What is a Financial Plan and How Can a Financial Advisor Help You?

Jul 27, 2023 | 10 min. read

Financial planning can help military families set long-term financial goals and develop strategies to pursue them.

Navigating the world of personal finance can sometimes be challenging, leaving many service members and military families unsure about what steps they should take to get on track. To help you better understand how you can begin preparing for your financial future, this article explains:

- The role of a financial plan

- How having a plan can help you in the pursuit of your goals

- The best time to initiate a financial plan

A financial plan, by itself, may not be enough, though. The article also addresses the vital role a financial advisor can play in helping you:

- Establish a budget

- Set specific and meaningful goals

- Construct and implement your financial plan

- Make adjustments and course corrections as your circumstances and goals evolve over time

What Is a Financial Plan?

A financial plan is a roadmap for pursuing your unique financial goals. It includes strategies and specific recommendations for managing debt, saving, investing and reducing risks to your financial well-being. A well-constructed plan should be flexible enough that it can be modified and updated as your circumstances and goals change over time.

What is Included in a Financial Plan?

A comprehensive financial plan typically includes three key cornerstones: cash management, risk management and wealth accumulation and management. But a more complete list of all of the elements of a comprehensive plan might include:

- Financial Goals: Clearly defined short-term and long-term objectives, such as buying a house, saving for retirement, or funding education.

- Budgeting and Cash Flow Management: Analyzing income and expenses to create a realistic budget that tracks spending and encourages prudent cash flow management.

- Emergency Fund: Setting aside funds for unexpected expenses or emergencies, usually equivalent to three to six months' worth of living expenses.

- Debt Management: Developing strategies to manage and reduce debt, including prioritizing repayment, consolidating loans, or negotiating lower interest rates.

- Investment Planning: Identifying suitable investment vehicles based on your time horizon, tolerance for risk and specific goals.

- Retirement Planning: Estimating your retirement income need based on your desired lifestyle and determining the savings required to pursue that goal. This requires taking annuitized benefits like military retirement income and Social Security into account.

- Insurance Coverage: Assessing the need for various types of insurance, including life, health, disability, and long-term care, in an effort to help protect against unforeseen events and mitigate risks.

- Tax Planning: Optimizing tax efficiency through strategies that provide opportunities to reduce taxable income or defer taxes on earnings and employing tax-efficient investments when appropriate, while complying with applicable tax laws.

- Estate Planning: Establishing a plan for the distribution of assets after death, including wills, trusts, power of attorney, and healthcare directives.

When is the Best Time to Initiate a Financial Plan?

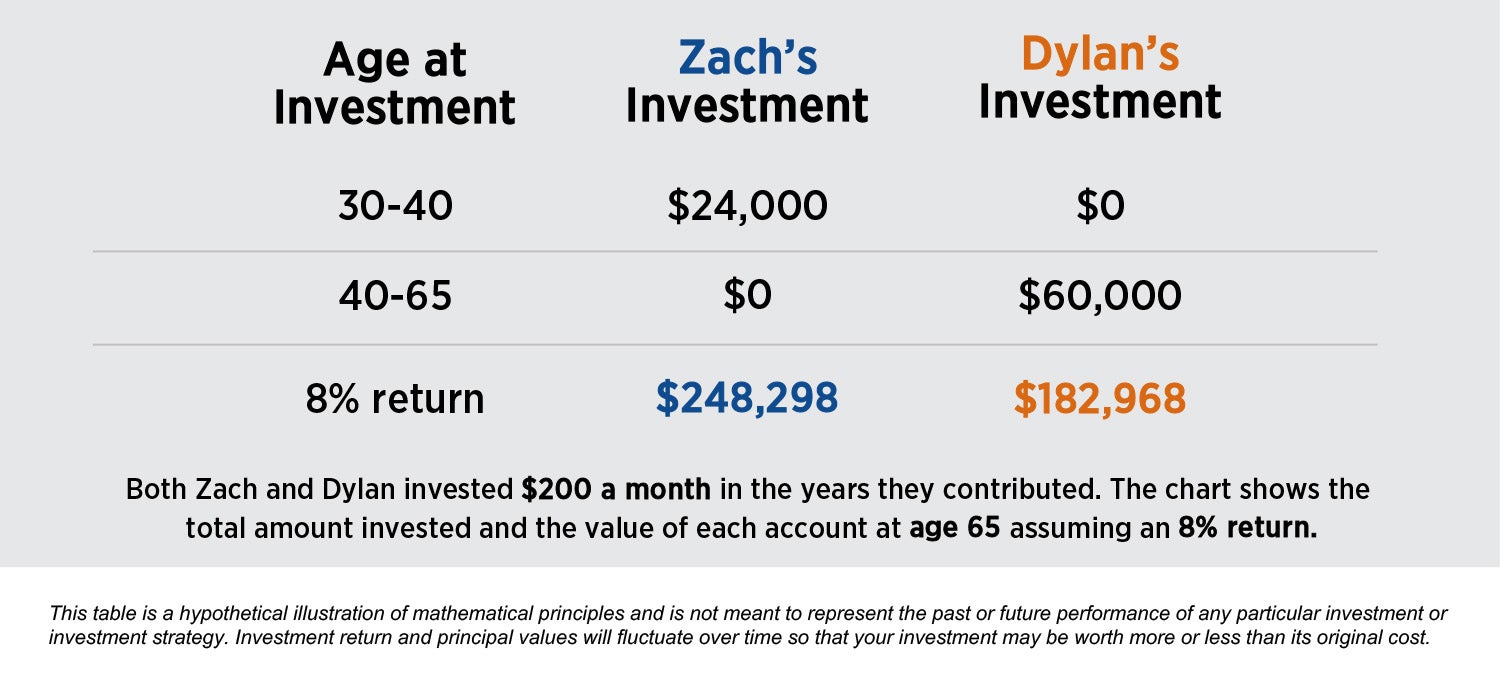

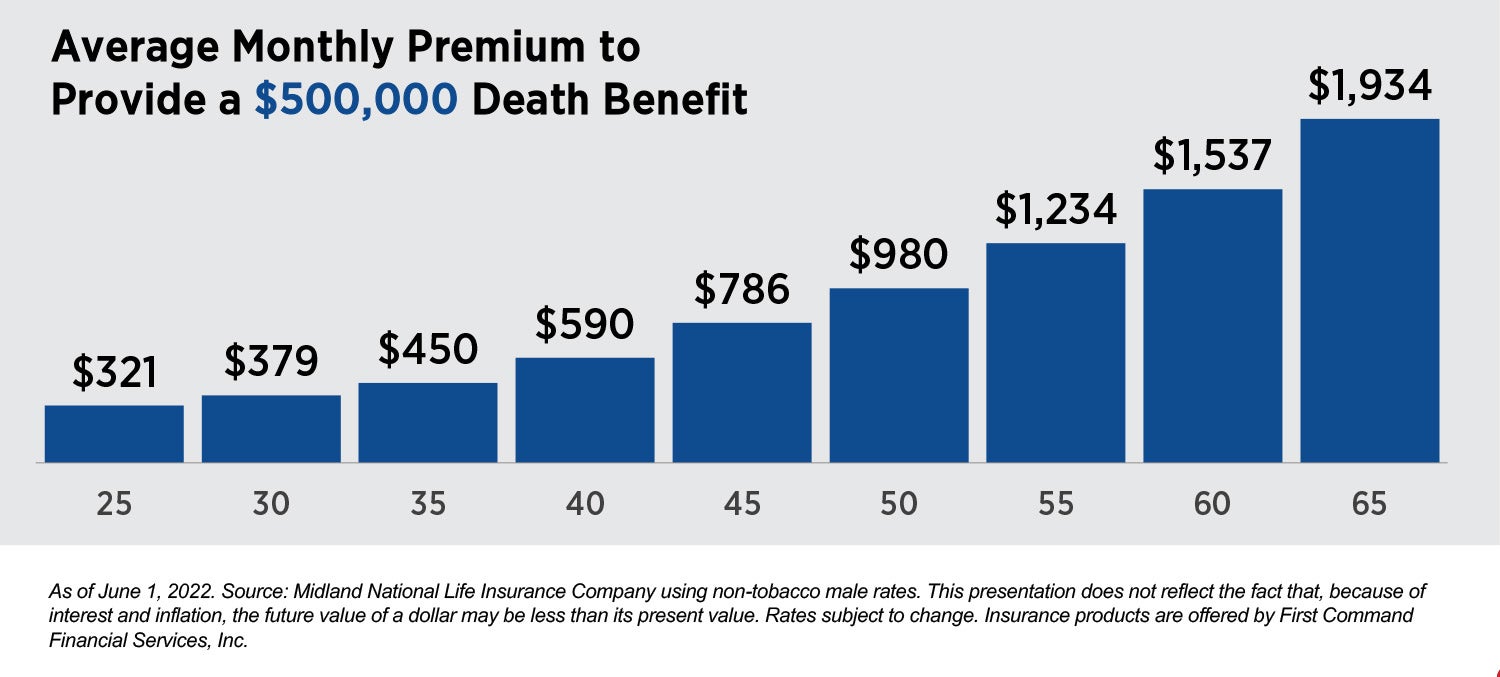

Timing is an important factor when it comes to financial planning. Though people often assume they don’t need a financial plan until they have accumulated significant assets, the reality is that time is a powerful ally and implementing a plan early in life offers a number of advantages. When it comes to saving and investing for your goals, an early start allows you to harness the power of compound interest. And when it comes to managing risks to your family’s financial security, most forms of insurance are more affordable when you are young and in good health.

What Is the Purpose of a Financial Plan?

Let’s compare your financial journey to another sort of journey – a family road trip. Both trips require the same basic information: where you are starting, where you want to go and how you are going to get there. For your family road trip, you’re going to need a map, or a navigation system. For your lifelong financial journey, you’re going to need the equivalent of a map or navigation system – a comprehensive plan. The purpose of that plan is to give you a flexible framework for pursuing your goals, and to serve as your North Star as you make important financial decisions over the course of your journey.

What Are the Benefits of Financial Planning?

If a financial plan is a roadmap for pursuing your financial goals, financial planning encompasses the lifelong process of:

- Developing your plan

- Executing your plan

- Regularly reviewing and updating your plan

But financial planning is not limited to the development and execution of your financial plan. It also includes helping you develop positive and productive financial behaviors and make consistently smart, informed financial decisions that are aligned with your plan. For that reason, having a financial advisor who can serve not only as a plan developer, but as a sounding board, a motivator and a coach offers considerable benefits, including:

- Increased knowledge and understanding of financial matters

- The confidence and peace of mind that comes from having a plan and a coach

- Timely guidance and recommendations at every stage of your life

Perhaps that explains why career military families who work with a financial advisor report a higher monthly savings rate, more accumulated assets, and greater confidence in their short- and long-term financial prospects than those without an advisor.1 Learn more about the positive outcomes experienced by military families who work with a financial advisor.

Few Americans understand the importance of strategic planning more than those who serve or have served in the military. And even fewer have the kind of discipline, focus, and resolve that are developed in the military. For those reasons, service members and their families are often well equipped to benefit from financial planning.

How Do You Create a Financial Plan?

Creating a comprehensive financial plan involves a series of steps to help you understand your current financial situation, set financial goals, and develop a strategy for pursuing them. Your financial advisor will work with you to:

- Assess your current financial situation. Begin by evaluating your income, expenses, assets, and debts. Gather information about your earnings, savings, investments, debts (including loans and credit cards) and monthly expenses. This assessment will provide you with a clear picture of your current financial standing.

- Define your short- and long-term financial goals. Short-term goals may include building an emergency savings fund, paying off debt, or saving for a specific purchase. Long-term goals can involve retirement planning, buying a home, or funding your children’s education. Make sure your goals are SMART, as in specific, measurable, achievable, relevant and time bound. And consider adding one more characteristic to that familiar formula – meaningful. Because you’ll be much more motivated to make the necessary sacrifices if your goals are truly meaningful to you.

- Develop a budget. Doing so will enable you to strategically allocate your income toward various expenses, savings, and investments. Track your income sources and categorize your expenses (such as housing, transportation, groceries, entertainment, etc.) Aim to prioritize essential expenses while identifying areas where you can reduce spending and increase saving and investing.

- Establish and maintain an emergency savings fund to cover unforeseen expenses. Most experts recommend setting aside an amount equal to three to six months of expenses. This fund could help you weather unexpected events like medical emergencies, major repairs, or the loss of a job. It may also prevent you from having to withdraw money from investments earmarked for specific goals.

- Develop a strategy for reducing your debt. Prioritize high-interest debts like credit cards. Consider a debt consolidation loan that reduces your interest rate. This may allow you to pay debts off sooner or reduce the amount of your monthly payments.

- Determine how much you can afford to invest each month. Then automate the process by establishing a government allotment or bank draft. Explore all of the options available to you, including stocks, bonds, mutual funds, and retirement accounts like the Thrift Savings Plan (TSP). Consider your risk tolerance, time horizon and specific financial goals when selecting investments.

- Calculate how much income you will need in retirement. Be sure to account for inflation and take maximum advantage of tax-advantaged retirement investing options and any available employer matching programs.

- Assess your insurance needs. This includes life, health, property, disability and long-term care coverage. Having the proper amount of coverage in place is essential to protecting your family’s financial security.

- Regularly review your plan. Make adjustments based on any changes in your circumstances or goals.

If you’re starting to get the impression that financial planning can be complicated, you’re right. That’s why, for most busy people who don’t have any specific financial expertise, a strong case can be made for seeking out qualified professional assistance. For military families in particular, there are considerable advantages to working with an advisor and a company that understands your lifestyle and is knowledgeable about your unique benefits.

What Should You Expect When You Meet with a Financial Advisor?

Why don’t more people meet with a financial advisor at the beginning of their career rather than at the end, when it’s often too late to make significant course corrections? When asked, many admit that not knowing what to expect when they meet with a financial advisor makes them apprehensive – and that much of that apprehension comes from a fear of being judged for things like having significant credit card debt, or not having more money in savings and investment accounts.

But the truth is that most financial advisors have seen it all, and they are much more interested in helping you than judging you. It is important for your financial advisor to understand your current financial situation, but only so that they can develop a personalized plan for pursuing your unique goals.

How Can I Find an Advisor?

At First Command, our Mission is coaching those who serve in their pursuit of financial security. Our company was founded by a retired Air Force officer, and four out of five of the Advisors in our 100s of offices nationwide are veterans or military spouses.

Reach out to a First Command Financial Advisor near you to learn more about our policy of waiving financial planning fees for active duty military members (pay grades E-5 and above) and their families, and to schedule a complimentary consultation.

1 First Command Financial Behaviors Index

First Command does not provide legal or tax advice, and this article does not contain any legal or tax advice. Should you require legal or tax advice specific to your situation, you should consult with an attorney or qualified tax advisor. The information provided to you herein is provided for informational purposes only, is not intended to be tax or legal advice, and should not be used for the purpose of avoiding tax-related penalties under the Internal Revenue Code.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.