2026 Military Pay Raise: Plan for Goals and Inflation

Sep 26, 2025 | 4 min. read

Use your 2026 military pay raise to strengthen your financial foundation and keep pace with inflation – by taking a balanced approach, you can address today’s needs while preparing for what’s ahead.

We’ve all experienced it before. The initial excitement that accompanies a pay raise quickly fades as the extra money is swallowed up by our ever-escalating financial obligations. That’s why it’s critical to have a purposeful plan for allocating those extra dollars in ways that address both your current and future needs and goals, whether that means buying a new laptop or stashing extra money in the TSP. And when inflation threatens to diminish the purchasing power of your income, it becomes even more important to make smart decisions about how to use your pay raise. In this article, we’ll provide details on the 2026 pay raise, discuss four ways to allocate your money to help enhance your financial and overall well-being, and offer some common-sense ideas on how to offset the impact of inflation. To talk specifically about your personal financial goals, be sure to reach out to your Financial Advisor.

What Is the Military Pay Raise for 2026?

The 2026 military pay raise proposed in the National Defense Authorization Act (NDAA) is 3.8%. This will become official when signed into law by President Trump.

Proposed 2026 Military Pay Table

The following table shows monthly military pay in 2026 for officers and enlisted members if the proposed 3.8% pay raise is approved. For conciseness, only a sampling of columns displaying years of service are included.

2026 Military Pay Raise and Inflation

Most companies provide an annual cost-of-living adjustment (COLA) to their employees based on the Consumer Price Index (CPI), a measure of the change in prices paid by U.S. urban consumers for day-to-day living expenses. The index includes a mix of goods and services, including food, rent, transportation, healthcare, entertainment, and more.

The military, however, bases its annual pay raise on the Employment Cost Index (ECI), which tracks changes in private-sector compensation. The ECI is calculated by the Bureau of Labor Statistics, and the October figure is the proposed military pay raise for the upcoming year. Using the ECI ensures that military compensation remains competitive with private-sector earnings.

While the ECI does not measure inflation, it indirectly reflects it since private-sector wages are adjusted for inflation through COLAs. For 2026, the proposed 3.8% military pay raise based on the ECI accounts for the current 2.7% rate of inflation and wage growth in the private sector.

Historical Comparison of Military Pay Increases

The military pay raise chart below was created using government data and demonstrates the trend toward larger raises in response to higher living costs over the last few years.

Inflation Rate vs. Military Pay Raises

The proposed 3.8% pay raise for 2026 is less than the last three annual pay raises, but more than the 13 annual pay raises before that. The lower pay raises in the 2019-2022 period reflect a period of tame inflation, while the more recent higher pay raises reflect inflation that spiked on the heels of the pandemic. Because a pay raise helps service members’ income keep up with rising prices, it’s smaller when inflation is low and bigger when inflation is high.

The 50/50 Plan: Make Smart Financial Moves With Your Pay Raise

At First Command, more than 65 years of helping service members and their families plan for and pursue financial security have convinced us of the merits of what we refer to as the 50/50 Plan. Its beauty lies in its balance and its simplicity. The idea is to allocate half of every pay raise to upgrading your current lifestyle and the other half to building a foundation for your financial future. For example, you could choose to save half of the extra money every paycheck for a vacation you’ve been dreaming about or the purchase of a new phone, and diligently apply the other half toward one or more worthy financial objectives like investing for retirement outside of the TSP or funding a Roth IRA for your spouse.

Four Smart Ways to Deploy Your Pay Raise

For the portion of your pay raise that you dedicate to strengthening your financial foundation, which should you prioritize? It depends on your current situation and future goals. Your Financial Advisor can help you decide, but here are four that are worth special consideration:

1. Pay down debt

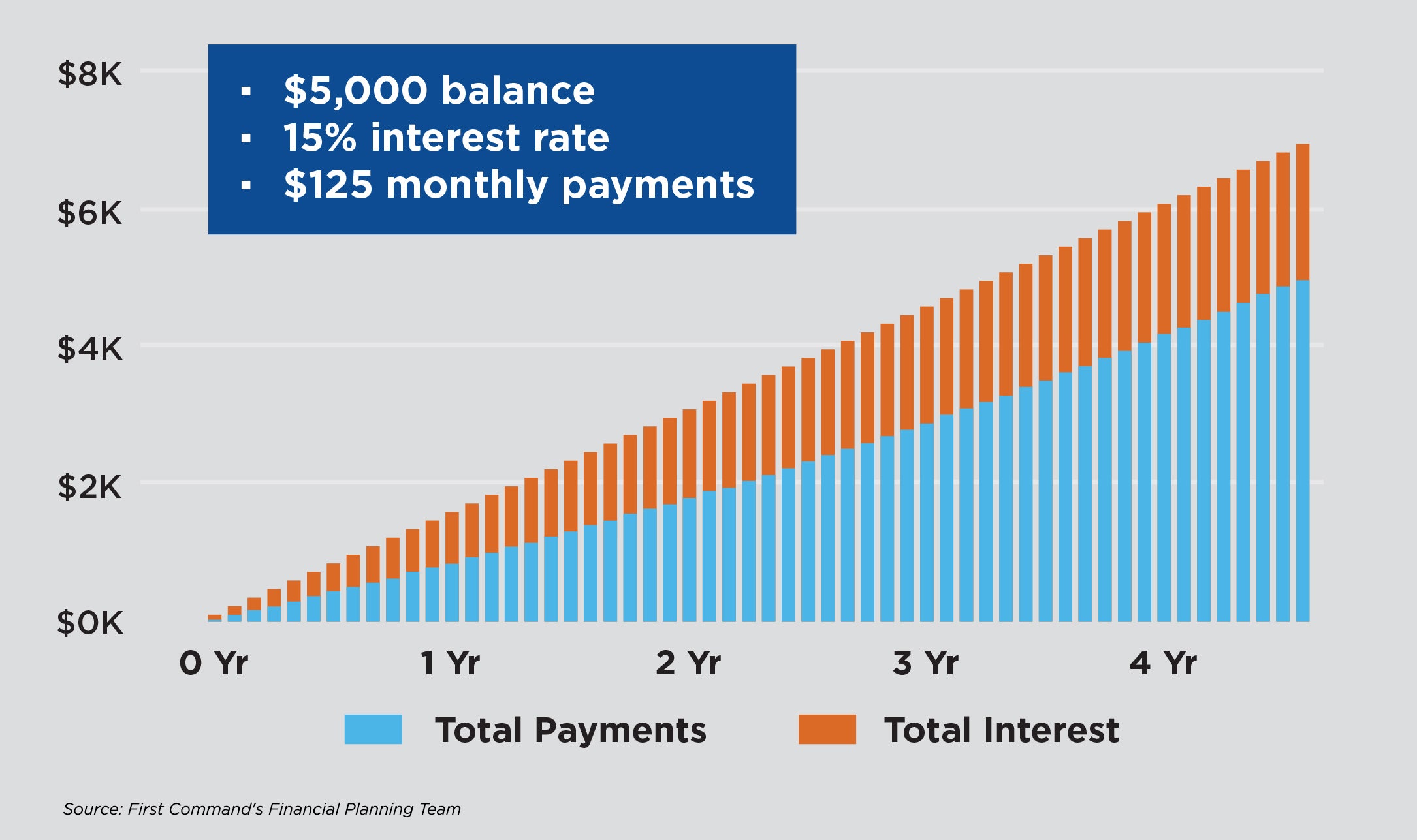

If you have high-interest-rate credit cards or other debt that is weighing you down, increase your monthly payment to reduce the amount of interest you are paying and retire your debt faster. As you can see in the graph below, paying off a $5,000 balance on a credit card with a 15% interest rate can end up costing closer to $7,000. Taking out a debt consolidation loan that allows you to lower your interest rate could further accelerate your efforts to eliminate debt. These options, either individually or in combination, enable you to utilize your military pay raise to thoughtfully and methodically pay off debt, and then repurpose that additional income for other objectives.

2. Increase your emergency savings

Life is unpredictable. Building an emergency savings account that will cover three to six months of expenses is a reasonable goal to give you a place to turn other than your credit card when unexpected expenses inevitably arise. By regularly contributing a portion of your pay raise, you can reach your emergency savings goal sooner rather than later.

3. Allocate more to retirement savings

If you participate in the Blended Retirement System, we recommend you allocate at least 5% to your Thrift Savings Plan (TSP) account in order to qualify for full matching contributions from the DOD. But even if you’re already contributing 5% or more and receiving the full match, using some of the extra money from your pay raise to increase your contributions is a good way to take further advantage of the tax benefits and long-term growth opportunities offered by both the traditional and Roth versions of the TSP.

4. Invest for other long-term goals

The funds in your TSP account can’t be withdrawn without a tax penalty until you reach age 59 ½, so if you have more immediate goals, consider using a portion of your 2026 military pay raise to invest for more immediate goals, like buying a house, funding higher education costs, or saving for a dream vacation.

By dividing the extra money between the present and the future, you can avoid the possibility of falling behind in the pursuit of your long-term goals or growing resentful from too much deferred gratification. If you’re strategic about how you allocate your funds, you can not only plan for your future but also have some fun along the way!

Ideas to Offset the Impact of Inflation

Even though your military pay raise accounts for inflation, it’s still a good idea to periodically consider how you can offset the impact of rising prices on your financial well-being. The arrival of your pay raise is an ideal time be sure you are using your income effectively.

- Reassess your budget. Be sure it accounts for rising costs and make any needed adjustments. Categories typically affected by inflation include groceries, utilities and transportation.

- Evaluate your spending. Reconsider needs vs. wants, and look for opportunities to cut expenses, like canceling unused subscriptions, switching to less expensive stores or brands, and reducing discretionary spending.

- Examine your insurance coverage. Ensure it remains adequate as the cost of goods and services rises. Review homeowner, automobile and health insurance policies and compare rates to ensure you aren’t overpaying. Bundling policies can lead to discounts.

Take Immediate Action

One more thing: Make implementing your 50/50 Plan a priority. Determine exactly how much additional after-tax income you will have in every paycheck after your raise becomes effective. Then, set up an allotment or bank draft to automatically direct the extra money to the appropriate accounts.

For example, if you decide to split the money between vacation savings and investing for retirement, that means increasing the amount of your allotment to the TSP and directing the other half of the money to a savings account. Just don’t make the mistake of sending the money intended to pay for your vacation to the checking account you use to pay all your monthly bills. If you do, you’ll likely wonder what happened to the extra money six months from now!

Having a specific plan is a great way to help make the most of your additional income. So, carefully consider how to effectively allocate your pay raise, and look for opportunities to offset rising costs. And don’t forget to responsibly reward yourself and your family as you continue your financial journey.

Military Pay Raise Frequently Asked Questions

When does the 2026 military pay raise take effect?

The proposed 3.8% pay raise will take effect on Jan 1st, 2026.

How is military pay calculated?

Military pay is a combination of base pay, allowances, and special pay. Base pay is determined by your pay grade and number of years of service. Allowances include compensation for housing, food, and cost-of-living adjustments for high-cost locations. Special pay covers bonuses and extra pay for unusual duty conditions like combat, hazardous duty, or family separation.

What is Trump’s role in the 2026 military pay raise?

President Trump’s defense budget proposal for fiscal year 2026 includes a 3.8% pay raise for service members, which matches civilian wage growth. Additionally, both versions of the Department of Defense Appropriations Act that are under considerations by the two houses of Congress include a 3.8% military pay raise. By U.S. law (Title 37, Chapter 19, section 1009), military pay raises are tied to the ECI unless overridden by presidential or congressional action.

Are junior enlisted troops getting a larger pay raise in 2026?

The draft defense appropriations bills under consideration by each house of Congress both include an additional 10% pay raise for junior enlisted service members.

Are military retirees getting a COLA increase in 2026?

A COLA for military retirees for 2026 will be announced once the percentage increase in the Consumer Price Index (CPI) between the third quarter of 2025 and the third quarter of the prior year is calculated. As of early August 2025, the 2026 COLA is estimated at 2.6%. You can learn more about the annual COLA increase here.

Are U.S. military pensions adjusted for inflation?

Military pensions are adjusted for inflation through a cost-of-living adjustment (COLA). Calculated annually, the COLA is based on the percentage increase in the CPI from one year to the next. COLAs help protect the purchasing power of a retiree’s pension from rising consumer prices.

What’s the expected increase to the Basic Allowance to Housing (BAH) in 2026?

Analysis to determine 2026 BAH rates is ongoing and will be finalized and announced in December of 2025. You can learn more here.

TSP funds have very low administrative and investment expenses, and low expenses can have a positive effect on the rate of return of your investment.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.