Markets Aren't Red or Blue: Investing in an Election Year

By: First Command's

Investment Management Team

Feb 29, 2024 | 3 min. read

“Mistakes can be corrected by those who pay attention to facts, but dogmatism will not be corrected by those who are wedded to a vision.” – Thomas Sowell

In November, voters will head to the polls to decide the outcome of what could be perhaps the most contentious election in recent history. Voters will not only determine control of the White House, but also the structure of the House of Representatives and a third of the Senate. This election could truly set the tone for both domestic and foreign policy through at least the 2026 midterms.

All things considered, it’s no shock that partisan election discourse is dominating the news cycle and most other conversations. And that’s not necessarily a bad thing, as there are some truly important topics that will be addressed through the ballot – tax policy, immigration, the amount of government spending, trade, and foreign aid and defense. An informed voter is a better voter.

But political rhetoric tends to be full of negative messaging. As such, it’s no surprise that times like these often lead to heightened investor anxiety and concern. Because emotion is an investor’s worst enemy, it’s essential for us to tune out the ever-present partisan “noise” if we are to be prudent investors. The truth is that elections always seem like a big deal when we are embroiled in non-stop coverage, but they tend to have little impact on the path of the economy or markets.

Election Year Market Drivers

Markets seem more concerned with uncertainty of outcome than any particular partisan outcome.

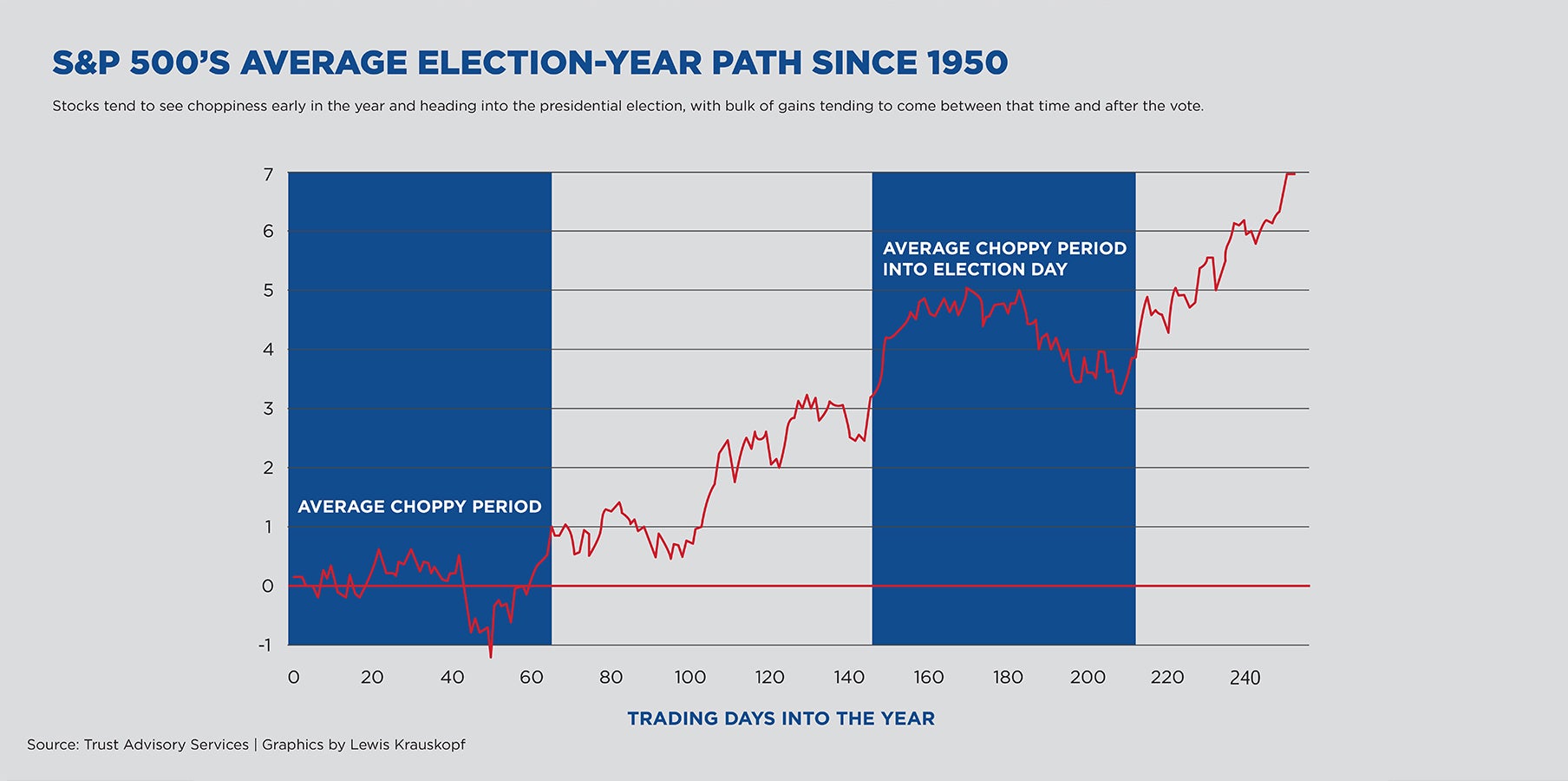

Of course, it’s impossible to determine exactly what influences market prices over any specific period of time; there are simply too many factors at play every second of every trading day. However, a broader view of market trends still reveals valuable insights. As an example, if we look at the average performance of the S&P 500 during presidential election years (figure 1), we see choppiness during primary season, when party candidates are battling for nomination, and again right before the actual election. Interestingly, however, markets are generally much calmer once it becomes clear which candidates will be selected during primary season and again after the general election.

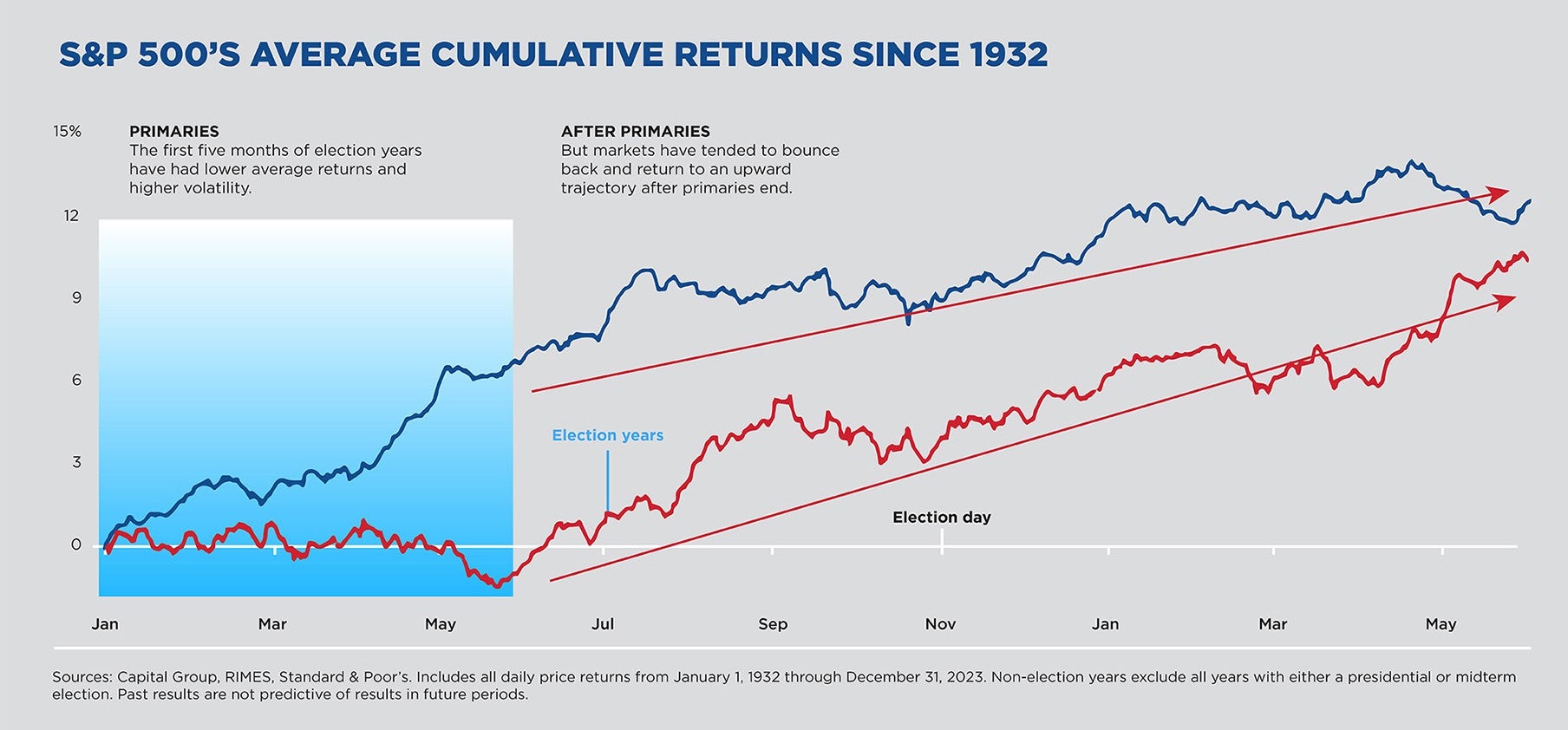

This pattern is even clearer if we compare market performance in election years and non-election years (figure 2). Primary season brings a bit of volatility (i.e., uncertainty), but afterwards, as the campaign picture begins to clear up, markets tend to perform similarly despite the looming election.

Remember, stock prices are, at the end of the day, based primarily on two factors: expectations of a company’s future earnings and market interest rates. As for the former, setting expectations for profitability requires a view of what the future regulatory and economic environments will look like, and anything that blurs that picture tends to impact stock prices – but only over the very short-term. As we discuss below, that is likely to occur regardless of which party is in office.

Politics of Economic Growth

While stock markets aren’t perfectly correlated with the broader economy, there still tends to be a strong relationship. Logically, this makes sense - if the economy is expected to perform well, corporate earnings in aggregate should also have a rosier outlook, and folks will also be more willing to hold long-term, “risky” assets like stocks. Accordingly, if we are making the case that partisan politics have an overall muted effect on markets, its impact on economic growth must be considered as well.

Admittedly, attribution of economic growth based on party control is, to put it plainly, a mess. We can look at historical metrics such as average GDP growth when each party was in control, but not only are there outlier events that make this data less meaningful (such as the Great Depression and various wartime shocks), but we also have to be honest about how much control sitting Presidents actually have to dictate the path of growth during their tenure. Of course, this is a major issue not only for economic analysis, but also for political discourse – many of the economic successes or debacles that parties and/or Presidents have received credit or blame for were often already in motion before they took office. And perhaps more importantly, those successes or failures are frequently not determined by executive or legislative power. They are, in other words, often more coincidental than causal.

Nonetheless, this won’t dissuade political commentators from tying economic outcomes to political control – something only made easier by the complexity involved in any economic calculation (including collecting data and measuring it accurately) and the ease with which statistics can be used to tell any story (a deceptive practice known as data mining). Suffice to say, when you see economic variables being presented through a partisan lens, make sure to keep a few things in mind:

- Economic data can sometimes be misleading simply because of how it’s measured over time. For example, GDP is reported quarterly, which means a period of solid growth could either be continuing a trend of strong performance or simply a “less bad” recovery from a previous worse quarter. This was on display during the economic “recovery” following the shutdowns during the pandemic – hardly a booming economy, despite how it looked on paper.

- Government policy can impact the economic environment through things like taxation, trade, public works, and legislation, but they don’t impact the economy immediately. Policy takes time both to implement and enforce. This is the main issue with attributing economic outcomes to any sitting President.

- Fiscal policy’s impact (through taxation and spending) on the economy is often limited, or even offset, by the Federal Reserve. The Fed’s mandate covers unemployment and inflation, and thus by extension, interest rates – if you see those things being attributed to the White House, remember that it cannot be solely responsible for the outcome.

Now, at the beginning of this commentary, we did say this election will influence all sorts of important policy, and that it paid to be informed. Surely that means there will be an impact on the economy and markets, right? Potentially, but remember that the best laid plans, which in this case often means the primary campaign promises, don’t necessarily lead to effective policy outcomes. In other words, we have to be realistic about how much will actually be accomplished. Campaigns have been run many times on the promise to fix immigration issues, balance the budget, make trade freer, and improve the tax system; however, these are not simple problems with simple solutions. More importantly, these often aren’t problems with politically attractive solutions, and thus good politics rarely equals good economics. That serves as an inherent check on how far policy promises will likely be taken (as good or bad as they may be interpreted to be by any given pundit) and reinforces the data we’ve seen so far – party politics simply shouldn’t be expected to have an outsized impact on the economy and markets.

Conclusion

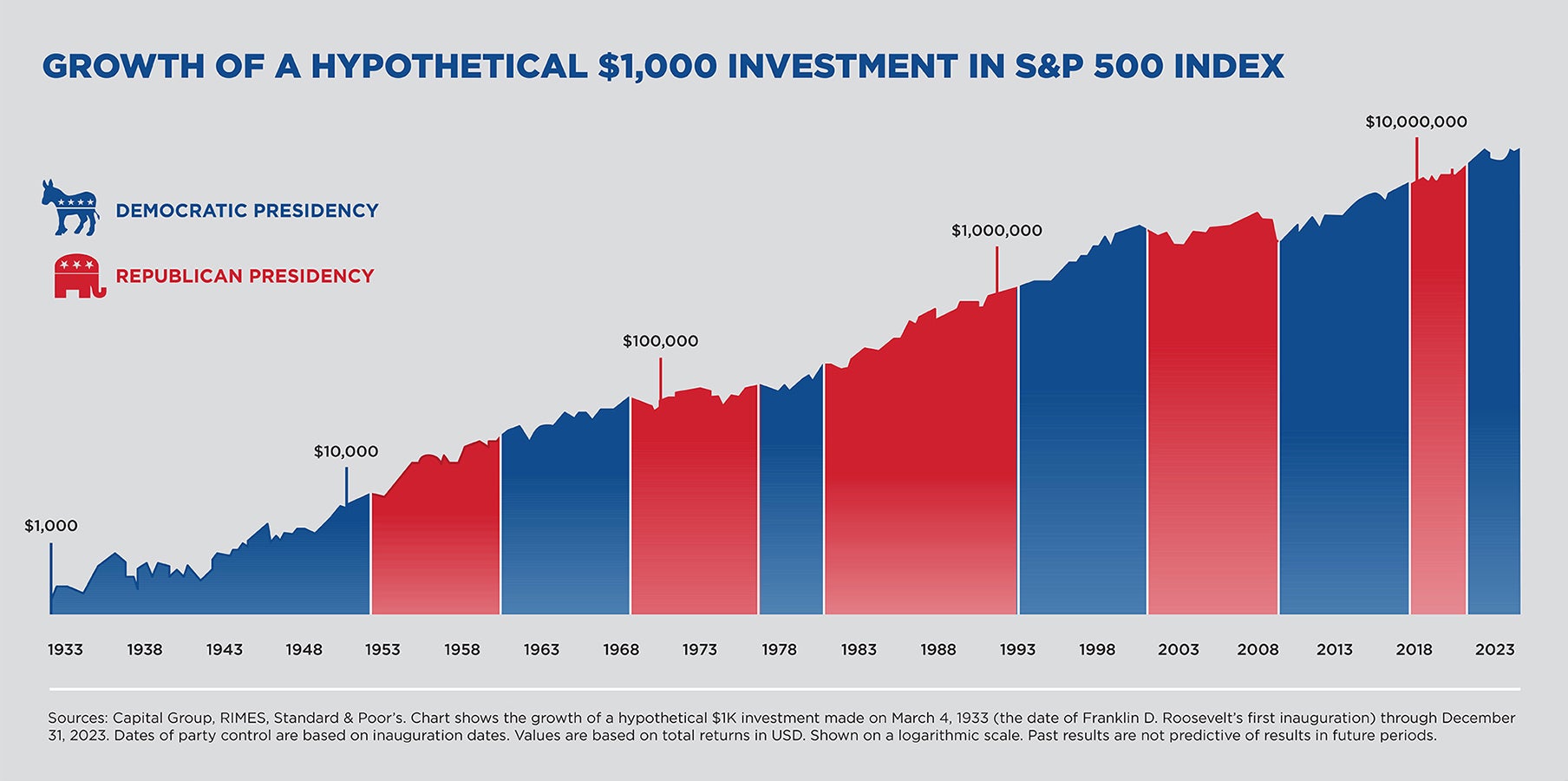

The two dominant political parties in the U.S. may represent very different visions of the world, but when it comes to the types of things that truly matter economically (government spending and regulatory scope), the differences in outcome aren’t always as different as advertised. In reality, their ability to influence major economic factors is shackled by, well, politics. Markets are going to experience unavoidable shocks and surprises, but those are often going to be unrelated to whomever is sitting in the White House or on Capitol Hill. Any political response that does have an impact, whether to a pandemic, a recession, or a terrorist attack, will likely be politically expedient as opposed to fully partisan. So, as we get closer to November, and rhetoric becomes more and more pitched over the future of the country, pay attention, stay informed, and vote for your values – but don’t let it impact how you invest for your long-term goals. When it comes to asset growth (Figure 3), the politics simply don’t tend to matter that much over the long-term.

The information in this report was prepared by John Weitzer, Chief Investment Officer, Matt Wiley, Vice President of Investment Management, and Matt Conner, Senior Investment Consultant of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual advisor. All statistics quoted are as of the date of this publication, unless otherwise noted. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.