2025 Military Pay Raise: Four Smart Ways to Put Your Money to Work

Sep 27, 2024 | 4 min. read

You don't have to choose between immediate gratification and your long-term financial health.

We’ve all experienced it before. The initial excitement that accompanies a pay raise quickly fades as the extra money is swallowed up by our ever-escalating financial obligations. Though progress has been made in the battle against inflation, the sharp increase in the price of goods and services in the last couple of years only heightens that possibility. That’s why it’s critical to have a purposeful plan for allocating these extra dollars in ways that address both your current and future needs and goals, whether that means buying a new laptop or stashing extra money in the TSP. In this article, we’ll provide details on the 2025 pay raise, and we’ll discuss four ways to allocate your money to help enhance your financial and overall well-being. To talk specifically about your personal financial goals, be sure to reach out to your Financial Advisor.

What is the 2025 Military Pay Raise?

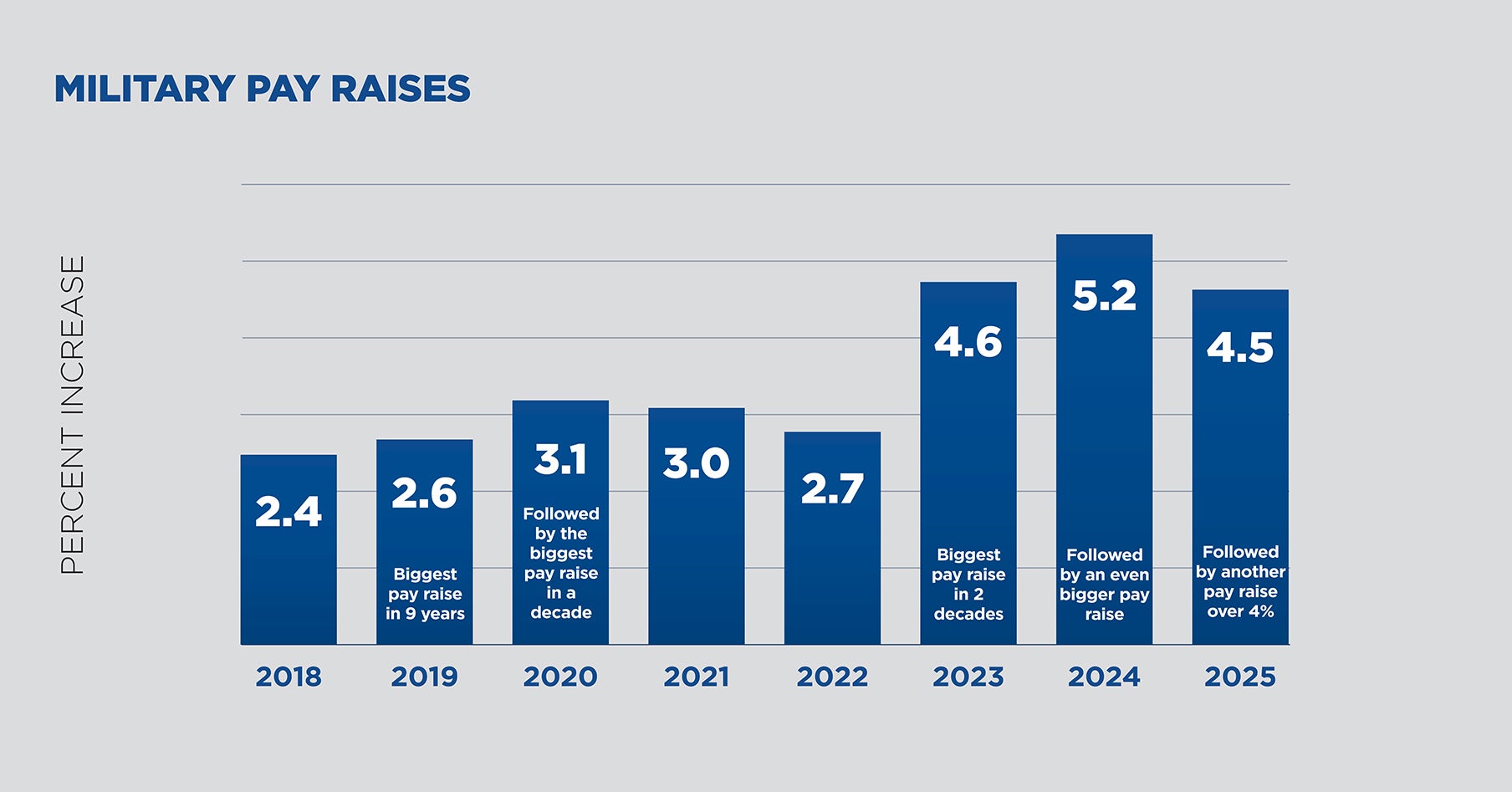

The 2025 military pay raise is 4.5%, as approved in the National Defense Authorization Act (NDAA) for fiscal year 2025. Similar to the past couple of years, President Biden signed the NDAA into law near the end of the 2024 calendar year. The military pay raise chart below was created using government data and demonstrates the trend toward larger raises in response to higher living costs over the last three years.

The 50/50 Plan: Reward Yourself and Make Smart Financial Moves

At First Command, more than 65 years of helping service members and their families plan for and pursue financial security have convinced us of the merits of what we refer to as the 50/50 Plan. Its beauty lies in its balance and its simplicity. The idea is to allocate half of every pay raise to upgrading your current lifestyle and the other half to building a foundation for your financial future. For example, you could choose to save half of the extra money every paycheck for a vacation you’ve been dreaming about or the purchase of a new phone, and diligently apply the other half toward one or more of the following worthy objectives, depending on what makes the most sense in your current situation.

Four Smart Ways to Put Your Money to Work

1. Pay down debt

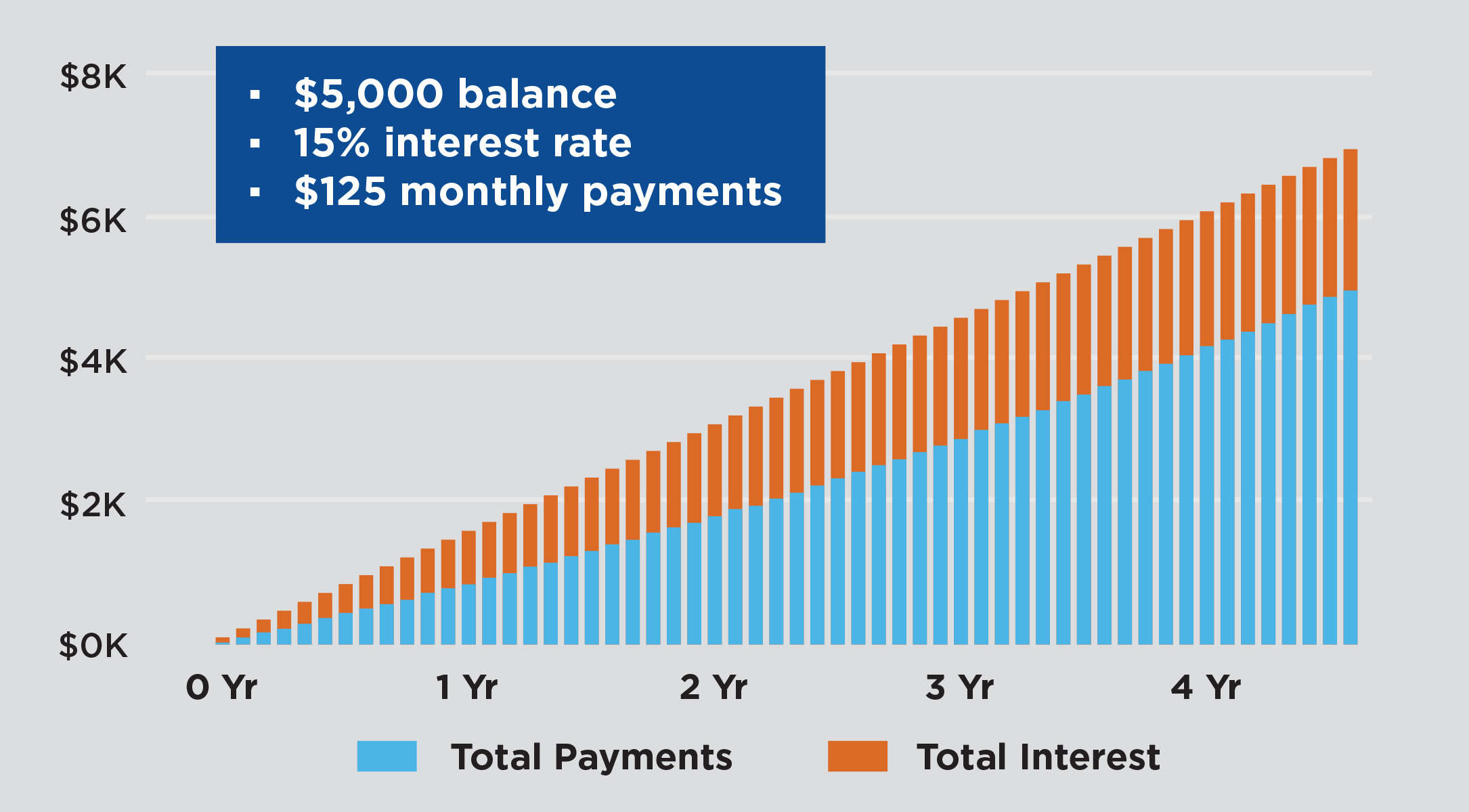

If you have high-interest-rate credit cards or other debt that is weighing you down, increase your monthly payment to reduce the amount of interest you are paying and retire your debt faster. As you can see in the graph below, paying off a $5,000 balance at a 15% interest rate can end up costing closer to $7,000. Taking out a debt consolidation loan that allows you to lower your interest rate could further accelerate your efforts to eliminate debt. These options, either individually or in combination, enable you to utilize your military pay raise to thoughtfully and methodically pay off debt, and then repurpose that additional income for other objectives.

2. Increase your emergency savings

Life is unpredictable. Building an emergency savings account that will cover three to six months of expenses is a reasonable goal to give you a place to turn other than your credit card when unexpected expenses inevitably arise. By regularly contributing a portion of your pay raise, you can reach your emergency savings goal sooner rather than later.

3. Allocate more to retirement savings

If you participate in the Blended Retirement System, we recommend you allocate at least 5% to your Thrift Savings Plan (TSP) account in order to qualify for full matching contributions from the DOD. But even if you’re already contributing 5% or more and receiving the full match, using some of the extra money from your pay raise to increase your contributions is a good way to take further advantage of the tax benefits and long-term growth opportunities offered by both the traditional and Roth versions of the TSP.

4. Plan for other long-term goals

The funds in your TSP account can’t be withdrawn without a tax penalty until you reach age 59 ½, but your 2025 military pay raise can be used as the start of a savings program that is part of a comprehensive financial plan for pursuing all of your unique goals. That could include buying a house, funding higher education costs, or saving for a dream vacation.

By dividing the extra money between the present and the future, you can avoid the possibility of falling behind in the pursuit of your long-term goals and growing resentful from too much deferred gratification. If you’re strategic about how you allocate your funds, you can not only plan for your future but also have some fun along the way.

Take Immediate Action

One more thing: It’s essential that you act immediately to implement your 50/50 Plan. Determine exactly how much additional after-tax income you will have in every paycheck after your raise becomes effective. Then, set up an allotment or bank draft to automatically direct the extra money to the appropriate accounts.

For example, if you decide to split the money between vacation savings and investing for retirement, that means increasing the amount of your allotment to the TSP and directing the other half of the money to a savings account. Just don’t make the mistake of sending the money intended to pay for your vacation to the checking account you use to pay all your monthly bills. If you do, you’ll likely wonder what happened to the extra money six months from now!

In 2025, military service members received their third consecutive above-average pay raise. Having a specific plan is a great way to help make the most of this additional income. So, consider these four ways to effectively allocate your pay raise, and don’t forget to responsibly reward yourself and your family as you continue your financial journey.

Military Pay Raise Frequently Asked Questions

When does the 2025 military pay raise take affect?

The 4.5% pay raise took effect on Jan 1st, 2025.

Are junior enlisted troops getting a larger pay raise in 2025?

Some military service members will receive an additional pay raise for part of 2025. The across-the-board 4.5% raise for all members took effect on Jan.1. Junior enlisted members in pay grades E-1 through E-4 get an additional 10% increase beginning Apr. 1, bringing their total pay raise for the remainder of the year to 14.5%. E-5s with less than 10 years of service will get an extra increase on Apr. 1 as well, but the percentage varies based on years of service. You can find basic pay tables for the Apr. 1 increase in the text of H.R. 5009 or by downloading a PDF of the legislation from the same page.

Are military retirees getting a COLA increase in 2025?

The 2025 COLA for military retirees is 2.5%. Due to cooling inflation, this year’s COLA is not as large as the 8.7% and 5.9% increases of the last two years. The 2025 COLA is lower for individuals who retired during 2024, and the amount varies depending on one’s retirement date. Those who retired after 1986 and also received a career status bonus may receive a smaller COLA as well. You can learn more about the annual COLA increase here.

What’s the expected increase to the Basic Allowance to Housing (BAH) in 2025?

BAH rates increased an average of 5.4% when they took effect Jan. 1, 2025. You can learn more here.

TSP funds have very low administrative and investment expenses, and low expenses can have a positive effect on the rate of return of your investment.

Get Squared Away®

Let’s start with your financial plan.

Answer just a few simple questions and — If we determine that you can benefit from working with us — we’ll put you in touch with a First Command Advisor to create your personalized financial plan. There’s no obligation, and no cost for active duty military service members and their immediate families.