Military Home Buying: Considerations for a First-Time Home Buyer

Mar 31, 2025 | 3 min. read

Homeownership is a big step, and military families have additional factors to consider.

For active-duty military families, the unique demands of service, such as frequent PCS moves and deployments, can make military home buying a challenging proposition. The advantages of homeownership, though, such as potential tax benefits and the opportunity to build equity, are appealing. If you’re thinking of purchasing a home, especially as a first-time home buyer, there are several factors to consider.

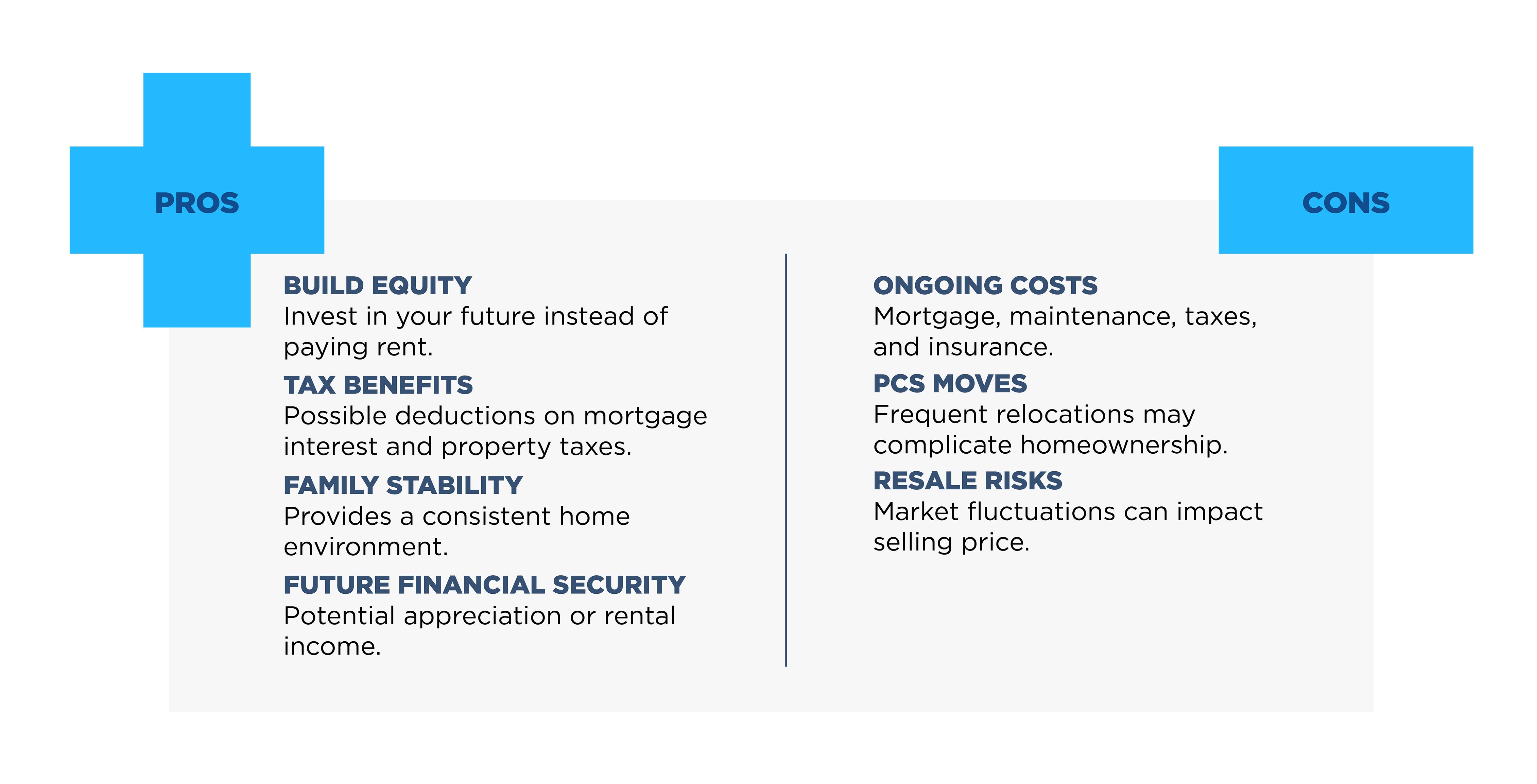

The Pros and Cons of Buying a Home in the Military

So, let’s start at the beginning: Is buying a home while you’re on active duty a good idea? As with any big life decision, it depends. That’s why it’s always best to carefully consider the potential pros and cons of such a significant purchase.

Before committing to homeownership, take a close look at your financial position, career plans, and family needs. If you anticipate moving within a few years, renting may be the more flexible and financially sound option. However, if you plan to stay in place for an extended period or have a strategy for managing the home as a rental property, buying may be a prudent long-term decision.

Another key factor to consider is your credit score, which affects your ability to qualify for a mortgage and the interest rates you’ll receive. A FICO score of 740 or higher typically earns the best rates. It’s important to know that mortgage lenders use different credit scoring models, pulling from credit bureaus like Equifax, Experian, and TransUnion. Asking lenders which scores they use can help you understand where you stand.

If your credit history has some ‘blips,’ working with a reputable lender or real estate agent early on can help you set realistic expectations and improve your application process.

Taking the time to evaluate these factors ensures that whatever decision you make—renting or buying—aligns with your financial goals and military lifestyle.

How Can I Buy a House While in the Military?

If you’re ready to buy a home, there are several paths to take—along with military benefits designed to make the process easier.

Calculate a home-buying budget and consider your military benefits.

Before house hunting, it's essential to establish a realistic budget. Factors such as your income, monthly debt, planned down payment, and location all play a role in determining what you can afford. Be sure to:

- Consider Your BAH: The Basic Allowance for Housing (BAH) is designed to cover 95% of rental costs for military families. If you're buying a home, you can use your BAH toward mortgage payments. That’s a big deal, but you should still be mindful of additional homeownership expenses.

- Plan for Long-Term Costs: Property taxes are a percentage of your home’s value, meaning a more expensive home results in higher annual tax payments. Similarly, the cost of your homeowners insurance will be based on the value of your home, and a home with more square footage or a bigger lot may result in higher utility and water bills. That’s why it’s a good idea to look for a home that has everything you need, but not lots of features that you don’t.

- Seek Professional Guidance: Work with a real estate professional who understands military moves and consult with your First Command Financial Advisor to create a home-buying budget that aligns with your other financial goals.

Once you’ve set your budget, stick to it—only consider homes within your established price range to help maintain long-term financial stability.

Advantages of VA Home Loans

The government provides many benefits to military families so it’s natural to wonder how the military helps with buying a house. In addition to the aforementioned opportunity to use your BAH toward mortgage payments, the VA Home Loan program, established in 1944, helps military families secure affordable home financing through approved lenders. VA mortgage loans offer several advantages over conventional loans.

As of 2024, nearly 75% of VA-backed loans are made without a down payment, allowing qualified buyers to finance up to 100% of the home’s value. A down payment may be needed if:

- The loan amount exceeds for VA loan limits.

- One of the borrowers is ineligible.

- A previous VA loan hasn’t been paid off.

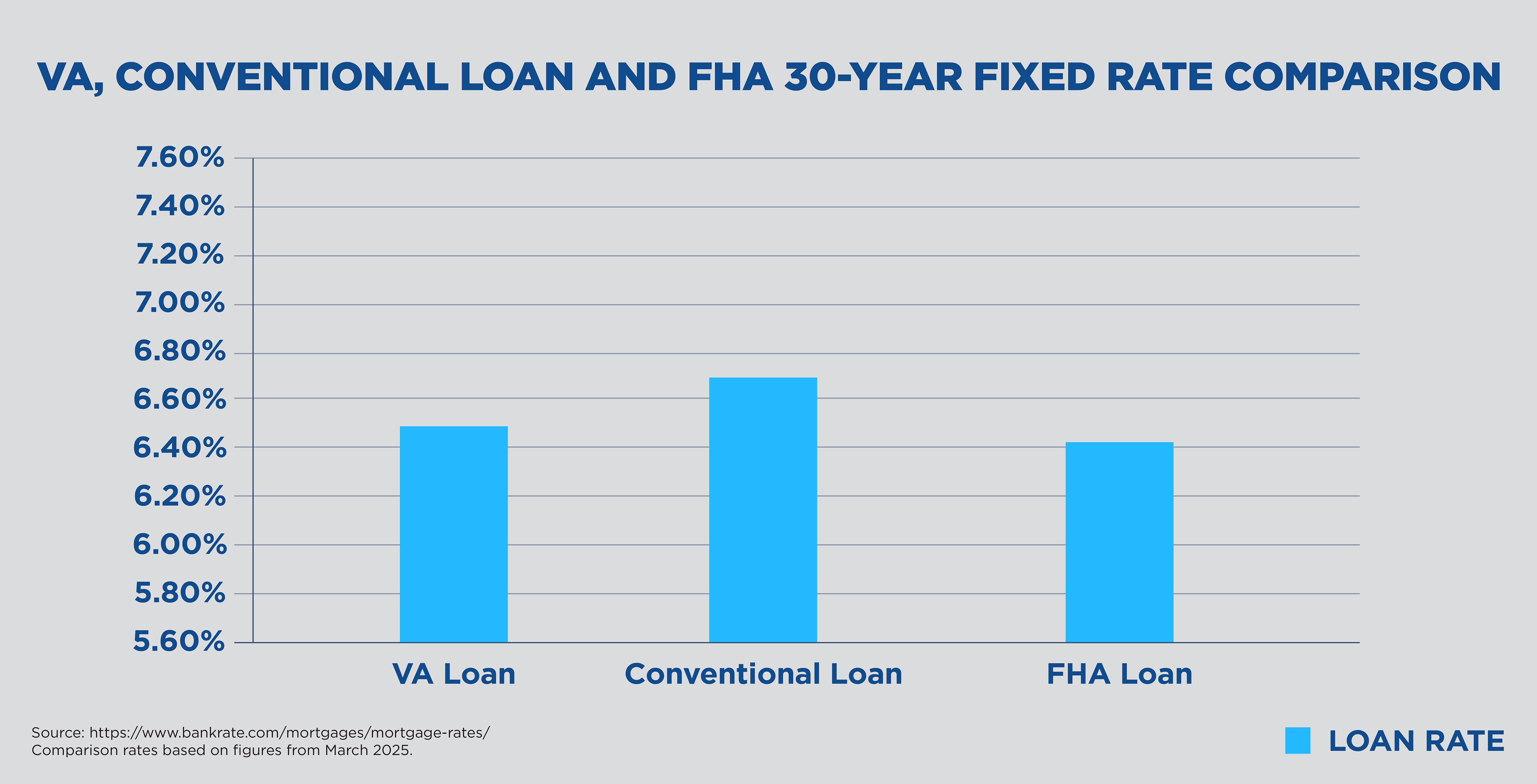

Unlike conventional loans, VA borrowers aren’t required to pay private mortgage insurance (PMI), lowering monthly costs. In addition, VA loans generally offer lower interest rates than conventional mortgages, making homeownership more affordable.

Eligibility for a VA Home Loan comes with meeting only one of these four requirements:

- Serve 90 consecutive days of active duty during wartime

- Serve 181 days of active duty during peacetime

- Serve 6 years in the National Guard or Reserves

- Be the surviving spouse of a service member who died in the line of duty

A lower credit score and higher debt-to-income ratio don’t necessarily disqualify you from securing a VA loan, either, giving you more flexibility than conventional options. And VA loans are assumable, meaning that if you find someone with a VA loan looking to sell their home, you can assume their current home loan rate. This is helpful when the seller’s interest rate is lower than current market rates.

Home loan rates fluctuate frequently. Staying up to date with current VA home loan rates will allow you to more accurately estimate your future payments.

Get Help for your Military Home Buying

As you can see, when purchasing a home as a military family, there are lots of things to consider, including your credit score, your budget, and the type of loan that will best meet your needs. That’s why consulting with knowledgeable, experienced professionals who can help you assess all of these factors should be an essential part of your decision-making process.

For more information about buying your first home in a competitive real estate market, read Home Buying Tips for Millennials. Then, if you’d like more personalized guidance, connect with your Financial Advisor to begin planning for homeownership.

Finally, when you’re ready to begin searching for the right home for your family, take the time to identify the right real estate agent to work with. Military families’ frequent moves and VA loan processes require experience and knowledge some real estate agents may not possess. Look for an agent with VA loan experience or certifications like Military Relocation Professional to help you navigate the unique challenges of military homeownership.

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Any recommendations provided to you in this article are strictly for financial planning purposes only. Should you require legal or tax advice, you should consult with your attorney or tax advisor.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.