How to Create — and Stick to — a Budget in the Military

Dec 28, 2023 | 8 min. read

Building a budget for your monthly expenses while serving in the military doesn’t have to be complicated. We’ll give you some tips for creating a budget – and actually sticking to it – so you can manage your finances easily.

Why do I need to create and use a personal budget?

A personal budget is your day-to-day tool for managing your money. The main reasons it’s beneficial to use one are to gain a clear understanding of your income and expenses, and to ensure you’re not spending more money than you’re earning. Plus, using a budget to guide your spending and keep your expenses lower than your income will help you reduce debt, save for unexpected expenses, and invest for longer-term goals like funding your kids’ college or preparing for retirement.

How to Create a Budget in 5 Easy Steps

Creating a budget doesn’t have to be hard. Here’s how you can set one up in five simple steps:

- Calculate your net income. The first step in creating a budget is to calculate your net income. This is the amount of money you bring in each month after taxes and other deductions have been taken out. Make sure to include all sources of income, such as your salary, bonuses, basic housing allowances, per diem, and money you may earn from any side hustles or part-time work.

- List monthly expenses. Next, list all of your monthly expenses. It's important to be thorough and include everything, no matter how small or insignificant it may seem. Make sure to account for any unique expenses related to your military service, such as deployment costs or moving expenses.

- Differentiate between fixed and variable expenses. Once you've listed all of your expenses, differentiate between your fixed and variable expenses. Fixed expenses are those that don't change from month to month, such as your rent, mortgage or student loan payments. Variable expenses like groceries, utilities, entertainment and gifts, on the other hand, do vary from month to month. For variable expenses, determine your average monthly cost by looking back over the past few months, perhaps by checking your credit card or bank statements, to get a sense of how much you should budget for these expenses.

Helpful tip: Keep variable expenses in mind as you build your budget. They are frequently areas where you can cut back on spending as you seek to balance your budget. - Establish goals and pay yourself first. Too often, people elect to save and invest only whatever money is left over at the end of the month. Instead, consider a “pay yourself first” approach. Set your short and long-term goals, determine how much you will need to put aside each month to get and stay on track for them, and then develop a budget that will allow you to pay your day-to-day and month-to-month expenses from what is left over.

- Set your budget by adjusting your expenses to your goals. Last, it's time to finalize your budget by adjusting your expenses if you find that they are higher than your income. You'll need to make some cuts or find ways to increase your income. If you have debt, consider prioritizing paying it off to reduce interest charges and free up money for other expenses or goals. If you receive a large tax refund every spring, consider adjusting your withholding so that you receive more money in every paycheck that you can allocate to your budget. Look for areas – potentially in your variable expenses – where you can reduce spending by eating out less or canceling subscriptions you don't use. Reducing expenses is often a matter of need vs. want. Realistically, things like meal deliveries, multiple TV or music streaming services, your clothing budget and technology upgrades are wants that stand between you and your financial goals.

How much of my monthly income should I save or invest?

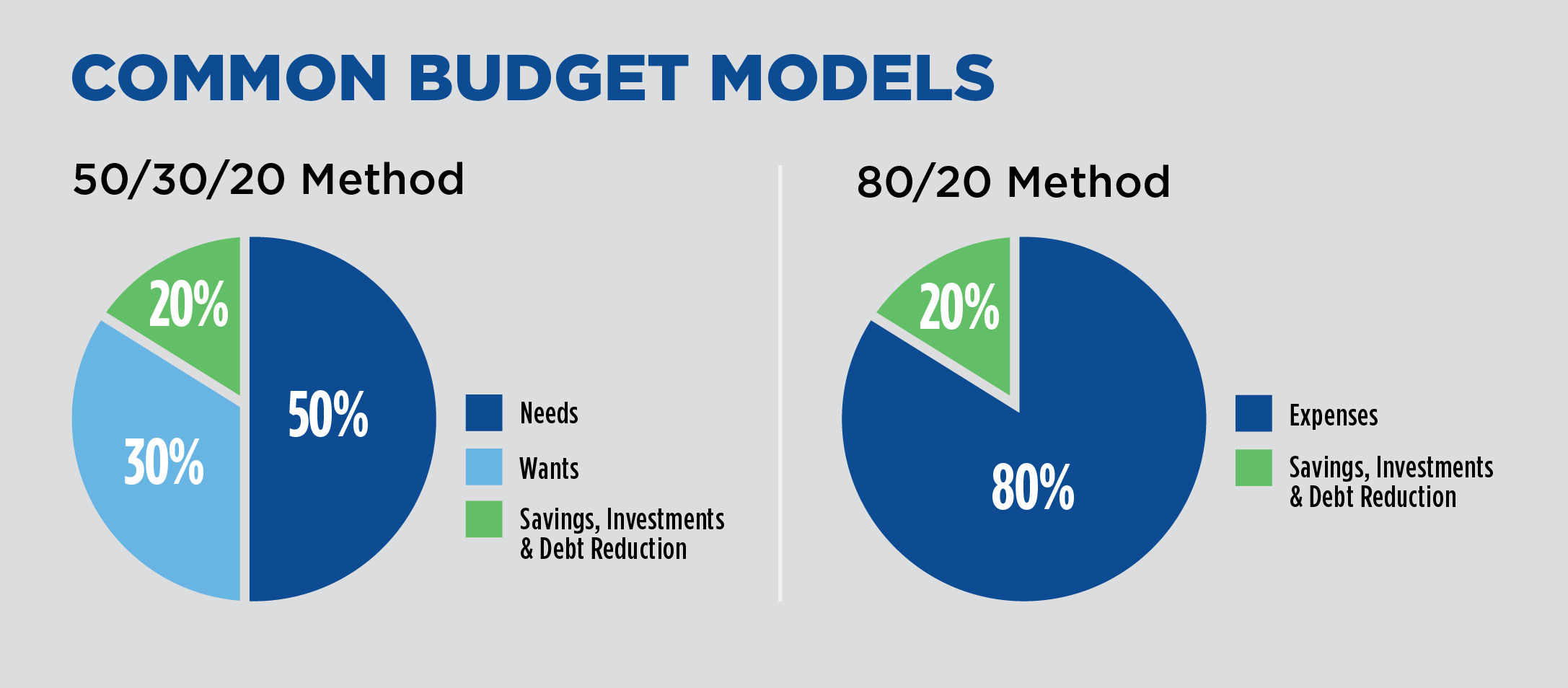

There are a lot of different budgeting methods you can try. The 50/30/20 method has 50 percent of your income going to needs, 30 percent to wants, and 20 percent to investments, savings or debt. The zero-based budget entails allocating every dollar to a different source, including savings and investments, in order to hit zero at the end of each month. There’s also priority-based budgeting, cash-only budgeting, and the 80/20 rule in addition to others, so talking to a financial advisor about which method makes the most sense for you could be helpful.

Monthly Budget Template

To help you plan your monthly budget, try our easy-to-use template specifically designed for service members. It can help you organize your expenses and determine your total household income. Most importantly, it can help you make decisions about the best way to allocate your money so that you can meet today’s needs while also working toward tomorrow’s goals. Download our complimentary military budgeting template here.

Tips for Sticking to a Budget While Serving in the Military

Sometimes the hardest part of budgeting is actually sticking to your budget once you’ve created it! To keep you on track, implement these tips.

- Pay expenses before spending paychecks. Make sure all of your bills are covered before you spend elsewhere. If you have a hard time keeping track of bills, set up automatic withdrawals with the companies you do business with to prevent late fees. Keep an eye on payments as they go through to make sure they don’t exceed what you calculated in your budget. Otherwise, it may be time to adjust these areas or another part of your budget to compensate.

- Use automatic withdrawals to invest money. Investments can also be set up for automatic withdrawal, just like your bills. Pay yourself first by making sure your future and your financial goals are all covered without having to manually set the money aside each month. When you don’t have to think about it, you’re more likely to stay on track.

- Set aside time to review spending on a bi-weekly or monthly basis. You’re more apt to stick to your budget when it’s working for you! Financial situations change all the time. That’s why it’s important to schedule time in advance to review your budget once or twice a month. Try picking the same day each time, like the 1st and 15th, or every first Friday of the month to help you make it a habit.

Budgeting Tips for your Military Family

Military members with families have extra things to consider while building their budget. Here are a few tips to help you make the most of your income:

- Use the resources that are available to you. Military families have access to a variety of resources that can help with budgeting. For example, many military bases offer financial education classes and the U.S. government’s Office of Financial Readiness offers valuable information online. There’s also the option of working with a financial advisor who has a comprehensive understanding of military benefits and can work with you one on one to plug them into your budget.

- Take advantage of military-specific benefits. Military families are eligible for a variety of benefits that can help reduce expenses, such as low-cost life insurance, a housing allowance, and dependent pay. On-base benefits also include options like the commissary, which offers discounted groceries, and the Exchange, which offers discounted clothing, electronics and household goods.

- Plan for deployments and PCS moves. Deployments and Permanent Change of Station (PCS) moves can be expensive. Make sure to factor in related costs that are not covered by reimbursements when creating your budget and consider ways to reduce expenses during these times.

- Involve the whole family. Budgeting is a family affair, so involve your spouse and children in the process. Make sure everyone is aware of the family's financial goals to help create a sense of shared responsibility and accountability.

Factoring a Military Pay Raise into Your Budget

If you already follow a budget, getting a military pay raise means it’s time to refresh it to ensure your additional income doesn’t disappear into day-to-day expenses. A pay raise presents an opportunity to evaluate your finances and purposefully allocate the new income in a way that is beneficial for you. Consider using a portion of your pay raise to improve your family’s current lifestyle, then dedicate the remainder to longer-term financial goals like college savings or retirement investments. You’ll implement your plans through your budget. So after a pay raise, update both the income portion of your budget as well as the lifestyle expense or investment where you’ll allocate your increase. Learn more about how you can make the most of your pay raise at in our article about the 2024 military pay raise.

Join the Three Quarters of Americans Who Report Using a Budget

According to Nerdwallet’s 2023 Consumer Budgeting Report, 74 percent of American adults have a monthly budget and nearly a third report that they review their budget regularly.1 No matter where you are in your military career, starting a budget can help as you move forward on your financial journey. Learn more about building a budget or reach out to a Financial Advisor to enlist some professional help in planning your budget and planning for your financial future.

1. Most Americans Have a Monthly Budget, but Many Still Overspend - NerdWallet

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.