A Story of Spending: Dollars, Deficits, and Debt

By: First Command's Investment Management Team

May 23, 2023 | 18 min. read

The national debt is a major point of concern for many Americans and is once again in the spotlight because of yet another debt ceiling debate. However, the latter is little more than political theater. We expect that the ceiling will be raised, and even if we hit the limit before it is, we will not technically default. That said, while the strength of the U.S. dollar makes default very unlikely, long-term debt reduction should still be a primary focus of policy makers. This will not, however, come in the form of marginal cuts in government spending. It will inevitably come from an increase in broad taxation and a reduction in entitlements, which should be primary financial planning considerations going forward.

The Current Debate

There are few fully bipartisan topics in our divided nation. However, the one thing that both sides of the aisle have consistently supported in recent decades is higher government spending. This has come in many different forms, including:

- Welfare and benefit plans

- Tax “rebates”

- Foreign aid

- Infrastructure improvements

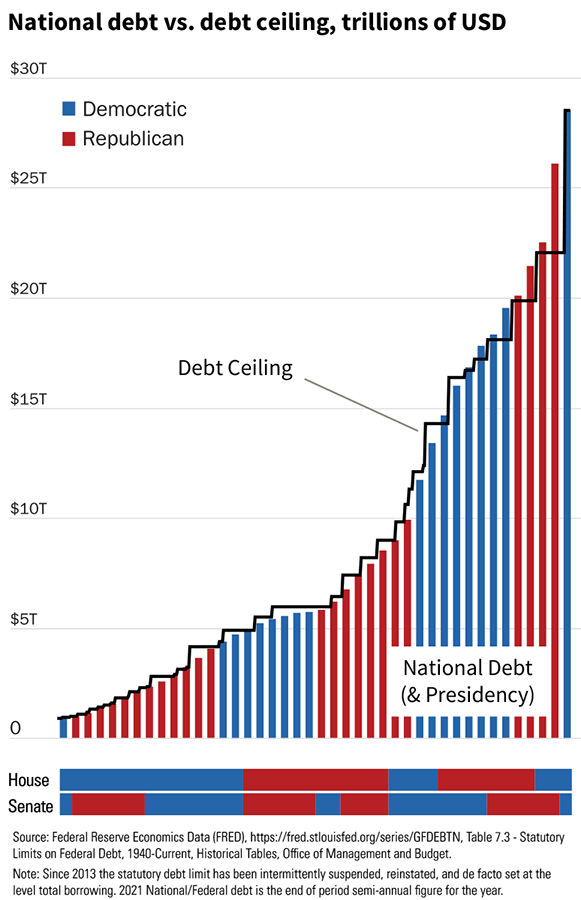

- Farm subsidies

The list could go on and on, but the result is always the same: a near-constant deficit and growing debt. Currently, we are gridlocked in another “will they or won’t they” raise the debt ceiling game. But at the end of the day, while there should obviously be checks on government spending, the entire concept of a “ceiling” for approved expenditures is tailor-made for political posturing and little else – and all politicians play the game (Figure 1).

Figure 1:

But if there is one thing about which we can feel very confident, it is that the government will not end up in default if the debt limit is not raised in time. Rather, if we hit the debt ceiling before both parties can agree on a limit increase, we can reasonably expect:

- There will be hand wringing about spending and plenty of theatrics to cast blame.

- There may be short-term financial repercussions that could have widespread impact, including delays in active military, GS, and contractor pay as well as various benefits, such as tuition assistance and reimbursement.

- Market volatility will likely increase. However, the broader economic impact of this debate is minimal, so any market response is likely to be short-lived.

- And most importantly, the debt ceiling will eventually be raised.

It’s worth noting that Social Security, Medicare, military pensions, and VA disability benefits are all funded through separate legislation and trust accounts. This means that the risk of these payments being impacted is considerably lower if the debt ceiling is reached. In fact, these benefits have never been halted once despite 22 funding gaps since 1976, 10 of which led to government furloughs.

On that furlough note, even if we enter an extended period without a deal after the ceiling is reached, remember that is not the same as a default. The only true consideration for acute default risk is whether the US is deemed creditworthy enough for countries and individuals to keep lending it money. That, luckily, is not currently in question.

Remember, headlines will always veer towards the most incendiary of potential outcomes, not the most likely. Since 1944, we’ve raised the debt ceiling 104 times; it is more of a debt target than a limit. While we are not minimizing the impacts even a very short funding gap may have on Americans, the problem is not that we must deal with consistent ceiling “constraints.” Rather, it is the processes that produce the spending in the first place.

THE APPEAL OF DEFICITS AND DEBTS

Using debt to finance a house or car is not a concept that requires considerable explanation – we all understand how useful it can be to spread a large purchase over a long period of time to make it affordable. However, the idea of running a consistent deficit seems like a much less logical financial decision (and one we would advise you against mimicking). So why does our government seem to ignore this logic so consistently?

At its simplest, deficit spending is economic stimulus intended to avoid severe slowdowns in economic growth when consumer spending falls. The concept, famously proposed by John Maynard Keynes as a fiscal policy stance to aid in recovery from the Great Depression, centered on the idea that the government has the ability to “make up” for a dearth of business and consumer expenditures. In other words, by simply increasing government spending, policy makers should be able to keep overall economic activity level, avoiding big swings (cycles).

According to the original theory, this increase in spending (and accompanying increase in debt), should be paid off when the economy recovers through increased taxation and other “austerity measures.” But this highlights a primary flaw in the theory of deficit spending – it assumes that politicians will take the necessary long-term view of the situation and behave accordingly. But in the real world, how many politicians, regardless of party, will champion the idea of higher taxes and less government support and expect to win re-election? Very few.

The Downside of Debt

So, we have a politically attractive policy prescription that, due to myopic politics, doesn’t immediately place the necessary burden on taxpayers (i.e., voters). As such, the path to growing government debt around the world seems obvious. But is that a major problem?

To answer that question, it is most instructive to compare outstanding sovereign debt to a country’s Gross Domestic Product (GDP), as opposed to considering only the absolute value of that debt. According to the World Banki, a ratio that exceeds 77% debt-to-GDP for an extended period is potentially troublesome. The U.S. debt-to-GDP ratio is currently 121%ii, having crossed that World Bank threshold in 2009. On the surface, that seems very high. But again, even this ratio on its own can be misleading. Here are a few countries with very low debt-to-GDP ratios:

- Russia: 17.8%

- Afghanistan: 7.8%

- Botswana: 18.2%

- Libya: 16.4%

These are not exactly economic titans. Clearly, there’s more to consider. It's impossible to estimate what an “ideal” level of debt may be for a particular country, and by extension, whether a particular debt level is problematic. Instead, the focus should be on the impact a large debt can have on an economy and whether it impairs the functioning of the government. Like a household, there are clearly risks associated with carrying a high level of debt. Lenders may simply not extend credit, and even if they do, it may be at a much higher rate to compensate for the risk. If this borrowing is necessary to meet the demands of previous loans taken, the issues simply compound. This can make it harder to react to emergencies, both at home and at the national level, because lending may simply dry up if it’s assumed that this new development could lead to default on existing debts.

This snowball effect is the exact same one faced by governments when the debt burden becomes too onerous. However, when analyzing national debt, it’s important to recognize that everything is relative. The true risk faced has much more to do with the idiosyncrasies of the country in question than any particular number. As for the U.S. situation, here’s a hint – we are a bit special.

THE U.S. NATIONAL DEBT

The U.S. national debt has a long and storied history, and debt financing is more American than baseball and apple pie. In fact, our first Treasury Secretary, Alexander Hamilton, argued vehemently in The Federalist and elsewhereiii that the capacity of the government to borrow extensively is perhaps the most important component of a functioning nation. However, even with this mentality and through multiple expensive wars, debt levels were kept relatively low for a considerable portion of our history due to higher tax rates that reduced the need to borrow. But if we fast-forward to the early 20th century, we can see where things started to change in terms of how Congress appropriated funds and how we thought about the debt itself. Back to our household example: If you’re setting a budget or planning for a large expenditure, you would logically start with your income projections or borrowing capacity before moving forward. This was essentially how the US government thought about spending before WW1 – there was a direct link between taxes, debt, and spending at the legislative level. However, after the Great War, a philosophical shift among policymakers began to unfold, which led to a surge in debt issuance, sowing the seeds for the move towards a U.S. dollar-denominated world economy.

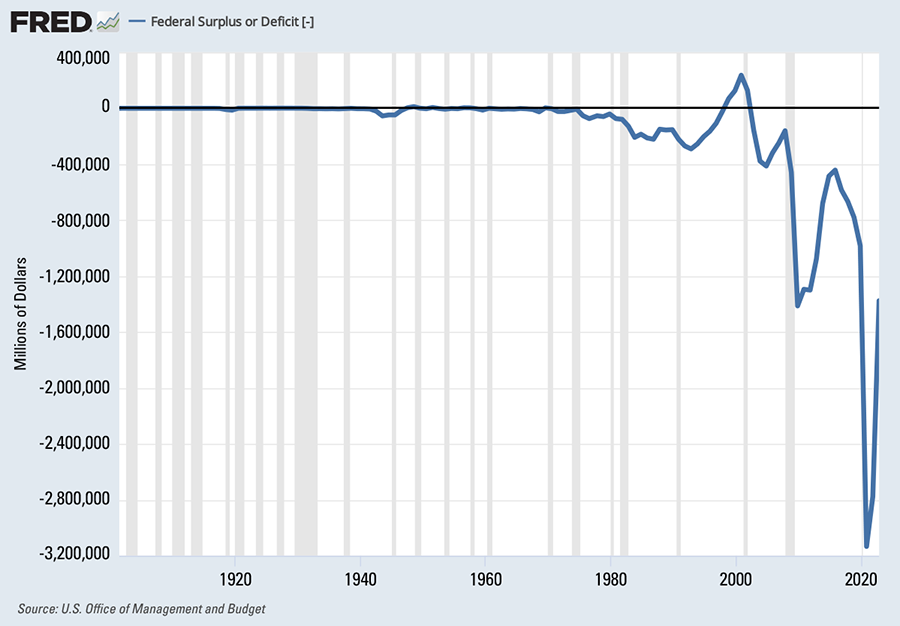

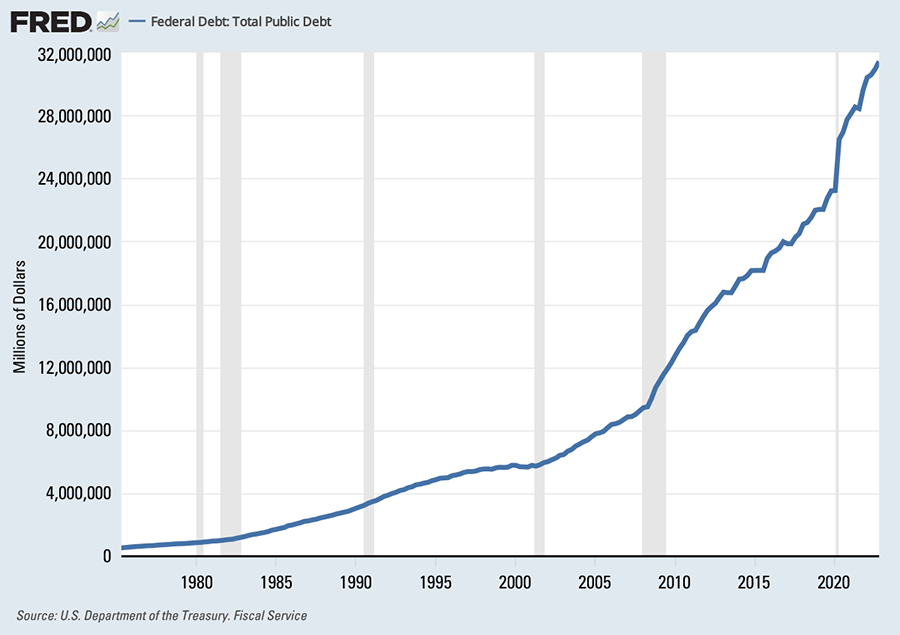

Figure 2:

When the Great Depression hit, the role the government played in economic recovery was further expanded. With President Roosevelt’s New Deal came the creation of massive new entitlement programs, the most impactful of which was Social Security. Then, World War II, as you would expect, led to a massive increase in government spending. In fact, the debt-to-GDP ratio peaked at 106% in 1946. Over the next few decades, however, due to higher tax rates and a post-war economic boom, we actually ran slight budget surpluses until the end of the Vietnam War in the mid 1970s. The U.S. debt-to-GDP ratio declined back to around 31%. However, this period of fiscal prudence was not to last (Figure 2). The shift towards a growing debt was led by the further expansion of social welfare programs, such as Medicare and President Johnson's “war on poverty,” which added considerably to its mandatory components.

Figure 3:

Even with all of this in place, deficit and debt levels remained relatively tame. While entitlements expanded dramatically, they were not a major burden because the working-age population far exceeded the elderly. But demographics continued to change with time, and eventually our debt dilemma was punctuated by two major catalysts, leading to the more pronounced increases in debt: the 2008 Great Financial Crisis and the COVID-19 pandemic. Both involved a massive outpouring of government support to weather the accompanying economic storms, and considerable emphasis by legislators was put on minimizing the taxpayer burden. As such, borrowing had to increase considerably to fill the gap (Figure 3).

A Case for US Stability

Given this meteoric rise in the debt level, how worried should we be about the fiscal stability of the U.S.? Our answer, at least for now, is “not very.”

As we stated before, the true risk of default rests almost exclusively on the creditworthiness of the country in question. Each country’s debt must be evaluated in the context of a wide variety of factors, ranging from internal stability and currency structure to the importance of that currency’s role globally.

The U.S. plays a unique financial role in the world today due to the U.S. dollar’s (USD) status as the global reserve currency. As we discussed in-depth here, the world views the USD, and more importantly, USD-denominated debt, as inherently more stable than any alternative – a comparative advantage relative to global peers. As such, the demand for U.S. debt is relatively resilient and high, leading to a more stable borrowing capacity, despite a growth in the absolute size of debt. This perceived stability and high demand allows us to maintain low relative borrowing costs, even after the sharp rise in interest rates that occurred last year. In fact, the average interest rate on US debt still hovers just around 2%iv.

As long as investors and governments around the world are willing to lend the U.S. money by purchasing its debt (bonds) at reasonable rates and quantities, default is practically impossible. This is even more the case considering that this willingness is inherently linked to the UDS’s role as the global reserve currency (which is not truly being threatened by potential usurpers, much to the chagrin of headline writers everywhere).

THE PATH FORWARD

Despite our place as a global reserve currency, it would be naïve to assume inertia in the face of otherwise unsustainable spending patterns.

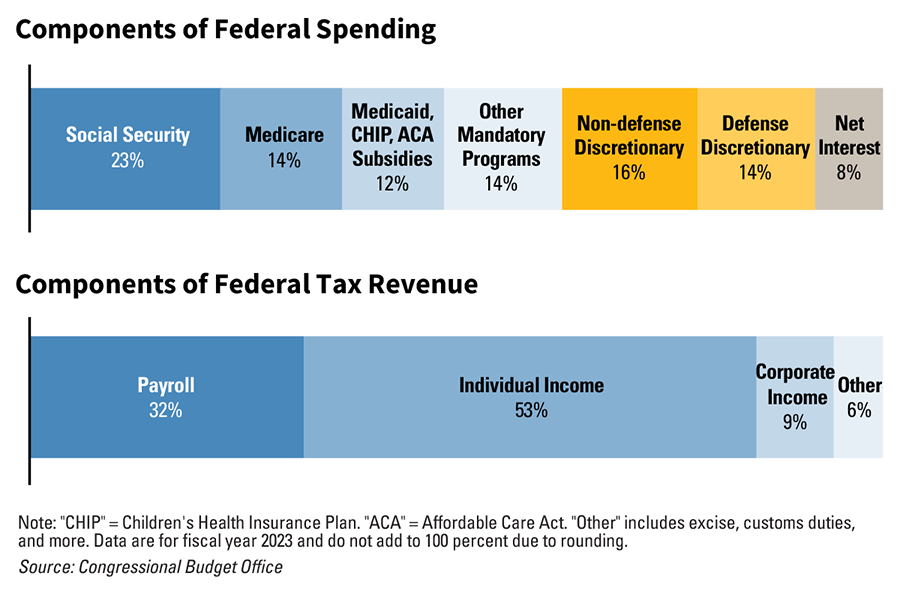

While much of the ongoing debt ceiling debate will focus on short-term concessions from political opponents, the three primary components of Federal spending – Social Security, Medicare, and Medicaid – are only going to grow as a percentage of GDP. Collectively, these programs make up approximately 40% of annual spending (Figure 4), and this is before considering full retirement of the Baby Boomers (expected by 2030v). As a reminder, these are all mandatory components of government outlays.

Figure 4:

Policy makers can argue all they want about cost-saving measures to trim discretionary spending, but without serious discussion about these entitlement programs, we are not addressing the elephant in the room. Next, we present the various solutions currently being offered, and analyze their practicality.

- Increased taxation – When President Biden submitted his recent budget proposalvi, the focus was on increasing taxes on corporations and the very wealthy. However, as Figure 4 above shows, the corporate tax increase will be only a minor aid. As for taxing the wealthy, the math simply does not work.vii For any true tax impact on the debt, the burden would have to be placed on a broad swath of the population.

- Grow our way out of it – Another argument is that the U.S. could simply spur enough economic growth to outweigh its growing debt (i.e., reduce the burden on GDP by making GDP bigger). This would also, theoretically, increase tax revenues without having to take the step to increase tax rates. However, this approach ignores the quickly growing mandatory burden of welfare programs, while paying no attention to the drag effect that massive amounts of government borrowing can potentially have on an economy over longer time horizons.

- Monetize it – Perhaps the most economically misguided argument is that the government could technically avoid the issue altogether by imploring the Federal Reserve to print more money to purchase more Treasury debt. However, this argument betrays a vast underestimation of the threat of inflation to the American people and our standing in the world. The rampant inflation we experienced last year at least partially reflects what can occur when this type of thinking, no matter how well intended, drives policy.

- Entitlement reform – As the American economist Herb Stein once observed, “If something cannot go on forever, it will stop.” We know that eventually these programs will be too large to fund and that spending increases cannot continue forever, making eventual default a real possibility if something does not change. The only logical conclusion is that something MUST change. As such, we must assume that any real solution to the growing debt issue must involve entitlement reform.

CONCLUSION

Debt is a serious issue globally, and resolving it, whether in your household or at the national level, is not quick nor painless. When dealing with personal debt, ultimately you are in control and can take direct action to avoid the repercussions of financial imprudence. As for national debt, however, to quote Sowell again, “It is hard to imagine a more stupid or more dangerous way of making decisions than by putting those decisions in the hands of people who pay no price for being wrong.” On that note, this will not be the last time that the debt ceiling creates a national circus, but just like the prior 100+ times it has been encountered, this too shall pass. Similarly, this will not be the last time commentators use the absolute debt level to make an argument about shifting geopolitical paradigms (or that marketers use it to sell an alternative to the tried and tested traditional portfolios).

Planning for the future often requires facing uncomfortable truths, and our goal is to help our clients think about these issues constructively as they plan for and pursue financial security. Part of that planning should involve what we ultimately assume will be higher taxes and lower entitlements in the future. However, these are challenges that can be overcome. Changes to either will not only be marginal and debated at length, but will also likely be announced far in advance of a change taking place. For better or for worse, Social Security has become axiomatic for retirement planning – a baseline that can be planned around. Luckily, there is very little chance of any major overhaul in the near-term due to inevitable and considerable political pushback. Instead, we are more likely to see small, marginal adjustments to things such as the retirement age, spousal benefit percentages, required credits, and how total benefits are calculated based on wages. Additionally, if we do see these changes, they are much less likely to impact those who are currently near retirement (and are therefore even less likely to impact those already taking Social Security).

Our Advisors are trained to utilize the wide range of investment options we offer to ensure that our clients’ investments are aligned with their financial plan and, just as importantly, to keep them on plan through inevitable periods of volatility. We hope the commentary provided here can prove useful to frame the U.S. debt not a looming disaster, but simply another variable to be considered when building, reviewing and updating your financial plan.

Footnotes:

iThe World Bank - “Finding the Tipping Point – When Sovereign Debt Turns Bad.”

iiU.S. Office of Management and Budget and Federal Reserve Bank of St. Louis, Federal Debt: Total Public Debt as Percent of Gross Domestic Product [GFDEGDQ188S], retrieved from FRED, Federal Reserve Bank of St. Louis.

iii“A national debt if it is not excessive will be to us a national blessing; it will be powerful cement of our union.” From a 1781 letter to Robert Morris.

ivUS Treasury

vThe Brookings Institution - “The Aging of America: Will the Baby Boom Be Ready for Retirement?”

viOffice of Management and Budget – “Budget of the U.S. Government - FISCAL YEAR 2024”

viiCato Institute

The information in this report was prepared by John Weitzer, Chief Investment Officer, Matt Wiley, Vice President of Investment Management, and Matt Conner, Investment Advisory Consultant of First Command. Opinions represent First Command’s opinion as of the date of this report and are for general informational purposes only and are not intended to predict or guarantee the future performance of any individual advisor. All statistics quoted are as of the date of this publication, unless otherwise noted. First Command does not undertake to advise you of any change in its opinions or the information contained in this report. This report is not intended to be a client specific suitability analysis or recommendation, an offer to participate in any investment, or a recommendation to buy, hold or sell securities. Do not use this report as the sole basis for investment decisions. Do not select an asset class or investment product based on performance alone. Consider all relevant information, including your existing portfolio, investment objectives, risk tolerance, liquidity needs and investment time horizon. Should you require investment advice, please consult with your financial advisor. Risk is inherent in the market. Past performance does not guarantee future results. Your investment may be worth more or less than its original cost. Your investment returns will be affected by investment expenses, fees, taxes and other costs.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.