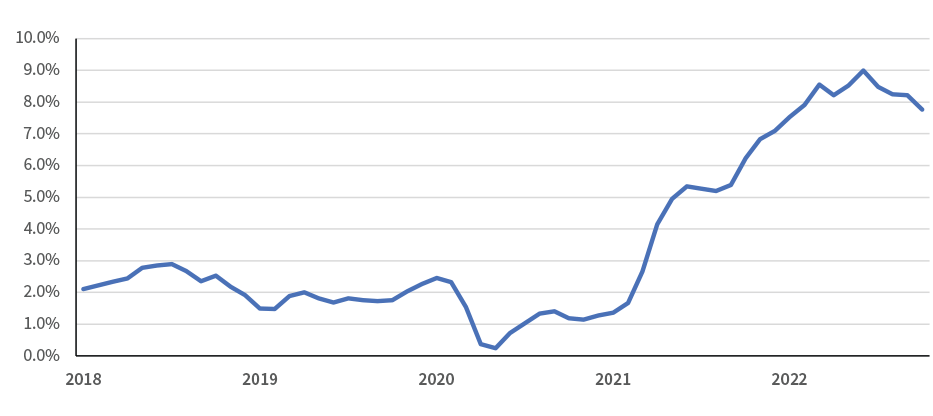

Figure 4: Consumer Price Index (Y/Y)(4)

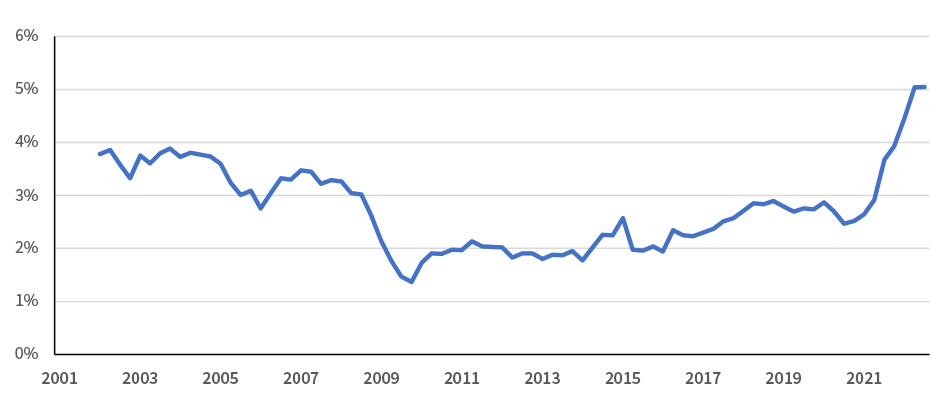

Growth in the most common measure of inflation, the Consumer Price Index, peaked at 9.0% in June and has since begun to decline. We expect this trend to continue through 2023 as demand slows and any remaining supply constraints, particularly in China, are resolved. The Federal Reserve is unlikely to hit its 2% target by the end of the year, however, because some components of inflation are sticky. For example, home and apartment rental prices only reset as leases expire and therefore lag changes in the current market; this impacts the shelter component of the major price indexes. Wages also tend to react slowly to changes in the economy, so elevated labor costs will continue to pressure prices to some degree. Ultimately, we expect inflation to settle in a range of 3 to 4% by the end of 2023, and decline further in 2024.

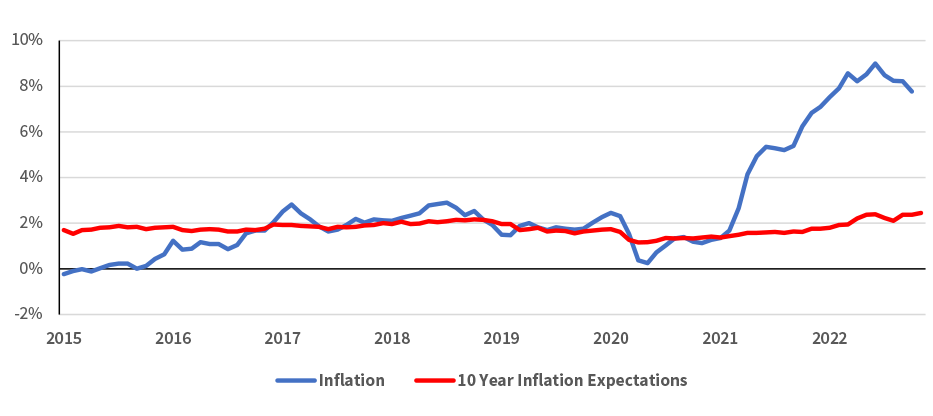

With inflation running high for close to two years now, it may seem a little puzzling that interest rates have not risen more. At its peak in October, the 10-year Treasury note yielded just 4.2% at a time when consumer prices were up 7.8% year-over-year. Why would an investor buy a security with an expected return so far under the rate of inflation that it looks destined to lose money on a real, inflation-adjusted basis? The answer lies in long-term expectations.

Figure 5: Consumer Price Index (Year-Over-Year) and Long-Term Inflation Expectations (5)

Since bonds mature at some point in the future, the current rate of inflation is not as relevant as the expected rate over the term of the security. In an indication that investors believe the Federal Reserve will ultimately tame high prices, the ten-year inflation expectation has not moved much, rising from 1.7% prior to the pandemic to 2.2% recently. On this basis, the 10-year Treasury note offers a real yield of more than 1.5%, which compares favorably to levels seen since the end of the 2007-2008 Global Financial Crisis (GFC).

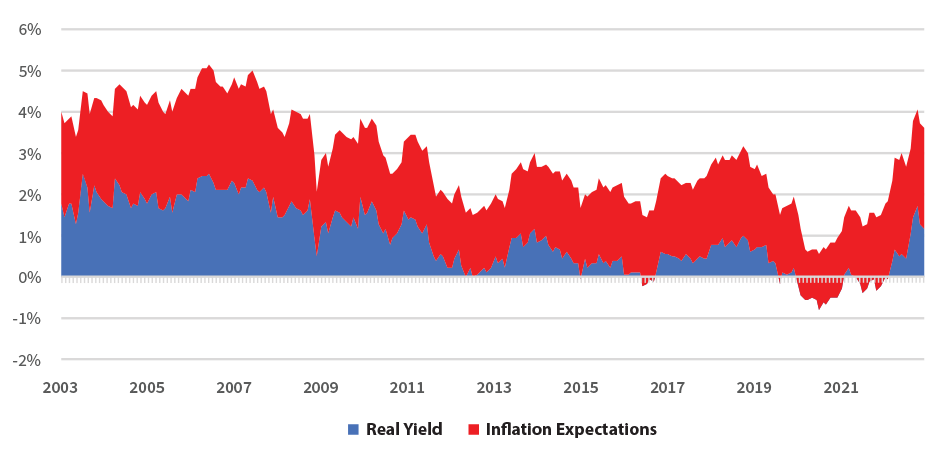

Figure 6: 10 Year Treasury Rate Decomposed into Inflation Expectations and Real Yield (6)

Because expectations never really became unanchored from the Federal Reserve’s 2% target rate, we do not expect this component of the 10-Year rate to move much as inflation declines over the course of 2023. We also believe the real yield will remain above 1% for a couple of reasons. First, starting at the onset of the pandemic, the Fed began purchasing Treasuries and other fixed income securities, as it has at other times since the GFC, to suppress yields and stimulate demand. Starting in June 2022, however, the central bank began reversing this process by pulling back from the market, letting these assets run off its balance sheet and easing downward pressure on rates. Second, elevated interest rate volatility and economic uncertainty means investors are likely to demand a higher real rate to compensate for the additional risk – particularly at a time when even higher rates are available at shorter maturities.

While the market determines interest rates at the intermediate and long end of the yield curve, the Fed controls the short end, where it moved its targeted range for the Federal Funds rate from 0.0% - 0.25% at the beginning of 2022 to 4.25% - 4.5% by its end. Currently, the median projection from the Fed is for this rate to continue higher, to a bit over 5% in the first half of the year. Based on the current tightness in the labor market, we agree that the Federal Funds rate will move higher in the near term. By the second half of the year, though, the economy is likely to be weaker, unemployment higher, and wage pressures abating. In this environment, there is an increasing probability that the central bank may take its first hesitant step towards a more neutral policy stance.

Employment

The labor market continued its robust recovery from the depths of the pandemic by adding more than four million jobs in 2022 according to the government’s monthly Establishment survey. During this period, the unemployment rate matched its lowest level in more than half a century before ending the year slightly higher. Workers have been emboldened to quit their jobs in larger numbers because, with more than three jobs open for every two people unemployed, they have been able to find higher paying positions. Employment has been so strong, in fact, that some businesses have been “hoarding” labor, or holding onto unnecessary employees because managers are afraid they will not be able to find replacements when they need to. But is this tightness in the labor market too much of a good thing?

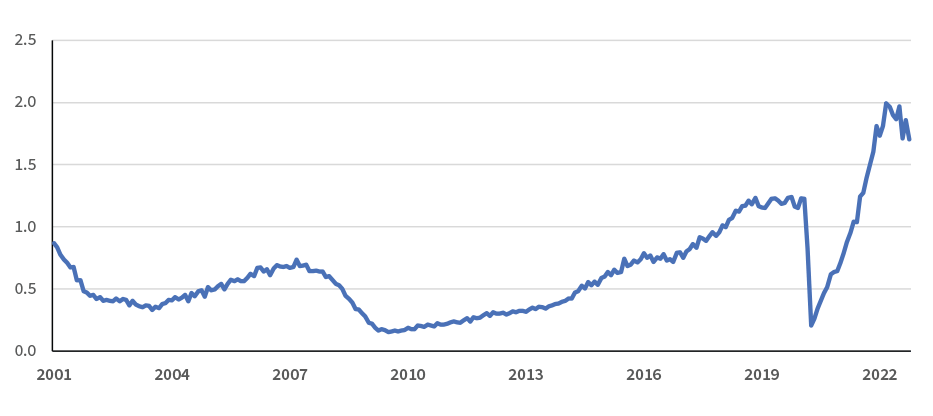

Figure 7: Number of Job Openings Per Unemployed Worker (7)

The imbalance in the market is driving workers’ wages higher at an accelerated pace. This sounds like a good thing, and it can be. However, in the absence of higher productivity, rising compensation tends to be inflationary, as businesses act to preserve their profit margins by passing along the additional expense to customers by way of higher prices. Unlike commodity price inflation that often cures itself as rising prices attract more supply, higher compensation can lead to a much more intractable wage-price spiral. In this scenario, strong demand for goods and services pushes up prices and a higher cost of living causes workers to demand higher wages. This, in turn, drives up demand and so on in a cycle where wages struggle to keep up with inflation and real, inflation-adjusted incomes stagnate.

Figure 8: Employment Cost Index, (Year-Over-Year) % Chg (8)

The Fed is trying to prevent this sort of harmful feedback loop from taking hold by raising interest rates and slowing the economy enough to alleviate the pressure in the labor market – but not so much as to cause a harmful recession. The challenge is complicated because it’s extremely difficult to gauge the timing and extent of any impact on demand from changes in monetary policy. This means that investors should not only factor in a higher unemployment rate next year to account for a looser job market, but also a wider range of possible outcomes given the uncertainty surrounding the timing and impact of higher rates.

Stock Markets

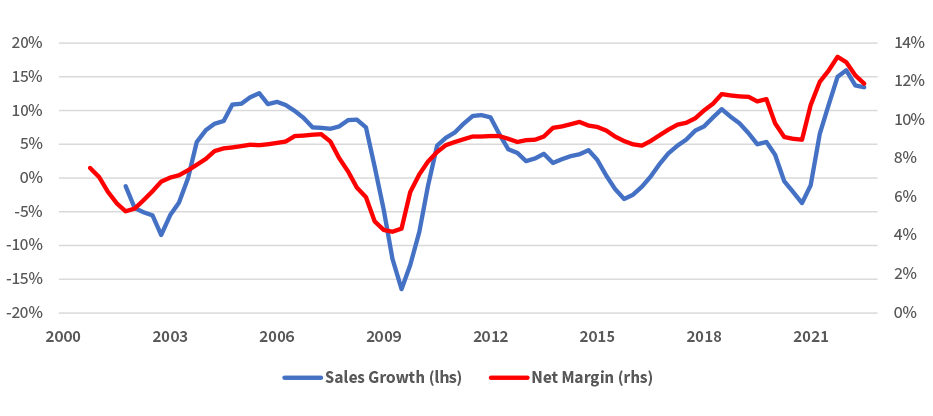

Simple math tells us that a stock market’s price return is a function of its earnings growth and the change in the price to earnings (P/E) ratio. After soaring in 2021 from pandemic-depressed levels, corporate profit gains slowed markedly in 2022 as margins came under pressure from rising input costs. In the fourth quarter of 2021, S&P 500 earnings per share (or EPS) were up over 25% versus the prior year. However, by Q3 2022 the bottom line was up just 4% despite revenues that advanced at a low double-digit rate.

Looking ahead to 2023, we expect slower sales growth, as the economy and inflation decelerate, accompanied by more profit margin contraction. Together, this unpalatable combination is likely to lead to a weak profit environment. As described in the chart below, margins typically contract as the top-line slows because, due to the fixed nature of many expenses, it takes longer for corporate managers to adjust their cost structure to a slowing business environment than it does for demand to decelerate. (The corollary to this is that when sales growth eventually re-accelerates, earnings and margins can move higher quickly but that looks more like a story for 2024).

Figure 9: S&P 500 Sales Growth and Net Margin (9)

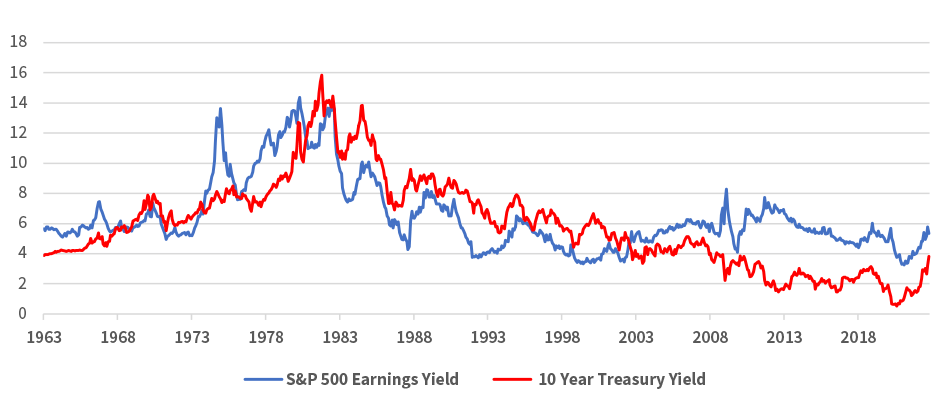

The good news for the market is that stock prices already seem to be anticipating some earnings weakness ahead. The combination of higher profits and lower stock prices in 2022 means the market’s trailing P/E ratio declined from close to 25 at the end of 2021 to about 18 today. Another way to view this is through the S&P 500’s earnings yield, which is simply the index’s earnings divided by its price or, put differently, the inverse of the P/E. On this basis, the S&P 500 yields about 5.6% in earnings for shareholders. If earnings fall as we expect, then the earnings yield would decline closer to 5%, which would still compare favorably to the yield in the Treasury market. In other words, there is room for stocks to absorb lower earnings through higher valuation levels rather than declining prices. Taken together, we believe that pressure on profits combined with a valuation level that has already come down quite a bit adds up to an environment for equity investors that is neither unusually negative nor positive.

Figure 10: S&P 500 Earnings Yield and 10 Year Treasury Rate (10)

Many markets outside the US will also have to contend with slowing growth and margin pressure, but international equities are still interesting for a few reasons. First, coming out of the financial crisis, developed international and emerging markets traded close to the S&P 500 P/E ratio, but since then their relative valuation has been cut to just about two-thirds that of the US. Second, the dollar is expensive versus most currencies, but less aggressive monetary policy in 2023 could spark a decline in the greenback which would benefit the dollar-translated returns of foreign equities. Lastly, the US has a much larger technology sector than international markets and we expect this group’s profits to pull back more than most next year, which could benefit the relative earnings strength of markets outside the US.

What does this mean to you?

First Command continuously assesses economic and market conditions. Stock market corrections are inevitable and an accepted risk for the prospect of higher returns. In fact, the average calendar year features at least one 10%+ correction for the S&P 500, and an even steeper bear market (20%+) typically occurs every few years[i] – often without a technical economic recession. Attempting to predict when these corrections will occur is an impractical approach, in our opinion, and is much more frequently the result of luck rather than skill. Keep in mind that timing the market really requires you to make the right call twice: getting out at the right time, and then getting back in before prices rebound. It is often the failure to correctly make that second call that leads to permanent wealth destruction.

For that reason, we at First Command value time in the market versus attempting to time the market, accept volatility as an inherent short-term risk for stock investors, and use it to our advantage to improve market returns. Our Advisors are trained to utilize the wide range of investment options we offer, to ensure that our clients’ investments are aligned with their financial plan and, just as importantly, to keep them on plan through inevitable periods of volatility. Experience has taught us that volatility can actually improve financial outcomes, particularly when addressed via a well-designed, globally diversified portfolio that is aligned with your financial plan, investment time horizon, and risk tolerance. If you haven’t met with your Financial Advisor recently to review your plan and assess your portfolio, we encourage you to do so at your earliest convenience.

Thank you for the confidence you have placed in First Command.

Footnotes:

(1) Bureau of Economic Analysis and First Command.

(2) Bureau of Economic Analysis and First Command.

(3) Board of Governors of the Federal Reserve System and First Command.

(4) US Bureau of Labor Statistics and First Command.

(5) US Bureau of Labor Statistics, Federal Reserve Bank of Cleveland, and First Command.

(6) Federal Reserve Bank of Cleveland, FactSet, and First Command.

(7) US Bureau of Labor Statistics and First Command

(8) US Bureau of Labor Statistics and First Command.

(9) Standard and Poor’s and First Command.

(10) Standard and Poor’s, FactSet, and First Command.

(11)Ned Davis Research Group

The information in this report was prepared by John Weitzer, Chief Investment Officer, Matt Wiley, Vice President of Investment Management, and Dan Murphy, Investment Strategist of First Command. All opinions provided herein represent those of Mr. Weitzer, Mr Wiley and Mr. Murphy as of the date of this report; are for general informational purposes only; and are not intended to predict or guarantee the future performance of any specific investment or investment strategy. All statistics quoted are as of December 31, 2022, unless otherwise noted. First Command does not undertake to advise you of any change in the opinions or the information contained in this report. This report is not intended to be a client specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. You should not select an asset class or investment product based on performance alone. You should consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. If you require investment advice, please consult with your Financial Advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

©2023 First Command Financial Services, Inc. parent of First Command Brokerage Services, Inc (Member SIPC, FINRA), First Command Advisory Services, Inc., First Command Insurance Services, Inc. and First Command Bank. Securities products and brokerage services are provided by First Command Brokerage Services, Inc., a broker-dealer. Financial planning and investment advisory services are provided by First Command Advisory Services, Inc., an investment adviser. Insurance products and services are provided by First Command Insurance Services, Inc. Banking products and services are provided by First Command Bank (Member FDIC, Equal Housing Lender). Securities are not FDIC insured, have no bank guarantee and may lose value. A financial plan, by itself, cannot assure that retirement or other financial goals will be met.

In the United Kingdom, investment and insurance products and services are offered through First Command Europe Ltd. First Command Europe Ltd. is a wholly owned subsidiary of First Command Financial Services, Inc. and is authorized and regulated by the Financial Conduct Authority. Certain products and services offered in the United States may not be available through First Command Europe Ltd. In Germany, we provide financial planning services through Financial Planners associated with First Command Europe Ltd. 01033

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.