One for the Record Books

By: John S. Weitzer, CFA

Senior Vice President and Chief Investment Officer

Jul 23, 2019 | 4 min. read

The current economic expansion is now the longest in U.S. history. Does that mean the next recession is around the corner?

The U.S. recession caused by the Great Financial Crisis officially ended on June 30, 2009. As of July 1, the current economic expansion – defined as a period of positive economic growth – is now the longest in U.S. history.[1] This much maligned and doubted economic expansion is truly one for the record books!

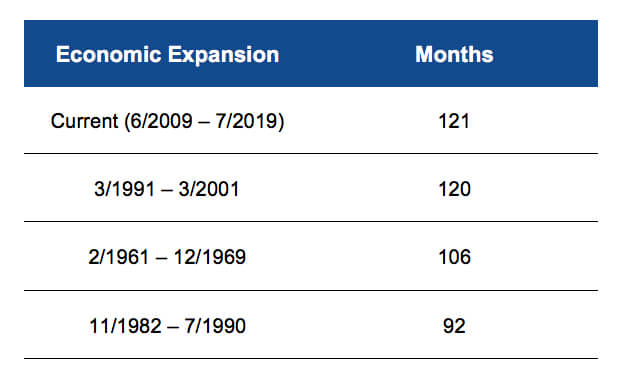

Take a look at the table[2] below that shows the four longest economic expansions in U.S. history:

Although the longest on record, the current expansion has only increased U.S. economic output by around 25 percent.[3] This slow growth makes it one of the weaker economic expansions in U.S. history. Although old in terms of the calendar, this expansion is showing no immediate signs of stopping. Business expansions do not die of old age. They die from excess. So given that we have not had a “boom,” or period of robust economic growth, we may not see the “bust” for a period of time.[4]

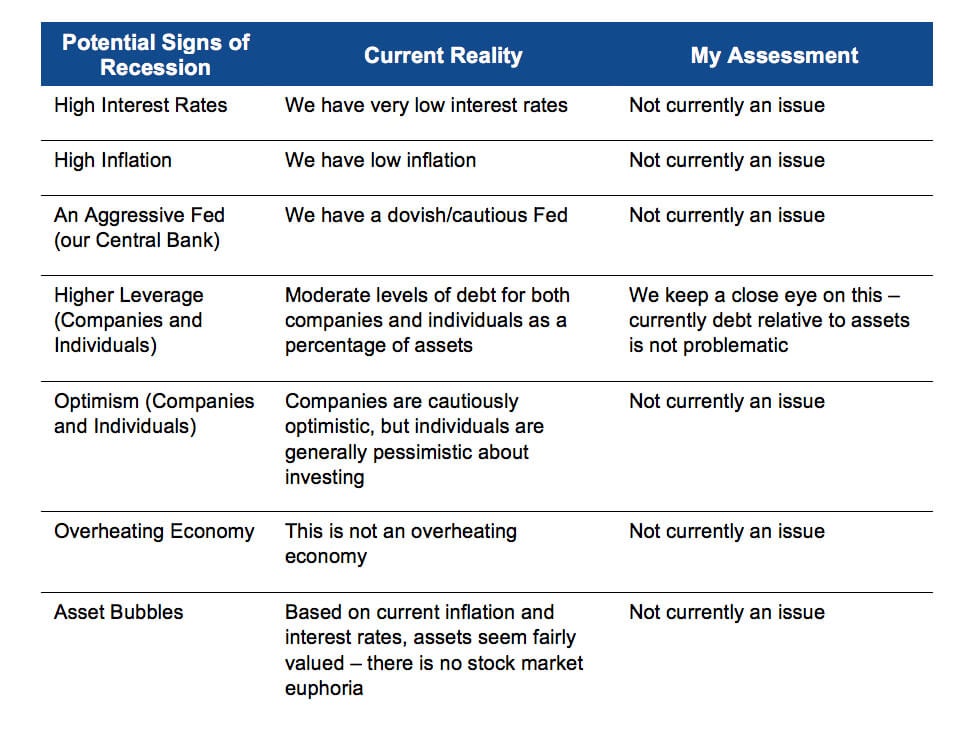

Let’s quickly review and address some signs of excess that have historically heralded an oncoming recession.

Currently, we do not see signs of excess in the U.S. financial system. Banks are not restricting lending and the absence of inflation makes it unlikely that the Federal Reserve will see the need to raise still-low interest rates. The bottom line is that this economic expansion has been going on for a long time and could very well extend even further. Maybe this is truly a case of “no boom, no bust.”

[1] Or, at least since 1854 when it began being tracked.

[2] National Bureau of Economic Research (www.nber.org).

[3] Through 3/31/2019.

[4] In his book, “Predicting the Markets (2018),” Ed Yardeni explains that one of the major lessons that he learned during the first 40 years of his career on Wall Street was that where there is no “boom,” you will not get a “bust.”

The information in this report was prepared by John Weitzer, Chief Investment Officer of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual security, market sector or the markets generally. First Command does not undertake to advise you of any change in its opinions or the information contained in this report.

This report is not intended to be a client-specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

The S&P 500 Index is widely regarded as the best single gauge of the U.S. equities market. This world renowned index includes a representative sample of 500 leading companies in leading industries of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 75% coverage of U.S. equities, it is also an ideal proxy for the total market. An investor cannot invest directly in an index.

The First Command Retirement Income Planning process has been designed to assist individuals in the pursuit of their retirement income goals. However, no financial plan, strategy or investment can assure that retirement income goals will be met.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.