What's a Credit Score and Why Does Mine Matter?

Jun 28, 2024 | 4 min. read

Learn what you need to know about your credit score.

As financial advisors, we spend a good deal of time coaching against the acquisition of bad debt. But the truth is that establishing and maintaining a strong credit score is an important component of good financial health. Let’s face it: it’s not realistic or even prudent to pay cash for everything and in those situations where borrowing makes sense, having a good credit score will allow you to do so on favorable terms. So, let’s start at the beginning.

What is a Credit Score and How is it Calculated?

In short, it's the number that lets bankers, lenders - and maybe even landlords and employers - know how reliable you are when it comes to repaying debt. It’s based on things like if you pay your bills on time, how much you’re using of the total credit you have available, the average age of your accounts (more history is better) and whether you have a mix of different types of credit (installment loans such as a mortgage or student loan, and revolving debt such as credit cards or lines of credit). Lenders like to know that you can manage different kinds of accounts responsibly.

What Makes a Good Credit Score?

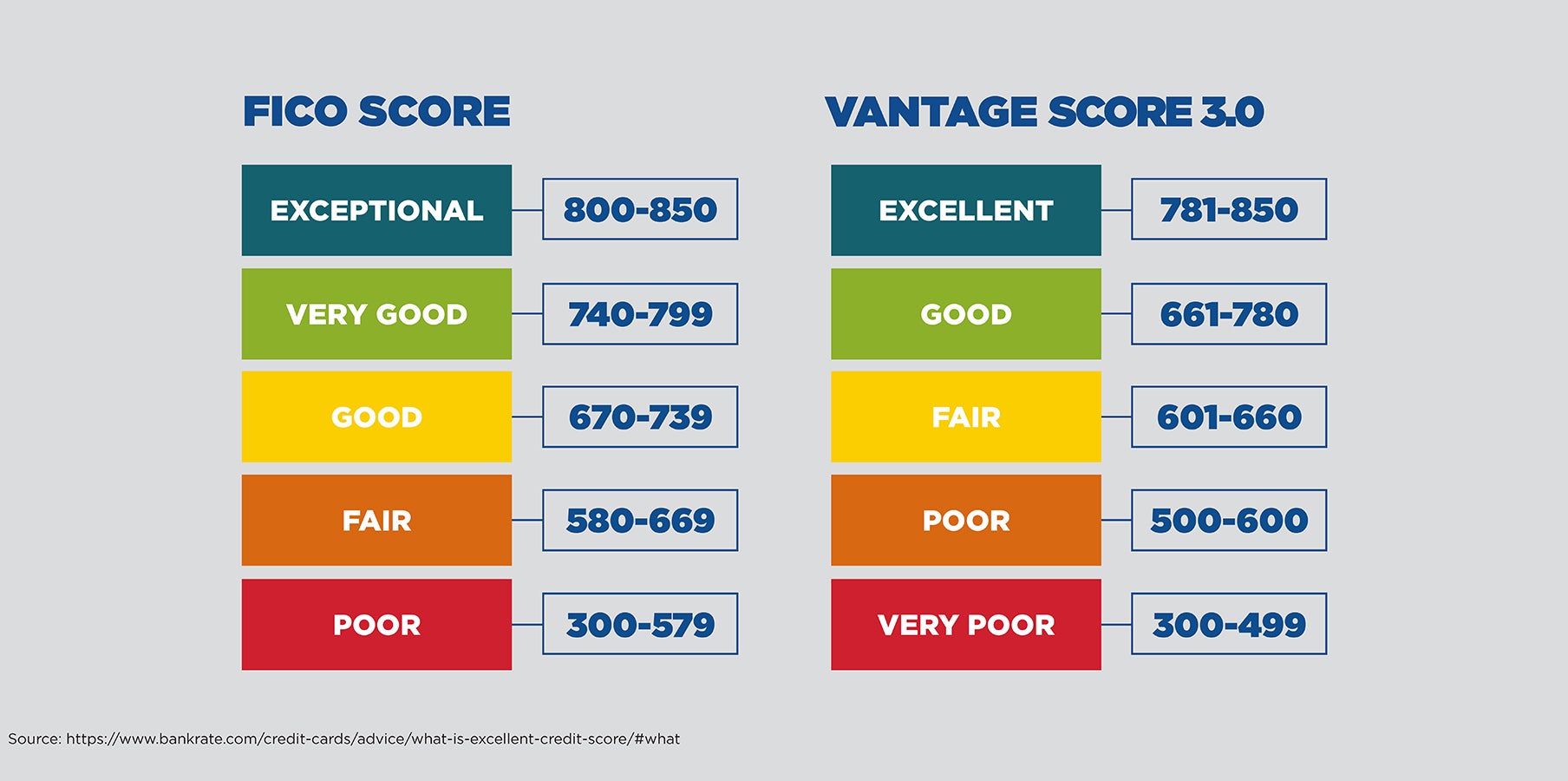

To make things even more confusing, There are two separate sources for credit scores: Vantage 3.0 (also known as the consumer score) and FICO. Though FICO is the most widely used, Vantage 3.0 is the score used by the three major credit bureaus: TransUnion, Experian and Equifax. The scoring range is the same for both – 300 to 850 – and the higher your score, the better. In general, any Vantage 3.0 score above 781 is considered excellent, while on the FICO scale anything over 800 is considered excellent and will qualify you for the best rates. While Vantage 3.0 and FICO use the same scoring range, there are a few differences in how a score is classified depending on the scale. Take a look at the chart below to see how each range is alike and how they vary.

Why Your Credit Score Matters

Your credit score will be important when it comes to some pretty big life events like buying your first home, buying or leasing a new car, or starting your own small business. A low score doesn’t always mean you won’t be approved, but it almost certainly means that you will be required to put down a larger deposit or borrow at a higher interest rate.

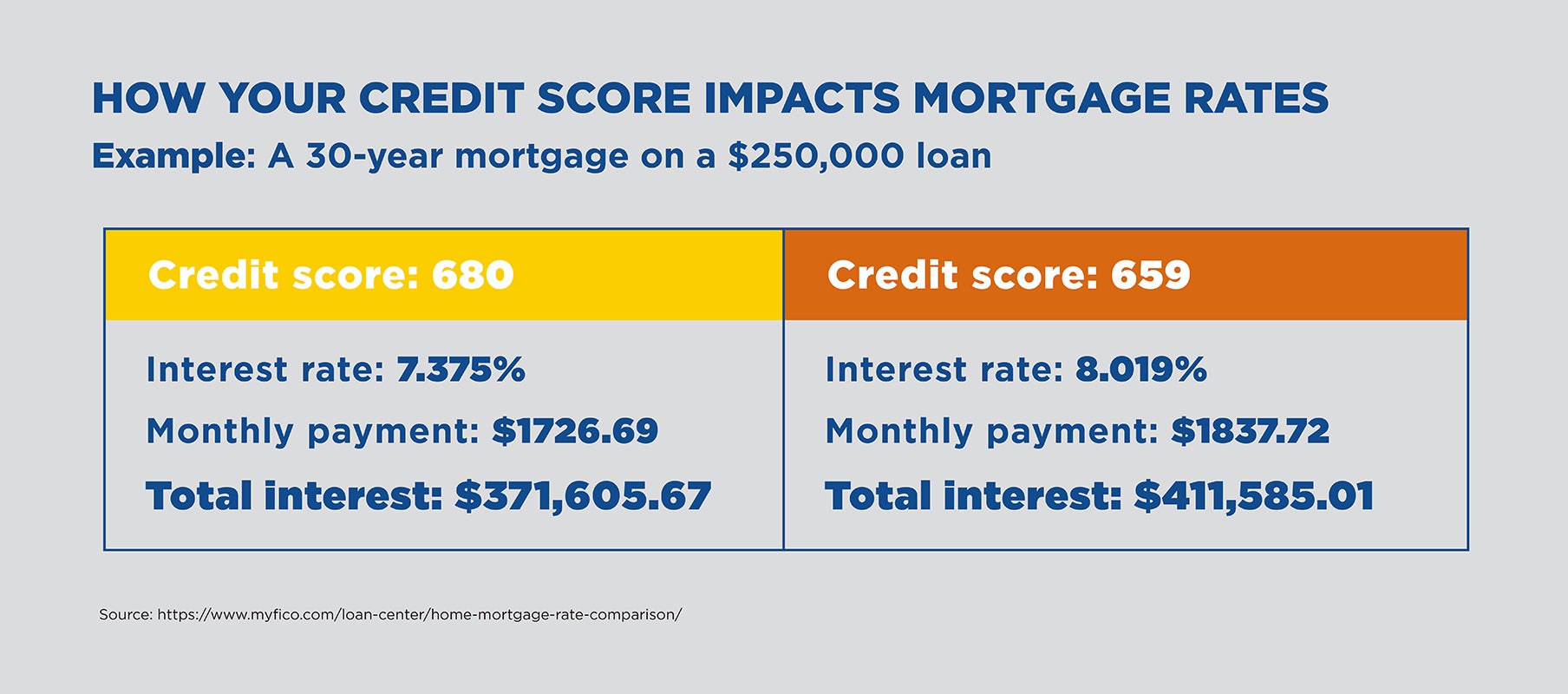

Even 20 points or so can make a big difference in what you’ll be charged for credit. Below, we have an example of two credit scores and what your monthly payment would be on a $250,000 loan for a 30-year mortgage based on mortgage rates from 2024. For those with a higher credit score, they can expect to pay less interest over the life of the loan and less in monthly payments.

Military Credit Score Considerations

If you are a member of the military or considering joining, it is particularly important to know your credit score so you can have a full picture of your finances. There are factors that may affect your finances. If you PCS or are deployed, there may be an impact on any bills that you have and the frequency in which they are paid. That is why it’s always a good idea to pay down debt or use autopay. As with any other career, it’s a good idea to maintain a healthy financial balance when in the military.

Yes, maintaining a good credit score is important for military service members because it can affect many aspects of their lives, including their security clearance, job, and ability to borrow money:

- Security clearance: A good credit score can show that you are reliable and financially responsible, which are important factors which can be attributed to whether you can handle sensitive information. Military members with a security clearance who damage their credit, such as by missing payments or filing for bankruptcy, could face serious consequences, including having their clearance revoked. In extreme cases, they could even be dismissed from the military.

- Job: Poor credit can make it more difficult to move up in different positions in your military career.

- Borrowing money: A good credit score can help you get better rates on loans and credit cards, which can save you money over time

Maintaining Your Score in the Military

Military service can sometimes make it hard for active-duty members to maintain a good credit score. Understanding credit is step one, but for complete peace of mind while on active duty, there are a few strategies to know and use while you serve.

Know your credit score.

Knowing your credit score helps you understand how to maintain (or improve) the score that you have and gives you a reasonable expectation of how your borrowing may be affected.

Carefully review your credit report.

Once you receive your credit report, read it. There may be incorrect items on your report. If so, dispute them.

Pay bills on time through autopay

Setting up autopay through your bank can help ensure your bills are not stacked up or paid late, which would have a negative impact on your credit score.

Consider appointing power of attorney

If you have the option, appointing power of attorney to a family member may provide some peace of mind while on deployment, allowing them to stay on top of your finances until you return.

How To Check Your Credit Score

Everyone is entitled to one free copy of their credit report every 12 months from each of the three nationwide credit bureaus, after which individual credit checks incur a fee. You can choose to space the reports out by ordering one copy every four months. If you choose this method, you will be able to monitor your credit reports on a continuous basis. When you order a report from the government-based website, Annualcreditreport.com, you may receive your report instantly or in up to 15 days, depending on your responses to several security-based questions. The Military Credit Monitoring Rule requires the nationwide credit reporting agencies to provide free electronic credit monitoring services for active duty military personnel. Take advantage of this access to always be aware of your current credit standing.

Plan Ahead

Most people don’t give their credit score much thought until they need to know it – and at that point it’s too late to do anything about it. So, plan ahead. Limit yourself to one or two credit cards. Unless it’s an emergency and you have no other options, don’t charge more on your card than you can afford to pay off at the end of the month. And if you don’t already have some money set aside for unexpected expenses, establish an emergency savings account that’s equal to at least 3 months of expenses. Practicing responsible cash management could help strengthen your credit score – and that helps give you a leg up on building the life you imagine.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.