When to Consider a Financial Advisor: A Guide for US Military Personnel

Apr 18, 2024 | 6 min. read

Getting a financial advisor early in your military career may positively impact your lifelong financial health.

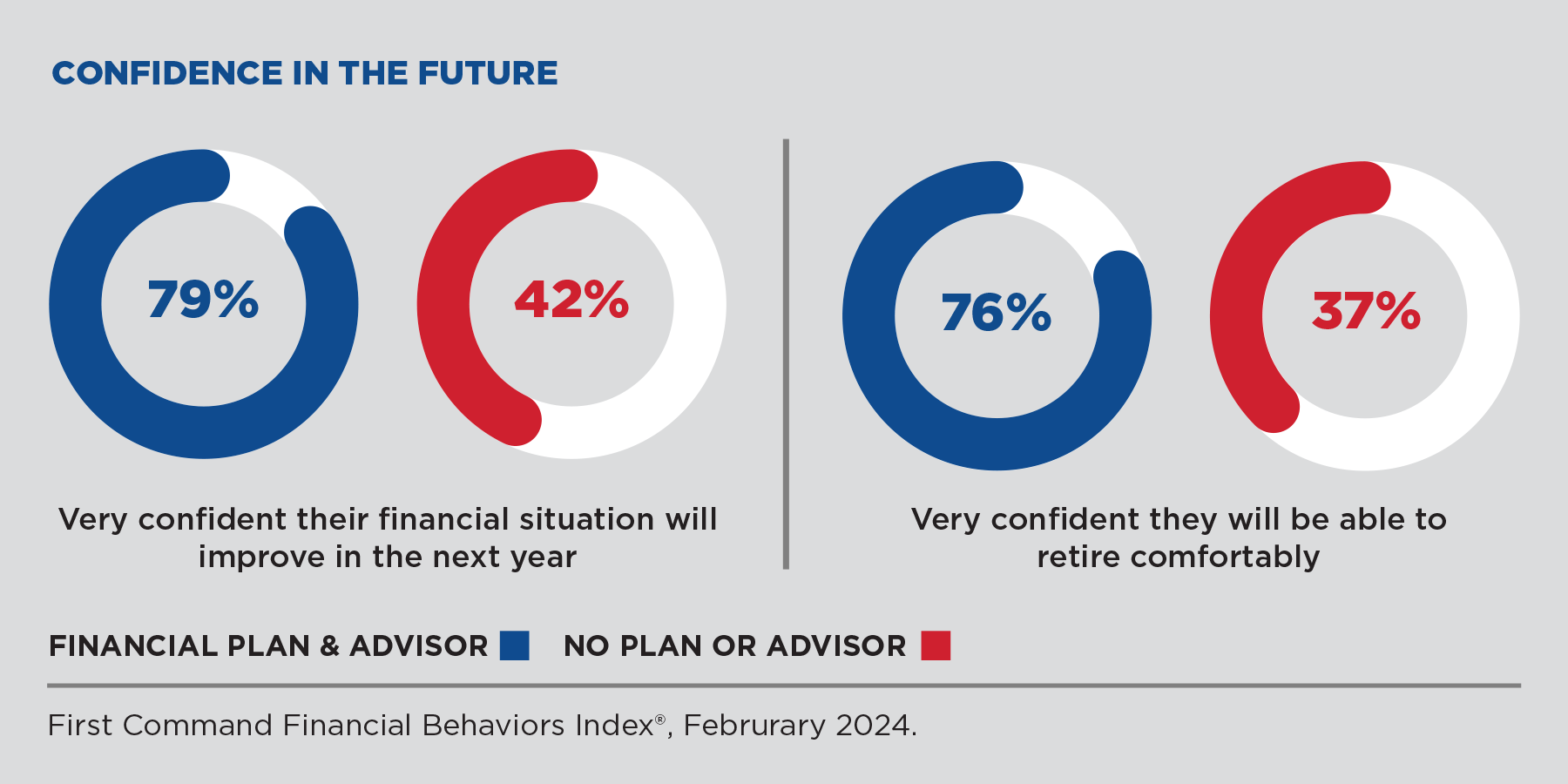

Most young service members don’t believe they need the help of a financial advisor until they have a significant sum of money to invest or some complex financial matter to resolve. But enlisting the assistance of a knowledgeable financial coach at the outset of your career – even if you have credit card debt and no initial money to invest – can boost your confidence and kickstart your pursuit of financial security.

A financial advisor who is familiar with military life and benefits can work with you to develop a comprehensive financial plan that provides clear guidance for:

- Paying off high-interest debt

- Establishing an emergency savings account

- Properly allocating your TSP contributions

- Saving and investing for your non-retirement goals

- Managing risks to your family’s financial security

The beginning of your military career may be the best time to begin working with a financial advisor, but there are also some very specific moments in your life and career when it can be especially beneficial to seek out professional advice. Let’s take a closer look at a few of those situations.

How a financial advisor can help during separation or deployment

Big life changes directly correlate to big financial decisions. If you plan on separating from service in the near future, you’ll need to carefully consider how you will replace key benefits like SGLI and TRICARE, and make the most of the assets you’ve accumulated in the TSP. And if you are going to be deployed soon, it might be prudent to grant your spouse Power of Attorney and review your life insurance to make sure it is sufficient to meet your family’s needs. A knowledgeable and experienced Advisor can answer all of your questions and help you prepare for what’s next.

How a Financial Advisor can help with marriage and family planning

It might not be the most romantic way to think about it, but in a sense a marriage is like a financial merger between two people, and that can get a little complicated. It’s not uncommon for couples to have different money “personalities” or even different financial priorities, but an experienced financial advisor can help you identify and plan for goals that reflect both of your priorities.

Starting a family comes with its own set of questions and challenges. Will both parents work full-time? If not, what steps need to be taken to make it financially feasible for one to at least temporarily leave the work force? What about your child’s education? How much will college cost and do you want to help with that cost? If so, what sort of investment account should you use for that purpose and how much do you need to set aside? Is there a way to utilize the Post-9/11 GI Bill to offset some of that expense? Your Advisor can provide you with the information you need to answer these questions and develop a recommendation for pursuing your objectives.

How a financial advisor can help when you’re ready for a home of your own

Most young people dream about buying their own home someday. But is buying always the right decision when you’re in the military? You won’t be surprised to learn that it depends! But your financial advisor can help you assess all of the variables and determine whether you should buy or rent. And if buying makes sense, unlike your realtor or lender, they can utilize their detailed knowledge of your financial circumstances and goals to provide guidance on how much home you can really afford and what you should do about the down payment.

The best time to get a financial advisor is now

We’ve offered examples of three specific life events when you could benefit from consulting with a knowledgeable and experienced financial advisor. But the best time to establish a relationship with an advisor is always right now, and that’s because time is your most important ally when it comes to planning for your financial future. The earlier you begin investing, the more time your money has to grow and compound. The younger and healthier you are when you secure the life insurance you need to protect your family, the less it will cost you over your lifetime. And the earlier you establish a relationship with a financial coach that you trust, the more likely you are to develop the disciplined, productive financial behaviors that are the real key to long-term financial security.

Ready to get a head start on your financial future? Connect with a knowledgeable First Command Financial Advisor near you.

TSP funds have very low administrative and investment expenses, and low expenses can have a positive effect on the rate of return of your investment.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.